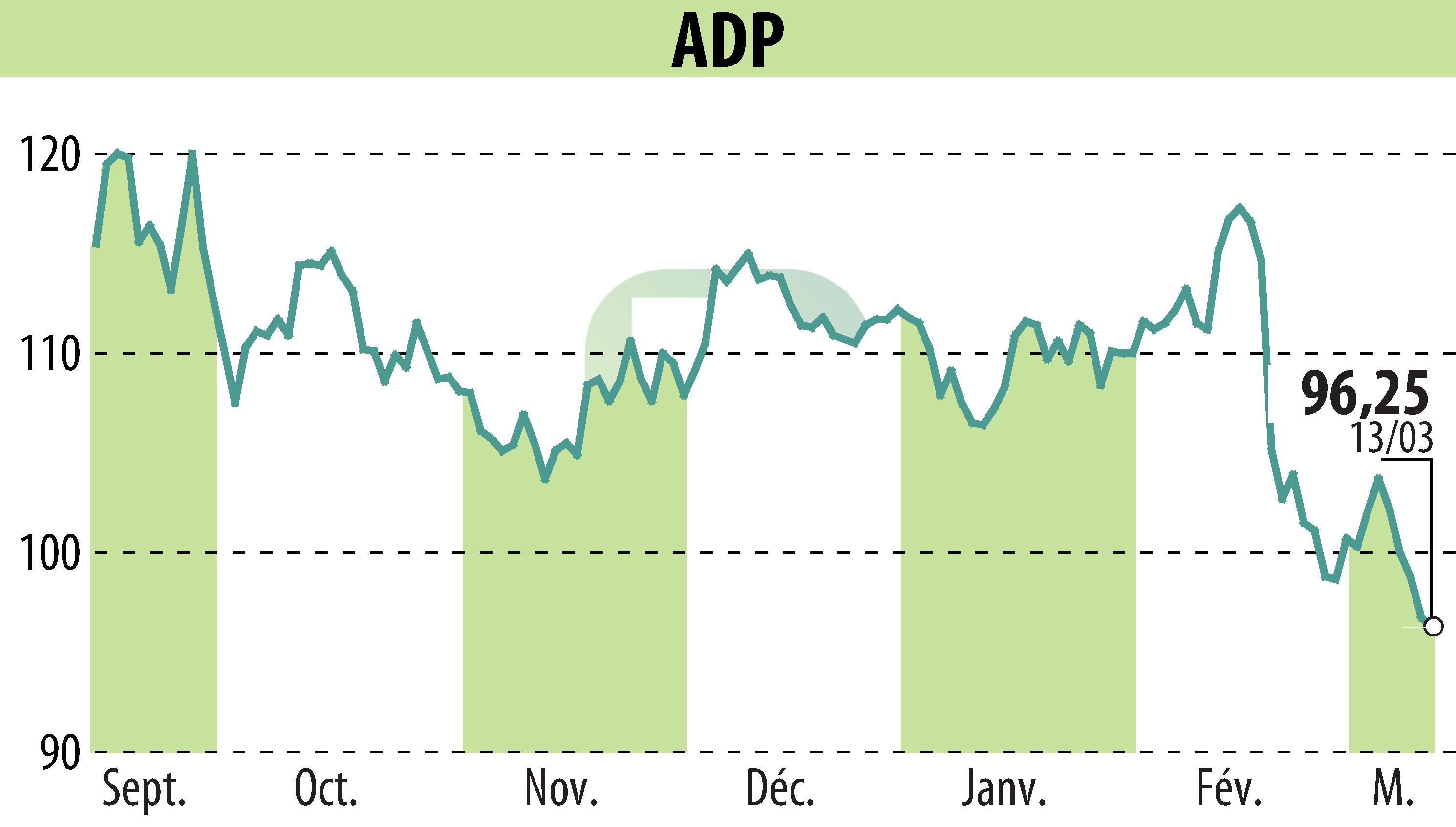

on GROUPE ADP (EPA:ADP)

Aéroports de Paris SA Issues €1bn Dual-Tranche Bond

On March 13, 2025, Aéroports de Paris SA, rated A- by Standard & Poor's, completed a successful bond issue worth €1 billion. This issuance consists of two tranches, each €500 million. The first tranche, maturing in 8 years, offers a fixed annual rate of 3.5% with a re-offer yield of 3.694%. The second tranche, with an 11-year maturity, has a fixed annual rate of 3.75% and a re-offer yield of 3.940%. Settlement for both tranches is set for March 20, 2025.

In tandem, the company has initiated a tender offer for bonds issued on April 2, 2020. This move aligns with the company's strategy to maintain a balanced debt profile by renewing and managing existing liabilities. The tender offer concludes on March 19, 2025, adhering to specific terms outlined in the memorandum.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GROUPE ADP news