on Askeladden Capital Management LLC (NASDAQ:ALOT)

Askeladden Capital Proposes Strategic Overhaul at AstroNova

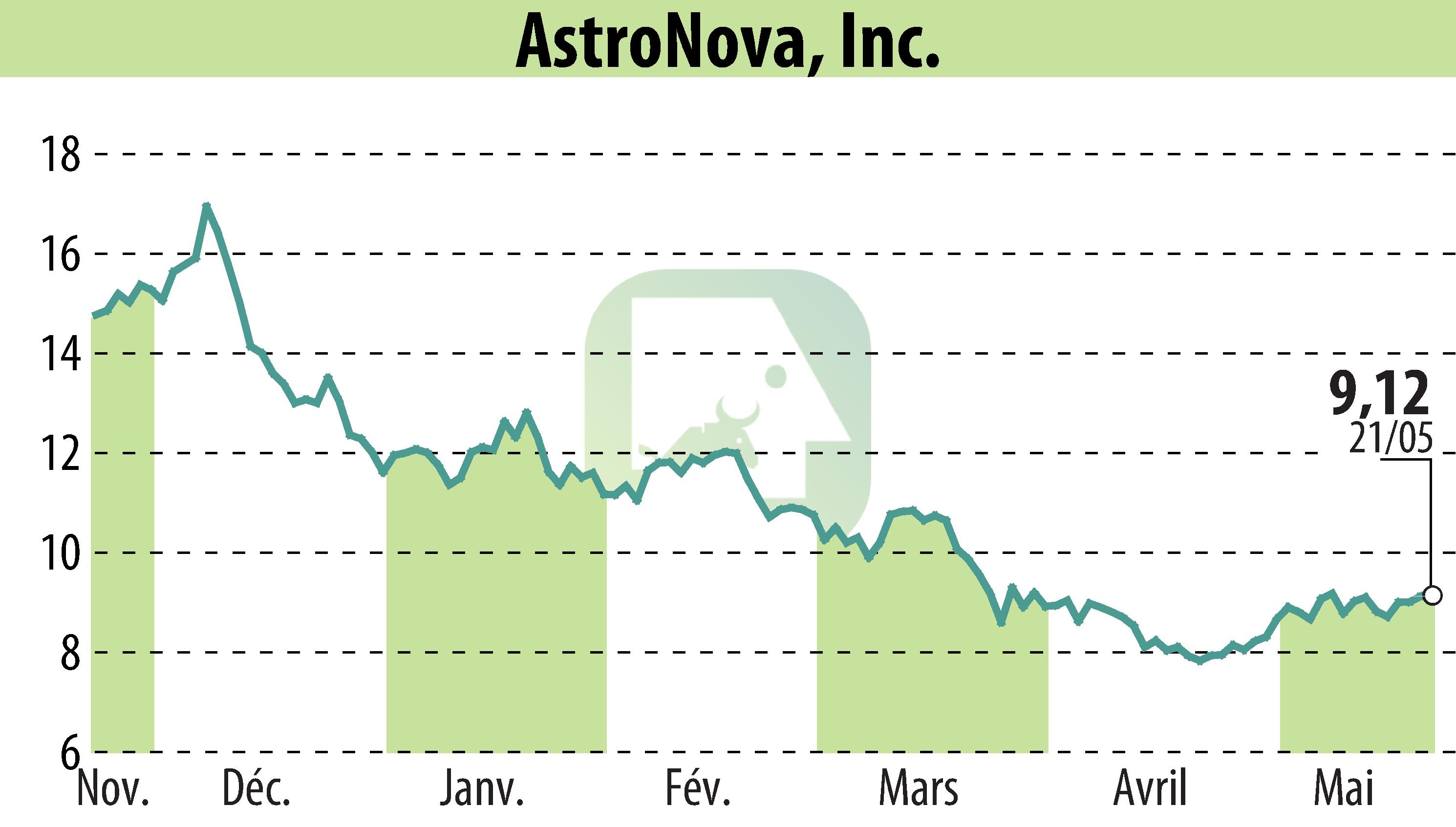

Askeladden Capital Management has outlined a plan to boost shareholder value for AstroNova, highlighting previous board decisions that led to diminished value. The 274% premium from Transdigm's acquisition of Servotronics is cited as an example of unlocking similar value at AstroNova. Concerns are raised about the independence of AstroNova's board, noting long-standing affiliations that may compromise objectivity.

Askeladden, with a 9.2% stake, intends to introduce operational reforms. Their plan advocates for immediate margin improvements and cash flow optimization. Askeladden promises to enhance accountability, scrutinize talent, and recalibrate marketing spend. They also mention strategic alternatives, including potential mergers, to maximize asset values.

The firm raises issues about AstroNova's stagnation, attributing it to ineffective acquisitions and misguided strategies. Invoking the potential of private-market assessments, Askeladden suggests that dissecting the company's segments could reveal untapped opportunities.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Askeladden Capital Management LLC news