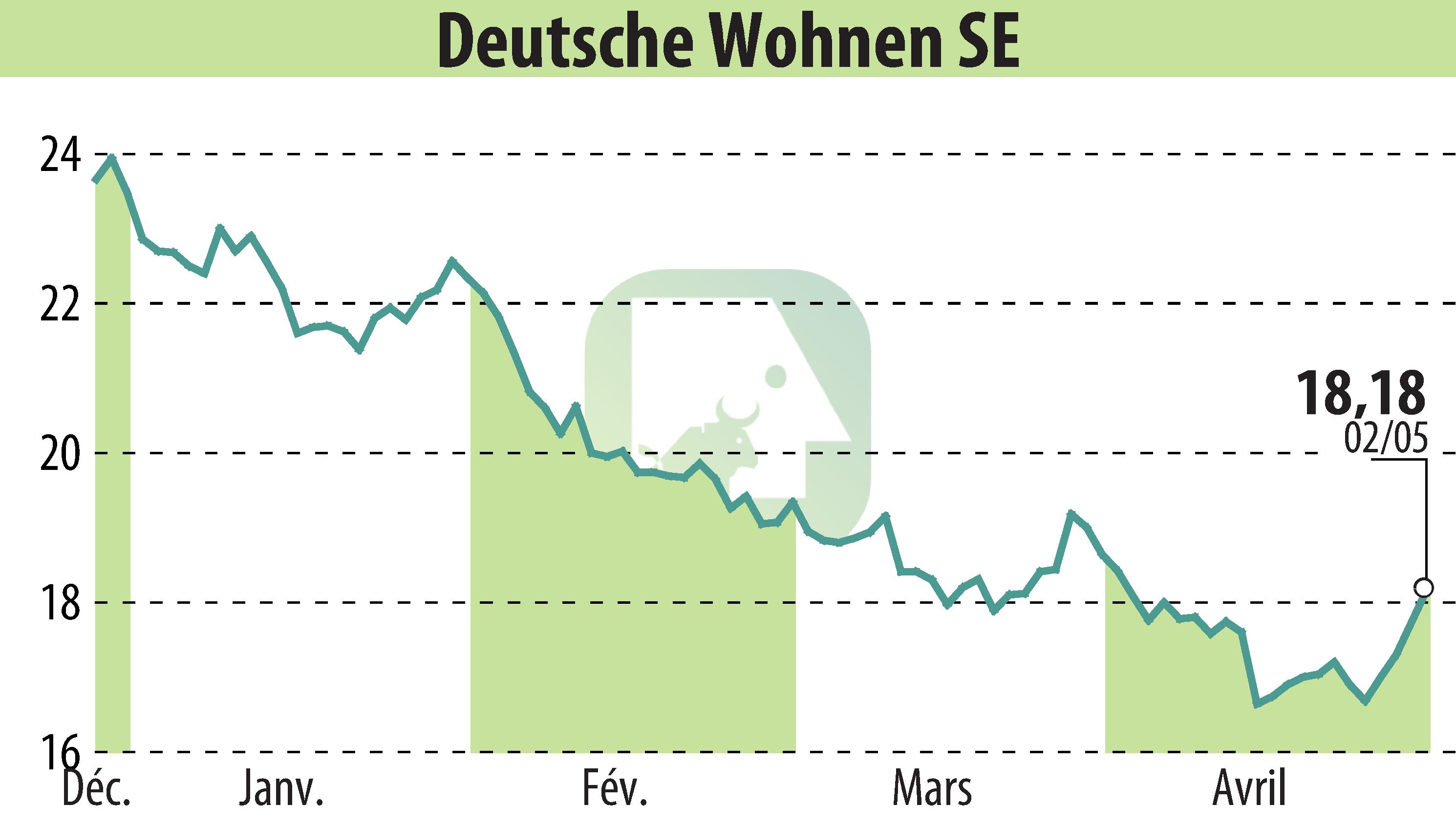

on Deutsche Wohnen AG (isin : DE000A0HN5C6)

Deutsche Wohnen Reports Steady Performance in Q1 2024

Deutsche Wohnen SE, navigating a challenging real estate market, has maintained a stable operation in the first quarter of 2024. The Berlin-based company noted an adjusted EBITDA for rental activities of €160.4 million, marking a 2.5% increase from the previous year. In a similar upward trend, the in-place rent per square meter saw a rise of 3.3%, reaching €7.76.

In financial terms, the company reported an Adjusted EBT of €141.3 million for the initial quarter, a slight improvement over the prior year. This performance translates to €0.36 per share in terms of Adjusted EBT. The Net Asset Value (NAV), previously noted as EPRA NTA, stood firm at €17,010.4 million, equivalent to €42.85 per share. Remarkably, the vacancy rate holds at a low of 1.6%. Another notable financial metric, the Loan to Value (LTV) ratio, was recorded at 30.0%.

R. E.Copyright © 2024 FinanzWire, all reproduction and representation rights reserved. Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Deutsche Wohnen AG news