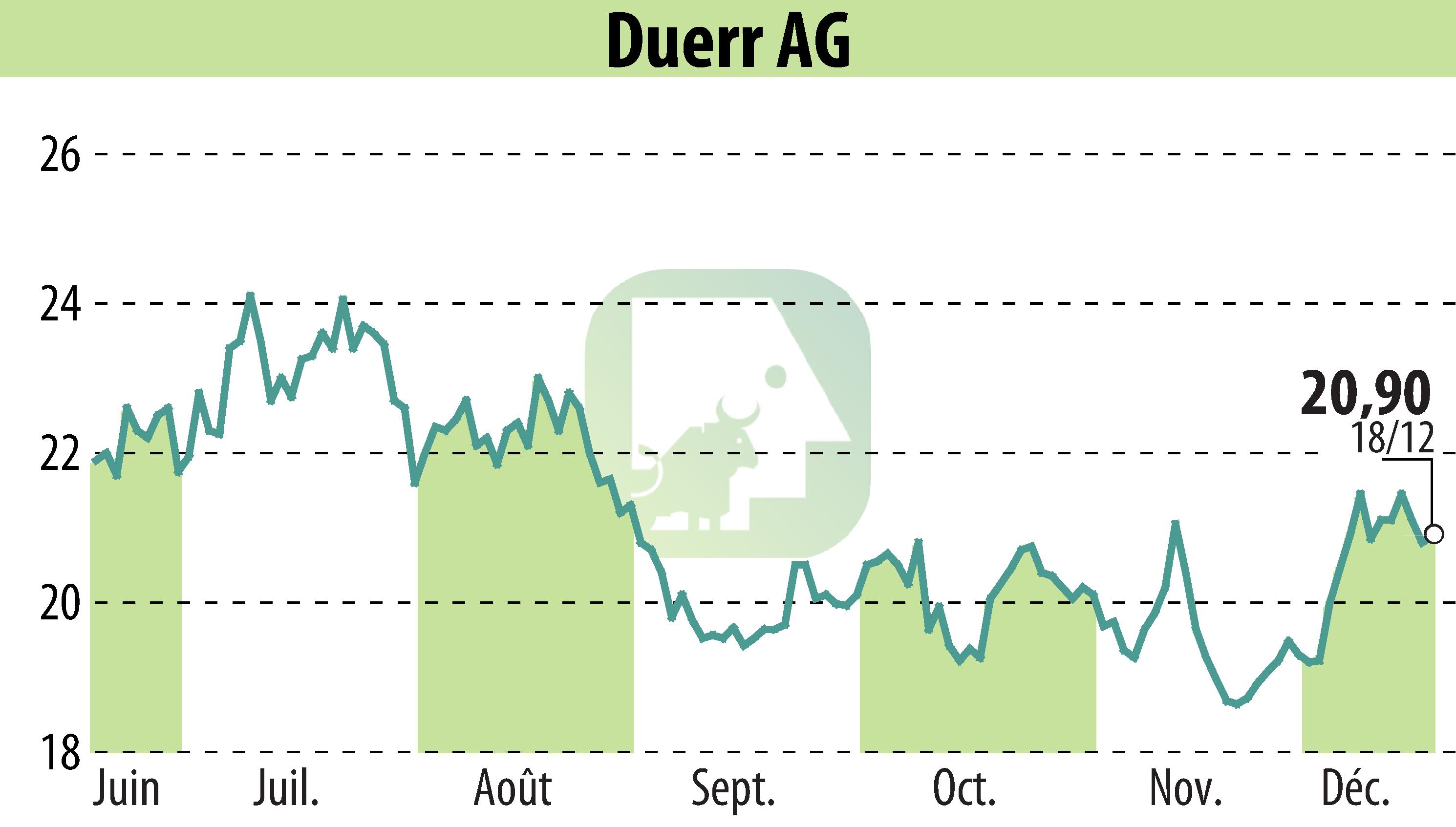

on Dürr Aktiengesellschaft (ETR:DUE)

Dürr AG Adjusts Free Cash Flow Forecast Amid Strategic Movements

Dürr AG has updated its 2025 fiscal forecast, now projecting a free cash flow of €100 to €200 million, significantly higher than the previous estimate of €0 to €50 million. The adjustment reflects early customer payments and postponed outgoing payments now expected in 2026. The net financial debt forecast for December 31, 2025, has also been revised to €-75 to €-175 million, improving from the earlier €-250 to €-300 million range.

A pivotal factor in this forecast adjustment is the anticipated proceeds from the sale of Dürr's environmental technology business, expected to contribute between €290 to €310 million. This transaction's tax-related outflows have been deferred to 2026, enhancing the company's net financial status more than initially expected.

Originally, in March 2025, Dürr AG anticipated a net financial status in the range of €-500 million to €-550 million, later adjusted in June following the sale agreement. These strategic financial decisions will likely impact the company's ongoing investments and operational adjustments across its three divisions: Automotive, Industrial Automation, and Woodworking.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Dürr Aktiengesellschaft news