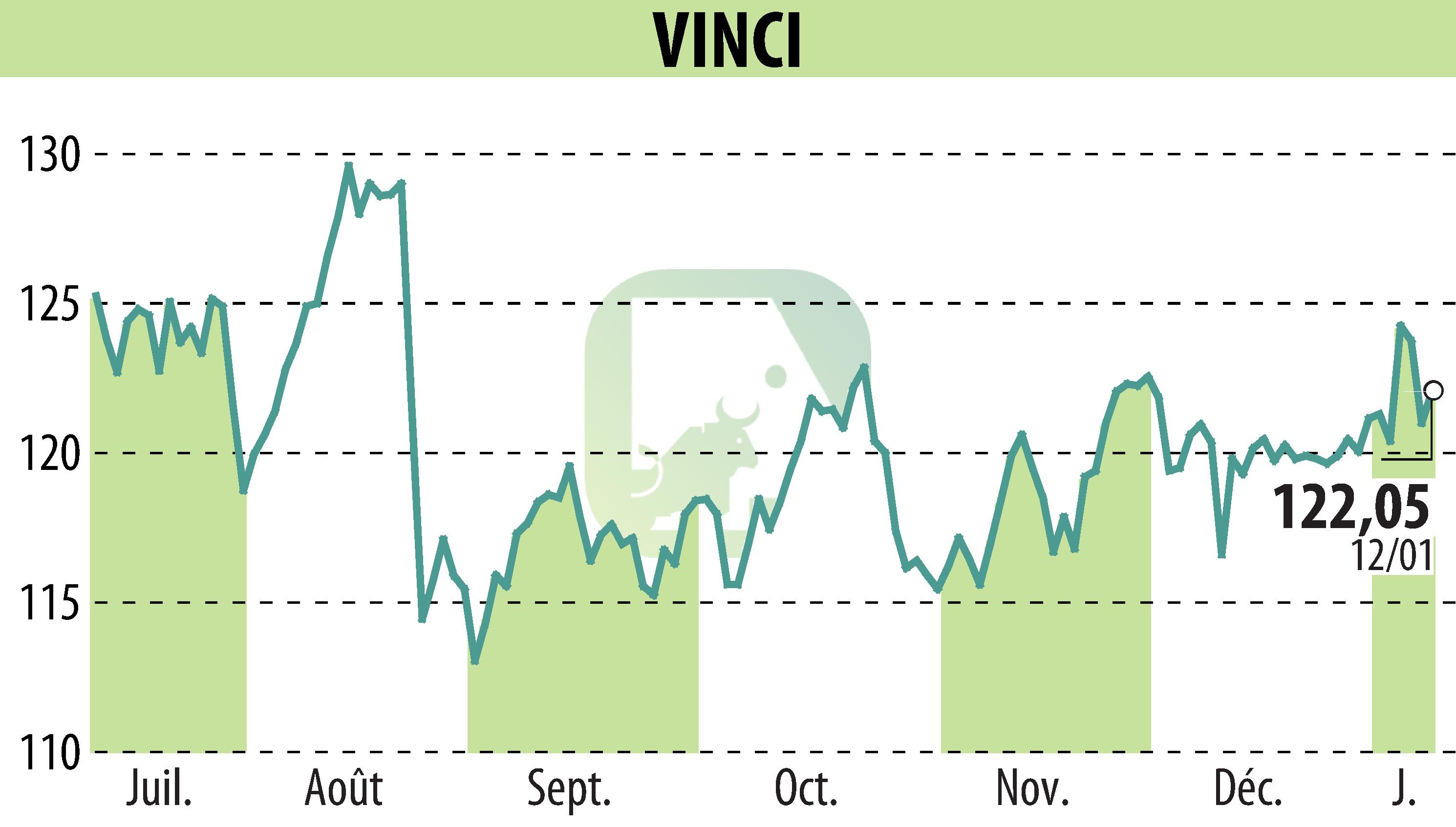

on VINCI (EPA:DG)

ASF successfully raises funds with a €500 million bond.

ASF, a VINCI subsidiary, has successfully completed a €500 million bond issue maturing in January 2034, with an annual coupon of 3.375%. The transaction was highly successful, being nearly four times oversubscribed. This demonstrates investor confidence in the company's credit quality, rated A- by Standard & Poor's and A3 by Moody's, both with stable outlooks.

This initiative is part of ASF's EMTN program and allows the company to extend the average maturity of its debt. The terms of this issuance are considered excellent, especially in the current market environment.

The main financial participants in this operation were BNP Paribas, Natixis, BofA Securities, CaixaBank, Commerzbank, NatWest Markets NV, RBC Capital Markets and Santander.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all VINCI news