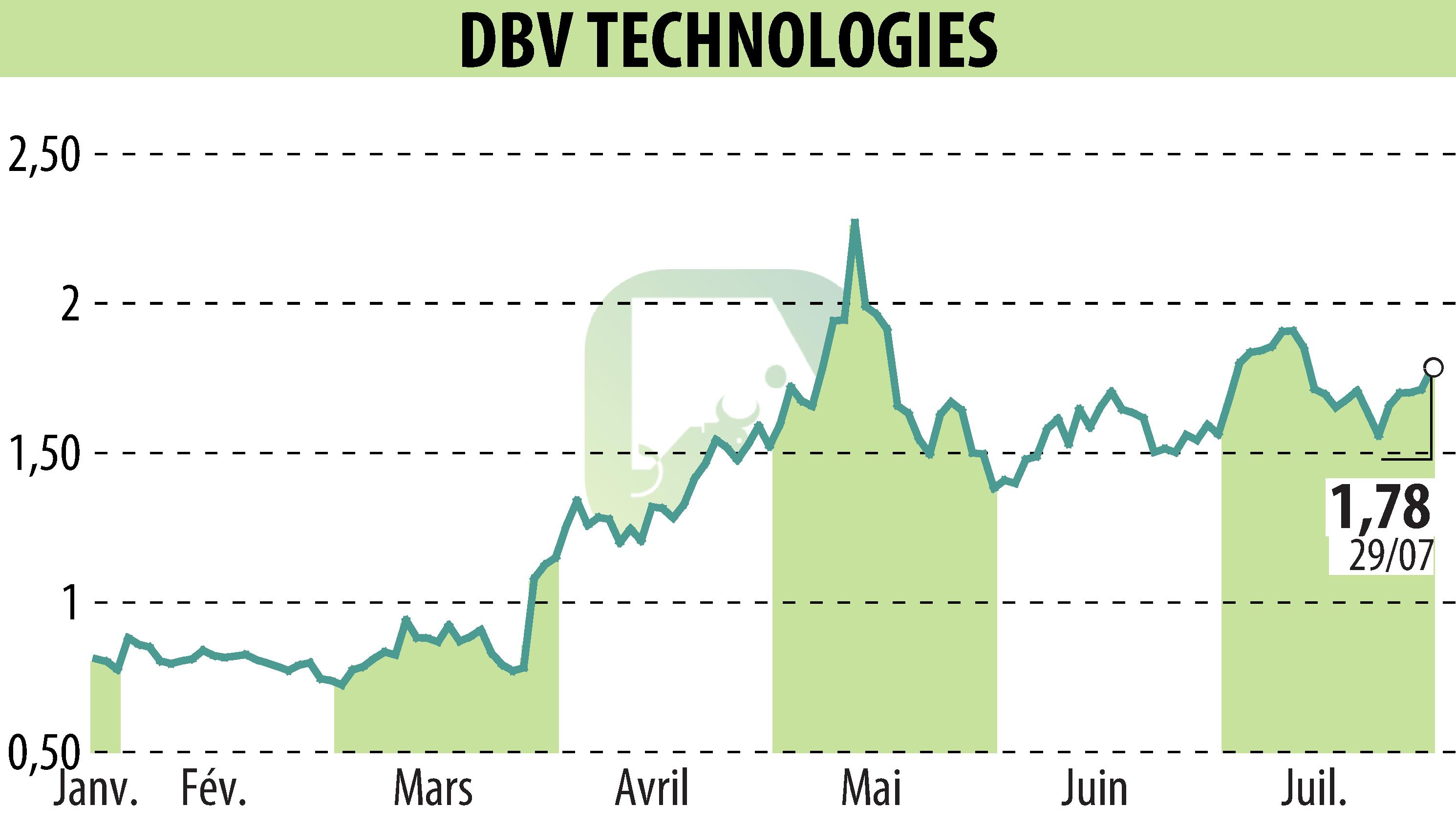

on DBV TECHNOLOGIES (EPA:DBV)

DBV Technologies Posts Financial Results for H1 2025

DBV Technologies, a clinical-stage biopharmaceutical firm, has disclosed its financial performance for Q2 and H1 2025. The company reported an operating income of $2.2 million for the first half of 2025, down from $2.6 million in the same period in 2024. This decrease is mainly attributed to less eligibility for the French Research Tax Credit as research activities were increasingly moved to North America.

Operating expenses rose to $69.9 million, up from $65.0 million in H1 2024, attributed largely to the launch of the COMFORT Toddlers study. Despite this, the company's net loss for H1 2025 was $69.0 million, slightly up from $60.5 million in 2024, with per share net loss improving from $0.63 to $0.58.

Cash reserves stood at $103.2 million as of June 30, 2025, a significant increase due to major financing efforts totaling $306.9 million. The company plans to use these funds to advance the Viaskin® Peanut patch program through regulatory submission and potential U.S. launch.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DBV TECHNOLOGIES news