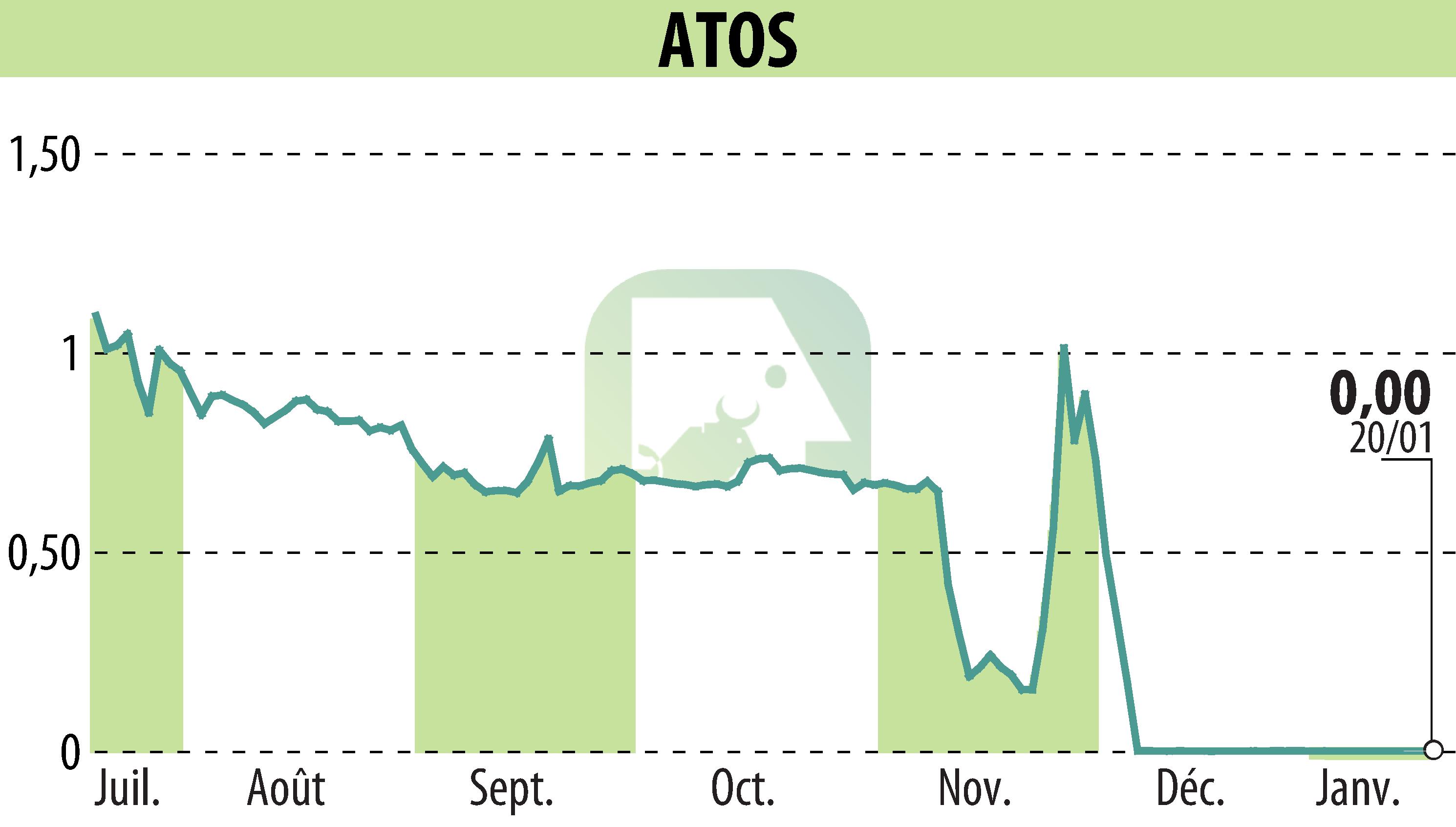

on ATOS ORIGIN (EPA:ATO)

Atos Anticipates Strong 2024 Liquidity, Exceeding Forecasts

Atos SE, a significant player in the digital transformation sector, announced an estimated year-end liquidity for 2024 that surpasses its initial business plan. As of December 31, 2024, Atos' liquidity is projected to be €2,191 million. This figure exceeds the €1,152 million outlined in their Accelerated Safeguard Plan by over one billion euros. The estimated liquidity includes €319 million in early payments from public sector customers, €240 million from selling the Worldgrid unit, and €440 million in undrawn revolving credit.

Without these elements, Atos' year-end cash would still be above expectations at €1,192 million, surpassing the forecasted €1,152 million. These financial insights are crucial for transparency with the Group's creditors. Atos aims to maintain balanced information sharing with investors, as per market regulations.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ATOS ORIGIN news