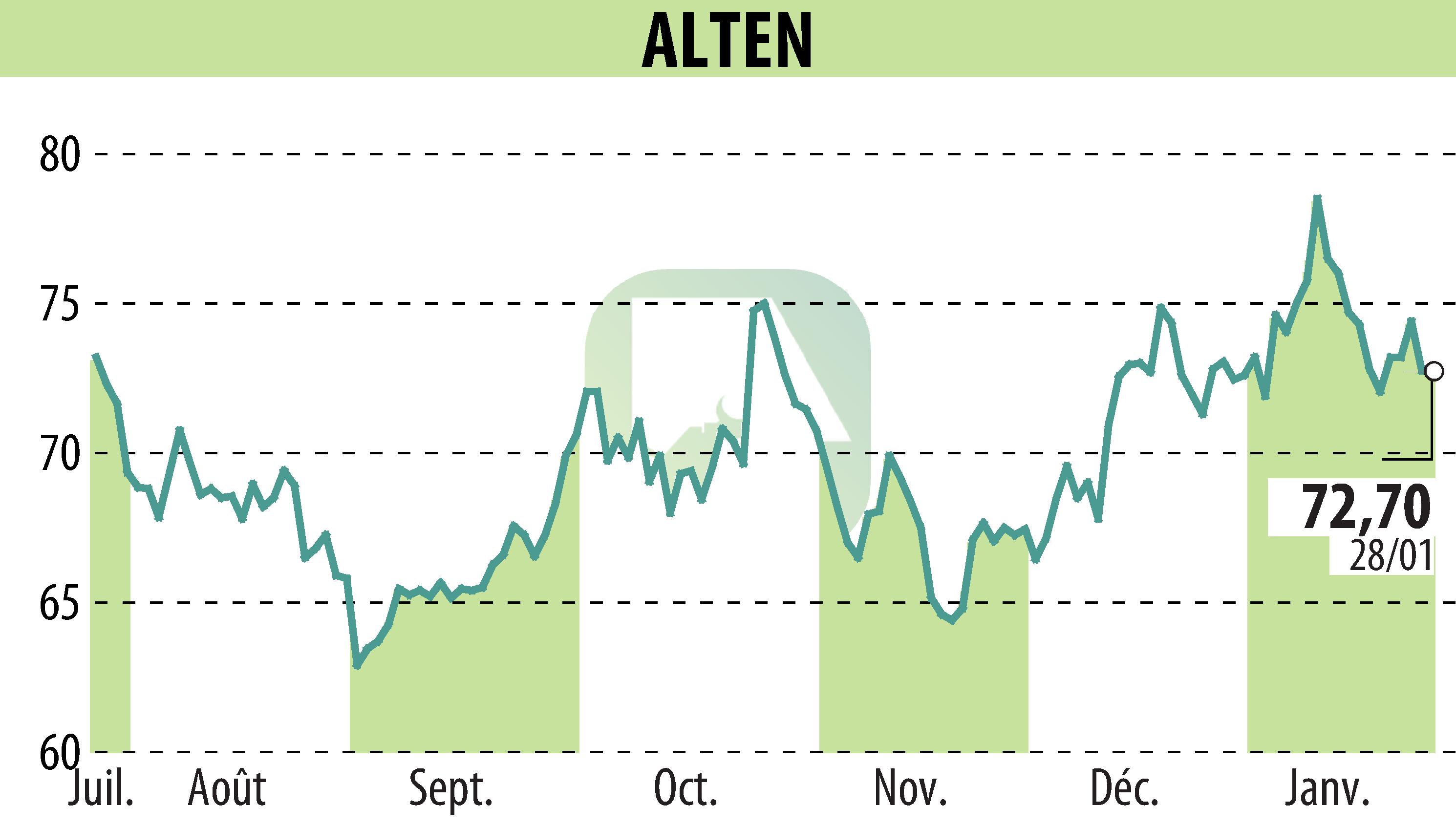

on ALTEN (EPA:ATE)

ALTEN: 2025 Revenue Results

ALTEN has published its annual revenue forecast for 2025, reporting a slight decrease of 1.1% compared to the previous year, despite four acquisitions. Organic growth amounted to 4.5%. In France, business increased by 4.3%, partially offsetting the 3.7% decline internationally. In the fourth quarter, ALTEN generated revenue of €1,023 million, down 0.35% compared to 2024. The Automotive and Telecoms sectors contributed significantly to this decrease, while the Defense/Security, Naval, and Energy segments recorded growth. Acquisitions in the United States, India, Spain, and South America strengthen capabilities in Life Sciences and Digital Transformation.

Southern Europe is showing growth, while other regions such as the UK, Benelux, and the Nordic countries are experiencing a decline. Despite this, the improvement observed in the last quarter should maintain the operating margin above 8.1% of revenue. The outlook for 2026 appears more optimistic, particularly with the rebound in the Aerospace and Banking/Finance sectors.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ALTEN news