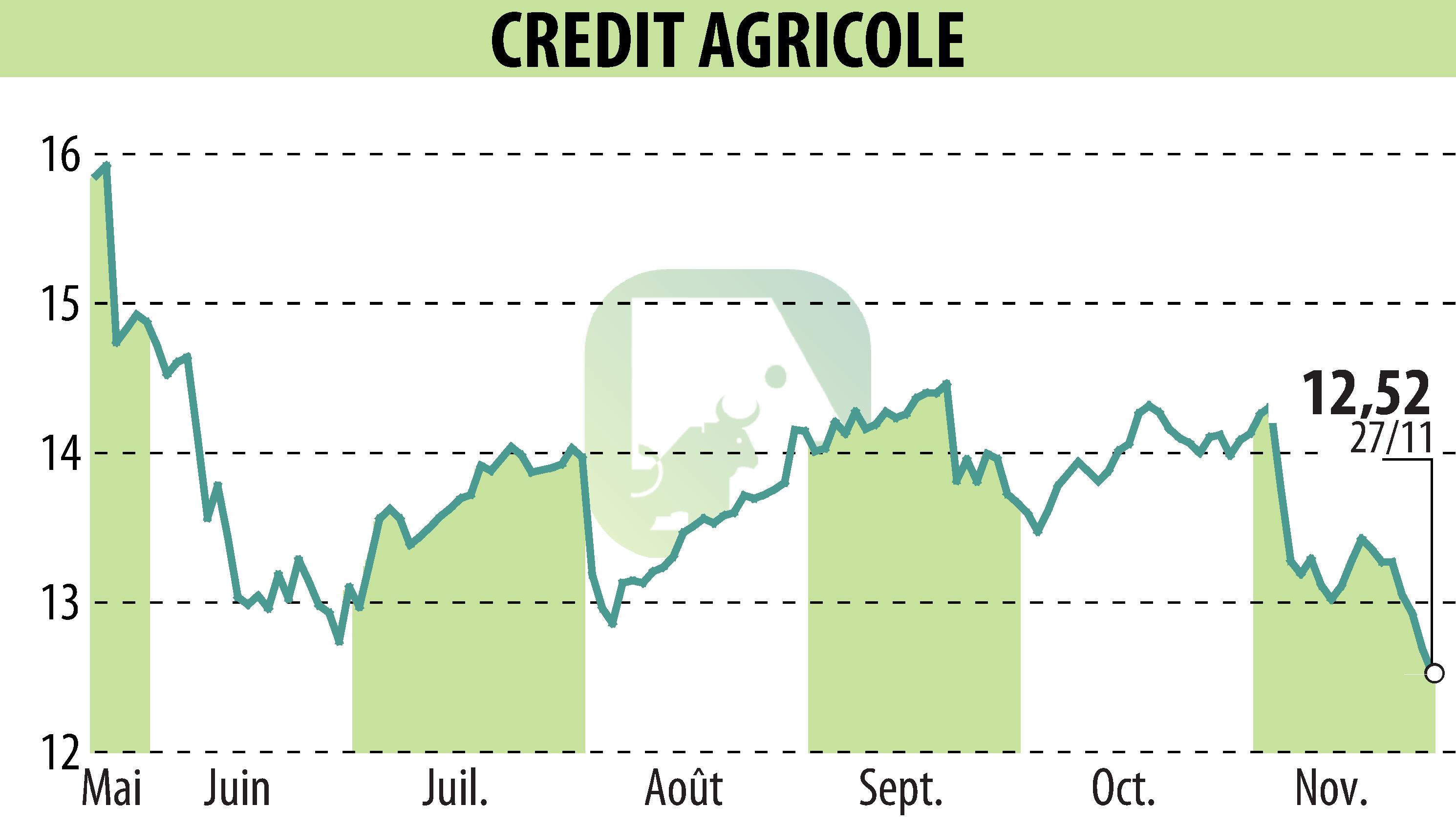

on CREDIT AGRICOLE (EPA:ACA)

Crédit Agricole designated as G-SIB category 2

On November 27, 2024, Crédit Agricole was designated as a Category 2 Global Systemically Important Institution (G-SIB) by the French Prudential Supervision and Resolution Authority (ACPR). This ranking is based on a score calculated from data from the end of 2023, highlighting the group's growth and leading position internationally.

This designation results in an increase in the additional capital requirement, or "GSIB buffer," from 1% to 1.5%, effective January 1, 2026. The current 1% requirement remains in effect until that date.

The Group stands out for its solid capitalization level, posting a CET1 ratio of 17.4% as of September 30, 2024. This represents a margin of 760 basis points compared to the SREP capital requirement as of the same date, giving it a robust position among European G-SIBs.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE news