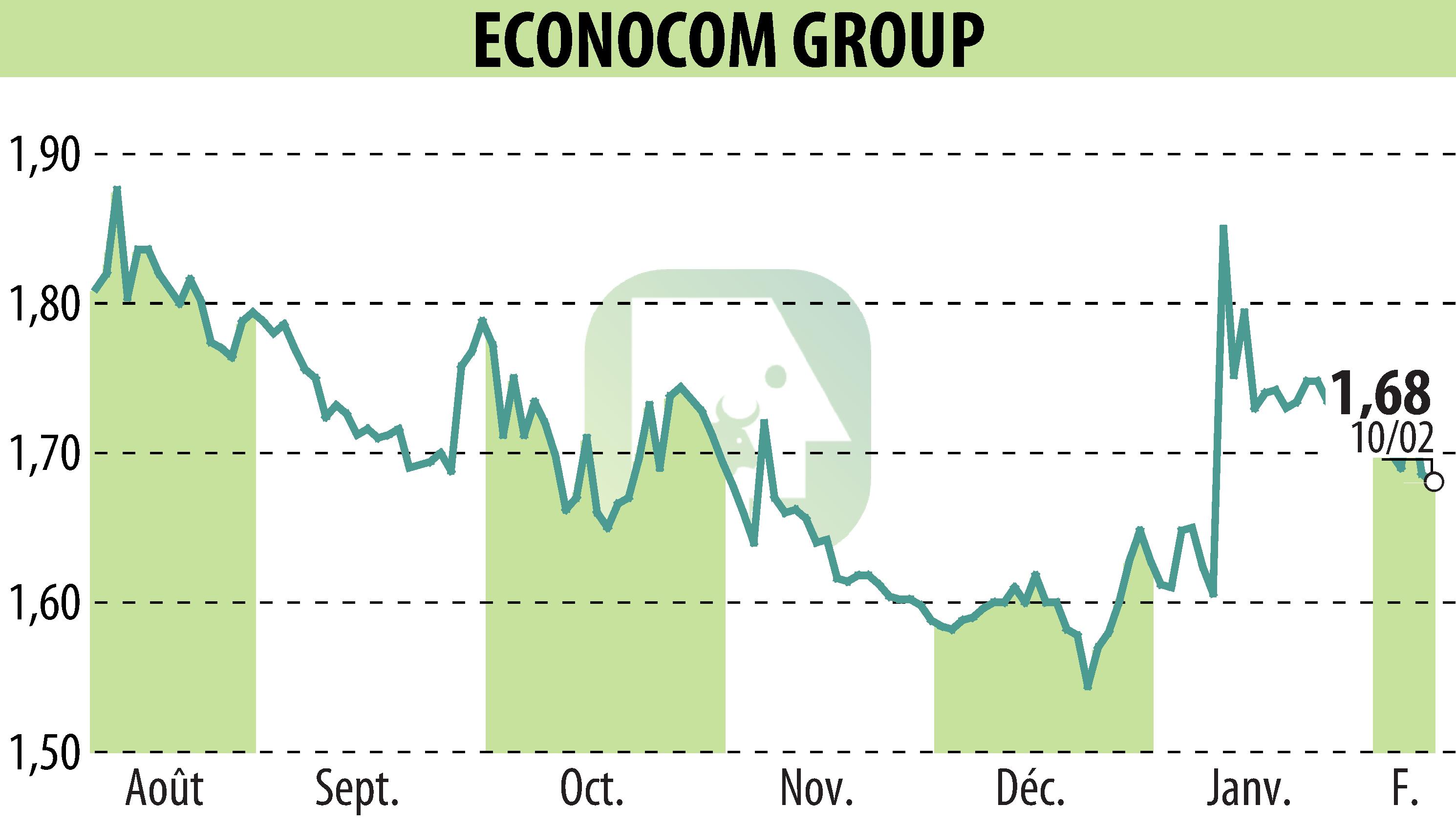

on ECONOCOM GROUP (EBR:ECONB)

Econocom Group 2025 Results: Solid Performance in a Challenging Market

In 2025, Econocom Group delivered a robust performance despite a challenging economic environment. The company reported a revenue increase of 4.3%, totaling €2,923 million, with 2.7% attributed to organic growth. This growth was driven by the Technology Management & Financing (TMF) and Products & Solutions (P&S) segments, particularly in Southern Europe and Germany.

The operating margin rose to €118.1 million, maintaining a profitability rate of 4.0% amid ongoing transformation initiatives under the One Econocom plan. A notable 42.5% increase in profit from continuing operations, reaching €53.2 million, was recorded due to enhanced operational performance. However, consolidated net income was €6.4 million, affected by non-recurring items linked to the exit of residual software activities.

The group significantly reduced its net financial debt to €36 million by the end of 2025. Despite external challenges, Econocom remains committed to its strategic ambitions, focusing on organic growth, AI investments, and selective external growth.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ECONOCOM GROUP news