on Delticom AG (ETR:DEX)

Delticom AG: Stable Growth Amid Stagnant Market

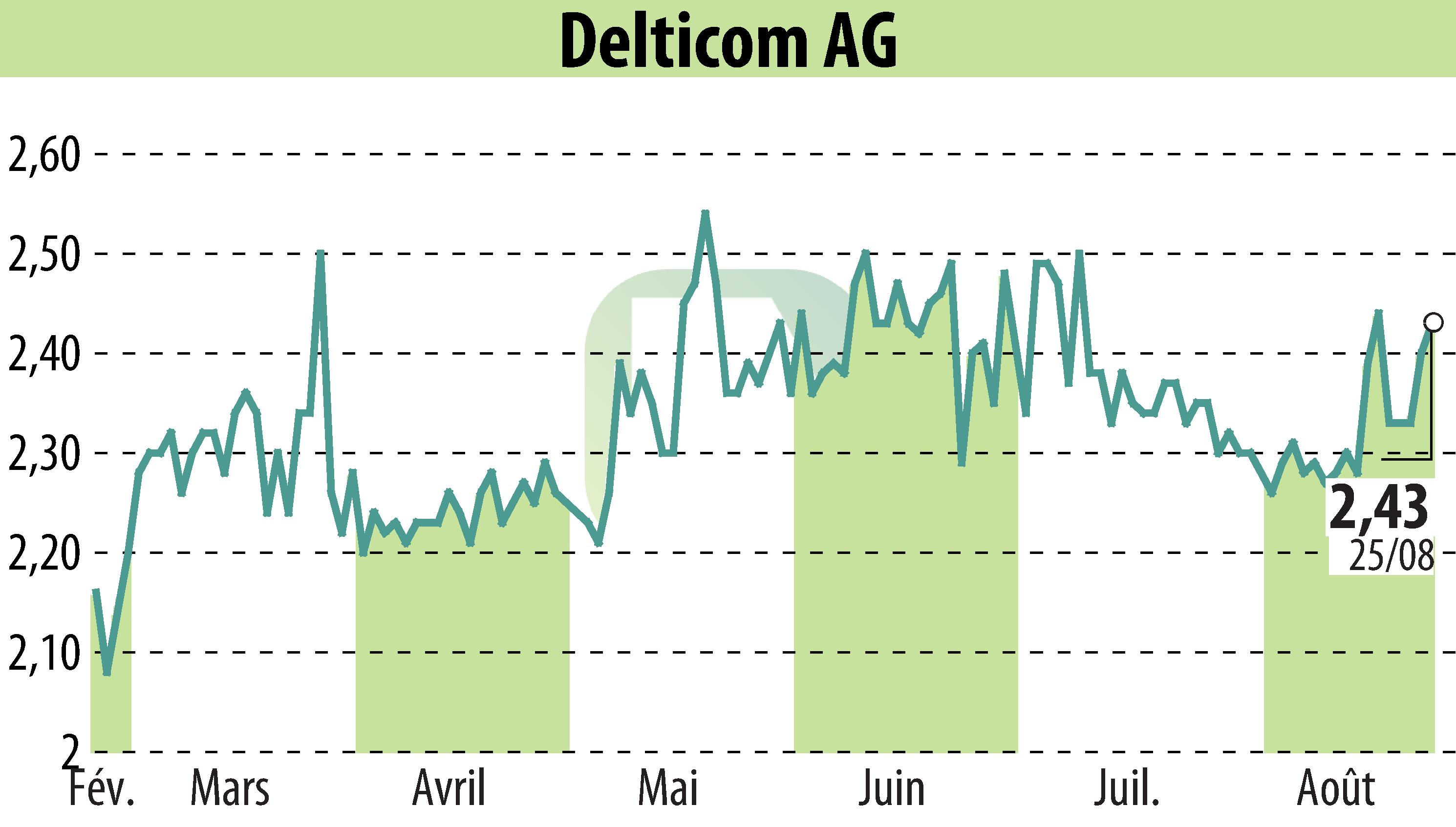

Delticom AG has been reaffirmed with a "BUY" recommendation by Quirin Privatbank Kapitalmarktgeschäft, with a target price set at EUR 3.90. The research highlights Delticom’s revenue growth of 11.6% in the first half of 2025, showcasing its ability to expand its market position despite a generally stagnant replacement tire business. The company's strong online presence and strategic combination of shop business with a platform model aid this expansion.

The estimated revenue for the full year 2025 is between EUR 470-490 million, with an expected EBITDA of EUR 19-21 million. Recent trailing twelve months (TTM) sales increased by EUR 16 million to EUR 506 million. Despite a decrease in TTM EBITDA due to special items, the prospect of reversing these effects in the latter half of the year highlights the resilience of Delticom’s business model.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Delticom AG news