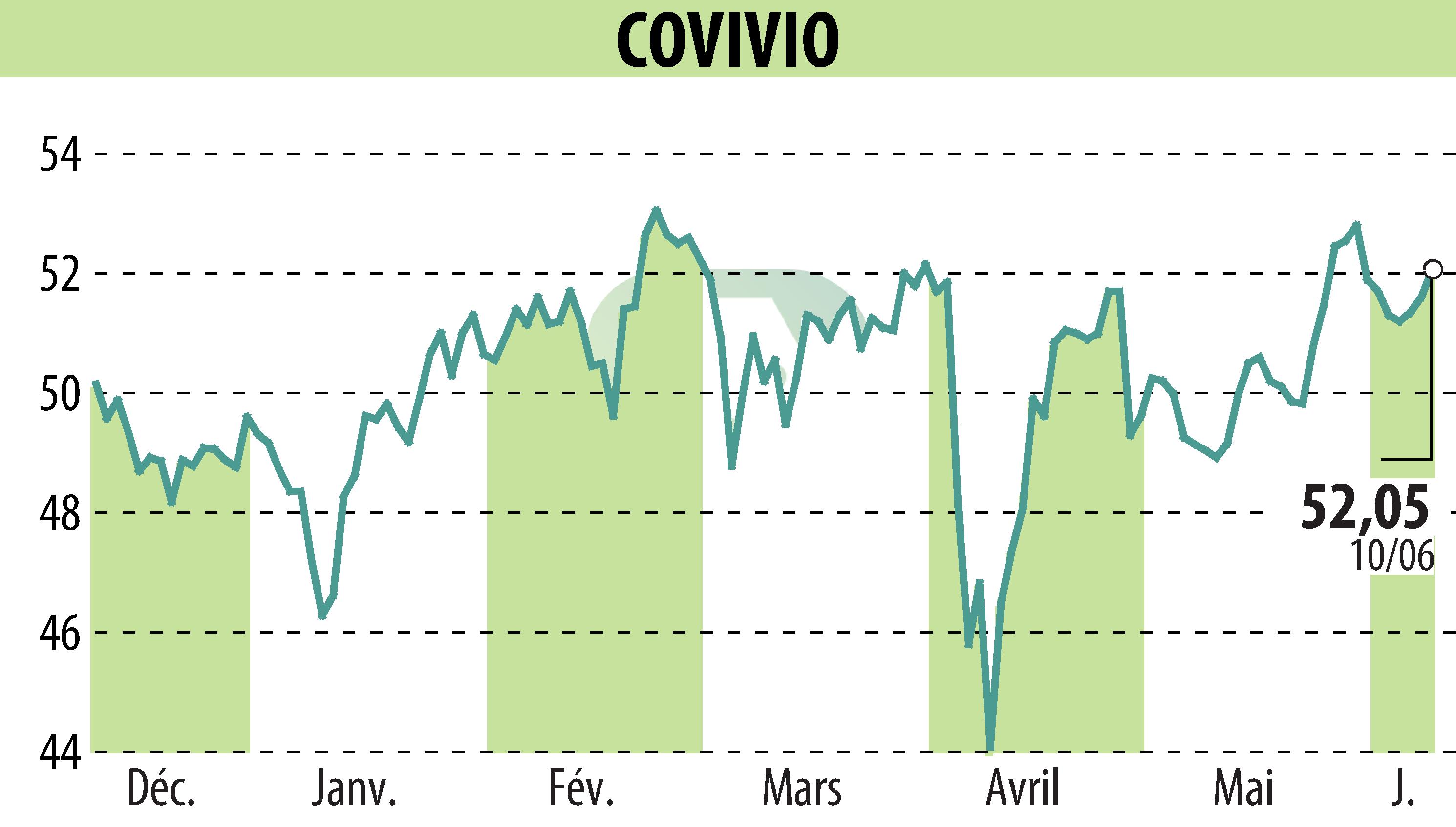

on COVIVIO (EPA:COV)

Covivio Launches €500 Million European Green Bond

Covivio has successfully issued a €500 million EU Green Bond set to mature in June 2034. This bond issuance marks the first under the European Green Bond format for the real estate sector. The issuance was highly sought after, being oversubscribed more than four times, which demonstrates strong investor confidence in Covivio's credit strength.

Priced at a spread of 135 basis points over nine years, the bond offers an annual coupon of 3.625%, with an effective rate of 3% due to strong hedging. This move strengthens Covivio's balance sheet and financial flexibility. It maintains an average debt maturity of 4.8 years, boosts liquidity to €2.5 billion, and promises a debt cost below 2.5% until 2028.

The bonds, aligned with the EU Green Bond Standards, will finance sustainable real estate projects. They are set to be traded on Euronext Paris from June 17, 2025.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all COVIVIO news