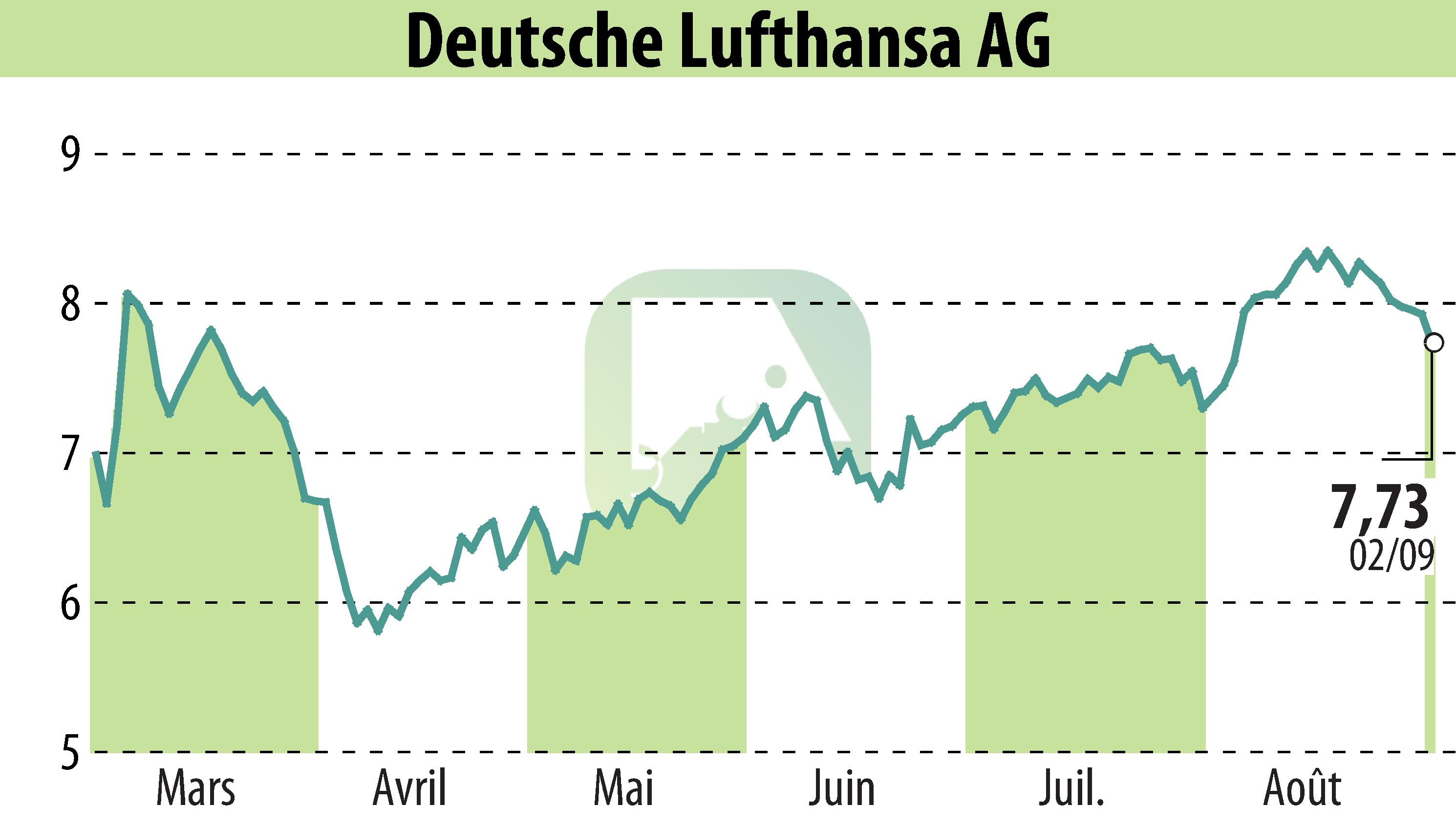

on Deutsche Lufthansa AG (ETR:LHA)

Deutsche Lufthansa Launches €600 Million Convertible Bonds Offering

Deutsche Lufthansa AG announces the launch of unsecured and unsubordinated convertible bonds amounting to €600 million, due in 2032. Each bond has a denomination of €100,000 and can be converted into new or existing no-par value ordinary registered shares of the company. The bonds target institutional investors outside certain jurisdictions, including the United States and Australia.

The company plans to use the proceeds for general corporate purposes and refinancing existing debt, alongside a tender offer for outstanding 2025 convertible bonds. The new bonds will be issued at full principal and bear no periodic interest. The initial conversion price is at a premium of 40% to 45% above the reference share price, based on a volume-weighted average price on XETRA.

Settlement is slated for around September 10, 2025, with plans to list on the Frankfurt Stock Exchange's Open Market. Concurrently, Lufthansa extends an invitation to holders of 2025 bonds to tender these for cash repurchase through a modified Dutch auction.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Deutsche Lufthansa AG news