on Deutsche Rohstoff AG (ETR:DR0)

Deutsche Rohstoff AG Maintains Buy Recommendation Amidst Oil Price Pressures

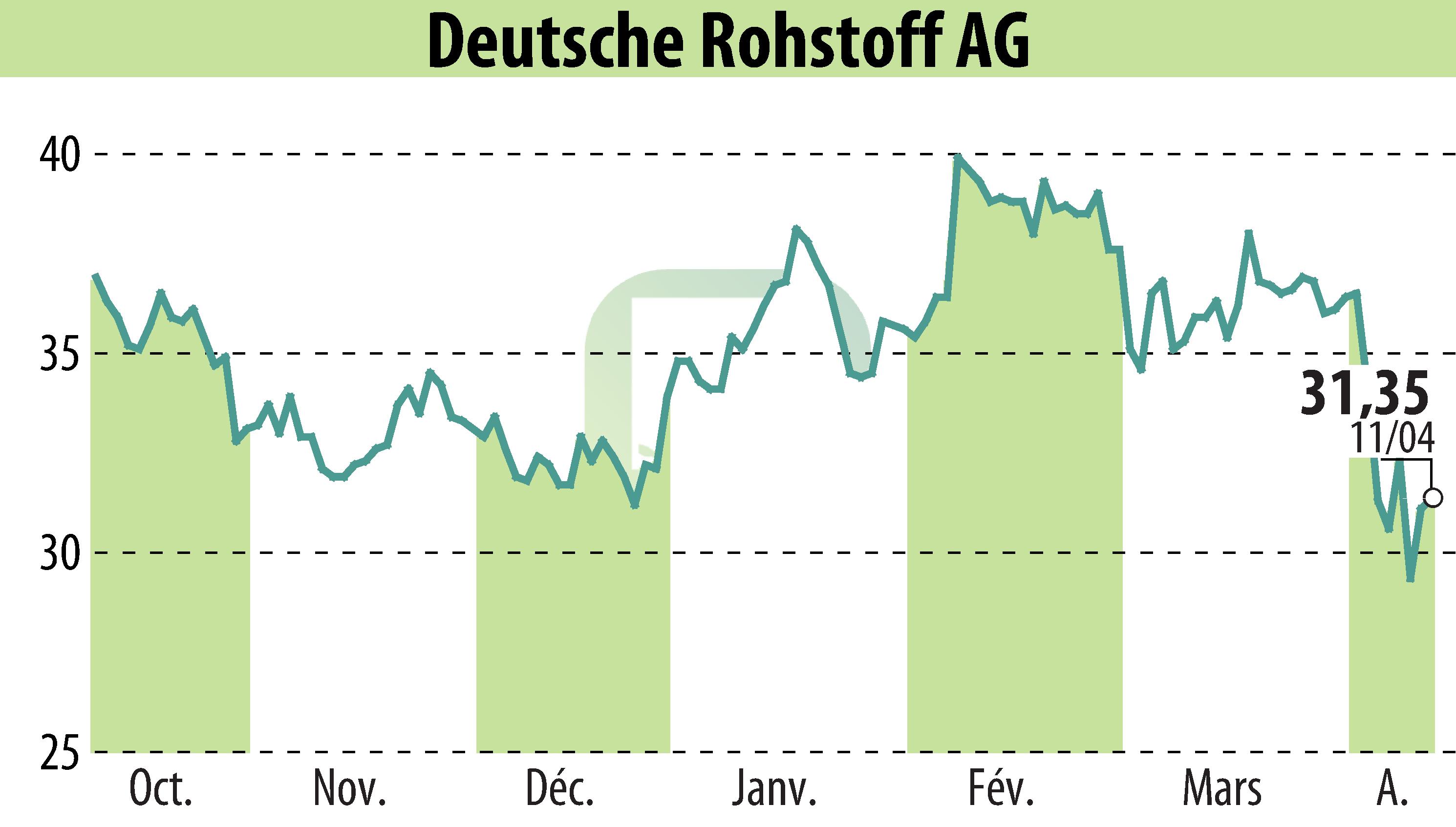

First Berlin Equity Research has reiterated its BUY recommendation for Deutsche Rohstoff AG, adjusting the target price from €48 to €40. Despite President Trump's tariff policies leading to downward revisions of economic growth forecasts, and consequently pushing oil prices to their lowest levels since 2021, Deutsche Rohstoff AG remains a strong prospect.

The company is trading at a low PE multiple of below 6x for 2025E-2027E and offers a yield of 5.7%. Their strategy includes maintaining production levels with the investment in approximately 11 new wells per year, each costing around USD10 million. This approach aims to stabilize EBITDA at €130 million annually over the next three years and reduce net gearing from 66% to 52% by 2027.

The analyst believes that even in a low oil price environment, Deutsche Rohstoff AG's disciplined investment strategy will sustain dividends and financial stability. A potential reversion of commodity prices could further enhance performance.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Deutsche Rohstoff AG news