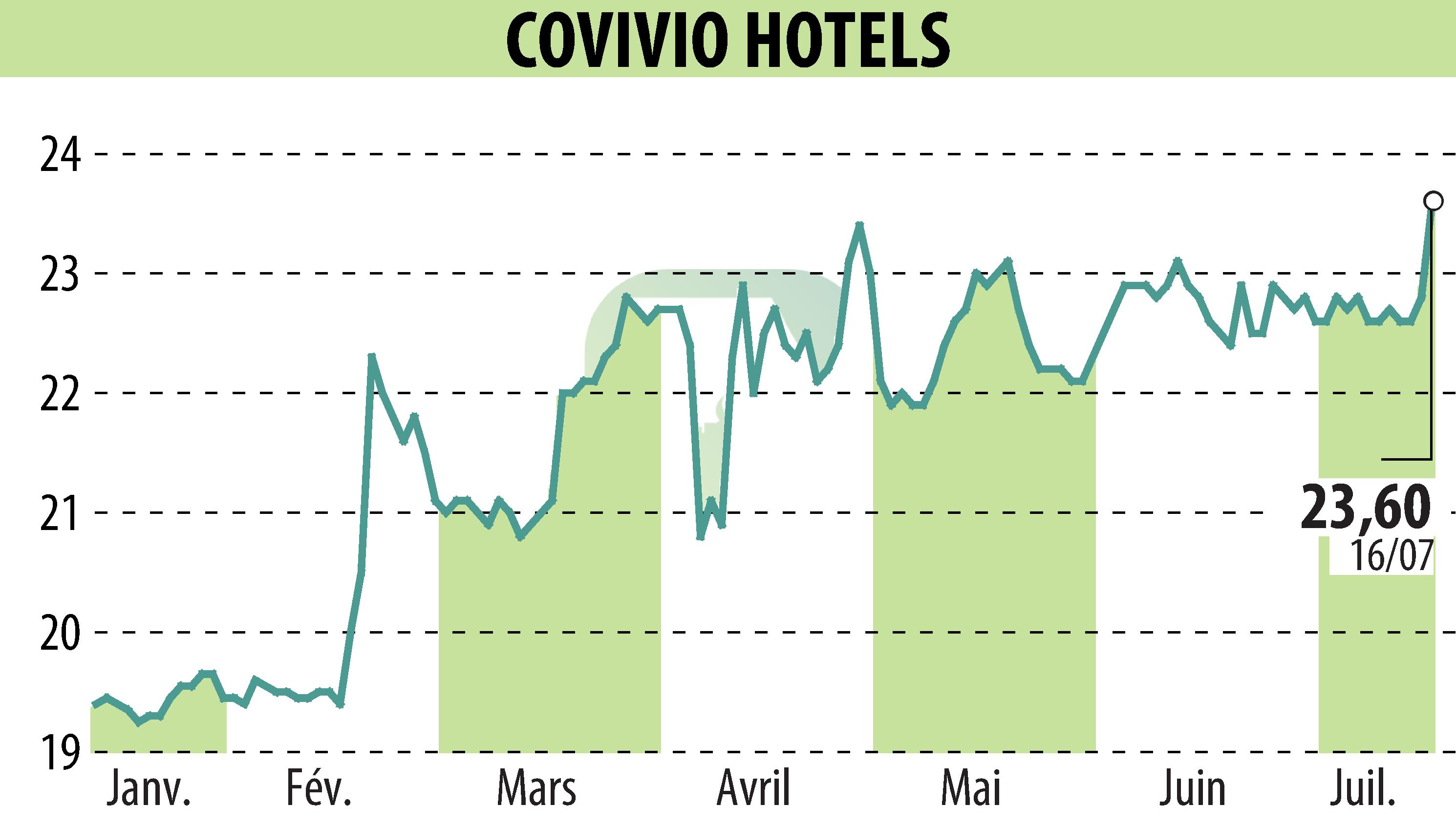

on Covivio Hotels (EPA:COVH)

Covivio Hotels: Steady Growth and Financial Performance in H1 2025

The European hotel market sustained its growth in 2025, with Covivio Hotels highlighting a robust performance. Revenue per available room (RevPAR) increased in Southern Europe, particularly in Spain (+5.0%) and Italy (+3.6%), while Germany saw a +4.1% rise. Overall European hotel investments remained stable at €4.95 billion, maintaining a significant portion of total real estate investments.

Covivio Hotels reported total disposals worth €60 million in the first half of 2025, aligning with 2024 appraisal values. Its hotel real estate portfolio was valued at €5,878 million, appreciating by +2.3% on a like-for-like basis, driven by revenue growth and strategic consolidations.

Financially, the company increased its equity by €183 million, facilitated by the dividend in shares. A notable reduction in net debt to €1,966 million improved its Loan To Value (LTV) ratio to 29.8%. Covivio Hotels also demonstrated a revenue growth of +5.3% on a like-for-like basis, reaching €162.9 million.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Covivio Hotels news