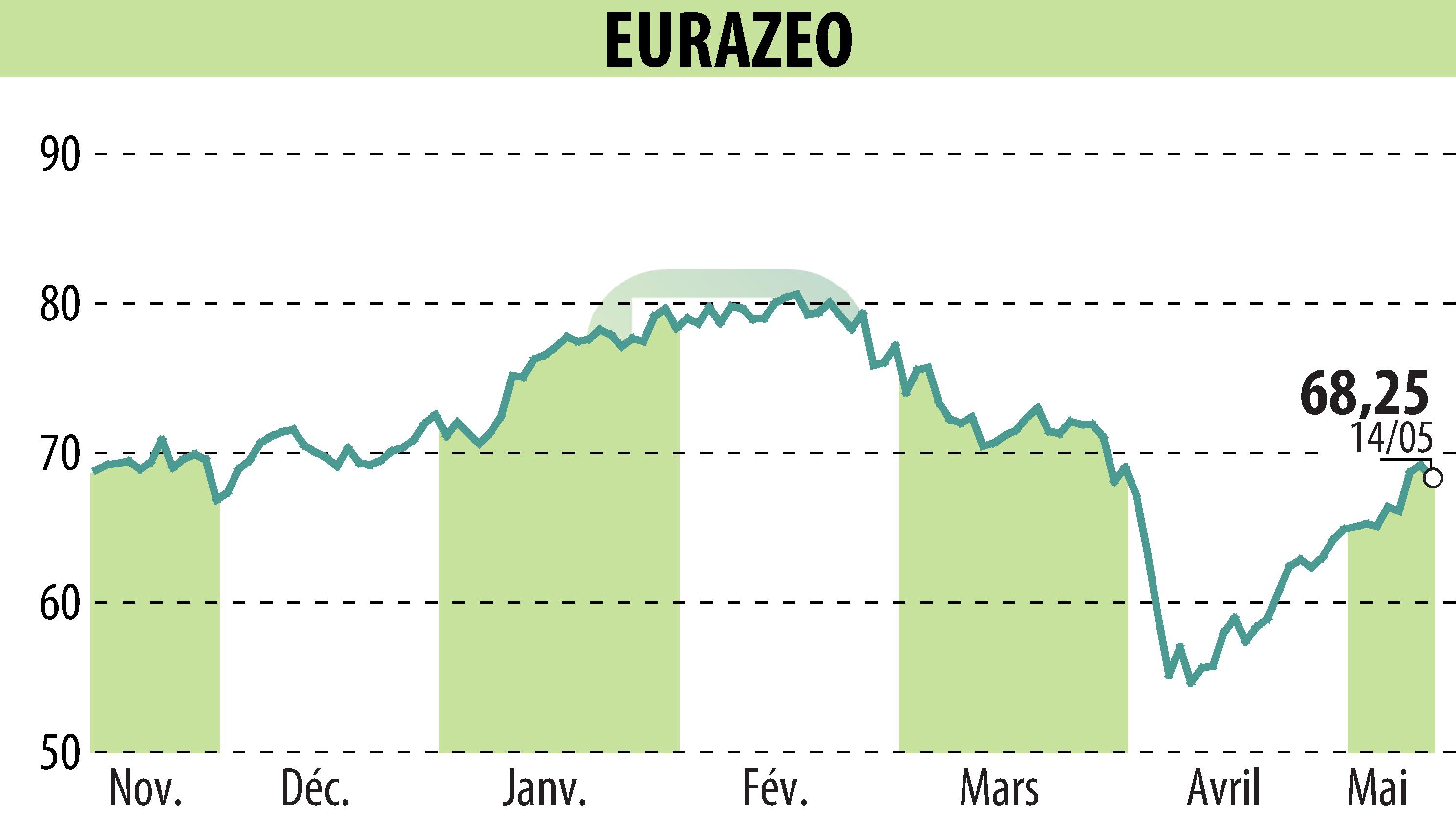

on EURAZEO (EPA:RF)

Eurazeo Achieves Strong Fundraising and Asset Rotation Success in Q1 2025

In the first quarter of 2025, Eurazeo reported robust third-party fundraising of €944 million, marking a fourfold increase from Q1 2024. The company's Fee Paying Assets Under Management rose by 9%, totaling €27.5 billion, supported by a 12% increase from third parties. Additionally, management fees grew by 9% to €107 million.

Eurazeo's asset rotation plan progressed well, with €0.8 billion deployed and €0.2 billion realized in Q1 2025. Including the sale of Albingia, divestments exceeded €525 million, aligning with the strategic plan.

Portfolio companies showed promising performance, with buyout companies' revenues increasing by 7%, and growth portfolio companies achieving a 14% rise. Notably, sustainable infrastructure saw a 20% revenue growth.

Finally, the company enhanced shareholder returns with a 10% dividend increase and a €400 million share buyback program, while furthering its sustainability initiatives by publishing its first CSRD-compliant Sustainability Statement.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news