on CRCAM ATLANTIQUE VENDEE (EPA:CRAV)

2025 Financial Results of Crédit Agricole Atlantique Vendée

Crédit Agricole Atlantique Vendée concluded 2025 with exemplary financial strength. Despite an uncertain economic climate, the bank managed to grow while preserving its cooperative model. The Board of Directors met to approve these results.

The bank saw a 4.9% increase in total deposits and loans, reaching €57.7 billion. Net banking income grew by 6.7%, driven by strong revenue from insurance and savings products. However, the cost of risk increased by 33.7%, slightly impacting consolidated net income, which remained at €85.5 million.

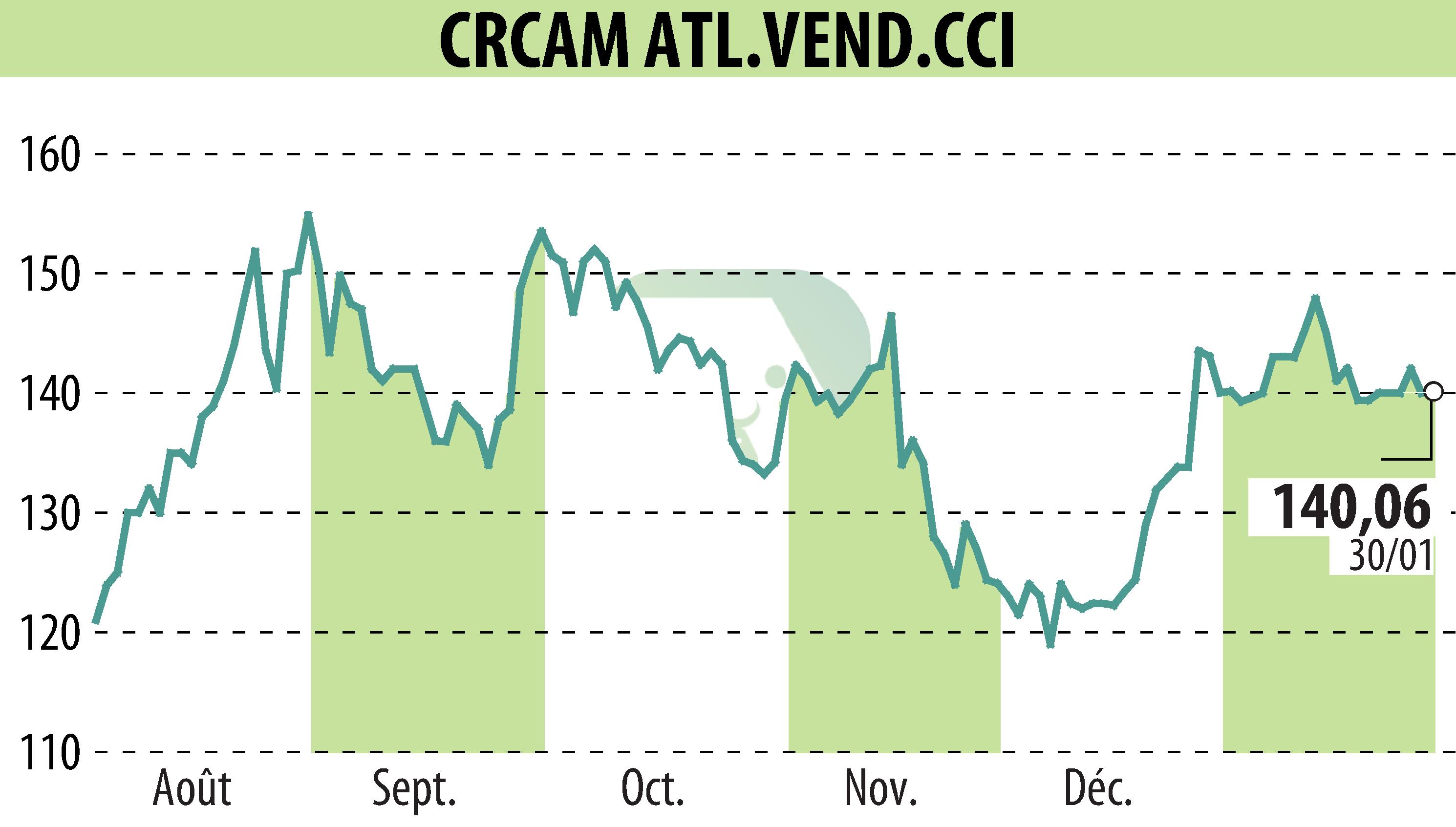

Solvency remains robust at 26.64%, well above the regulatory threshold. The Cooperative Investment Certificate saw its value climb by 63.7% over the year. In 2026, Crédit Agricole Atlantique Vendée will continue its commitment to the energy transition and digital innovation.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CRCAM ATLANTIQUE VENDEE news