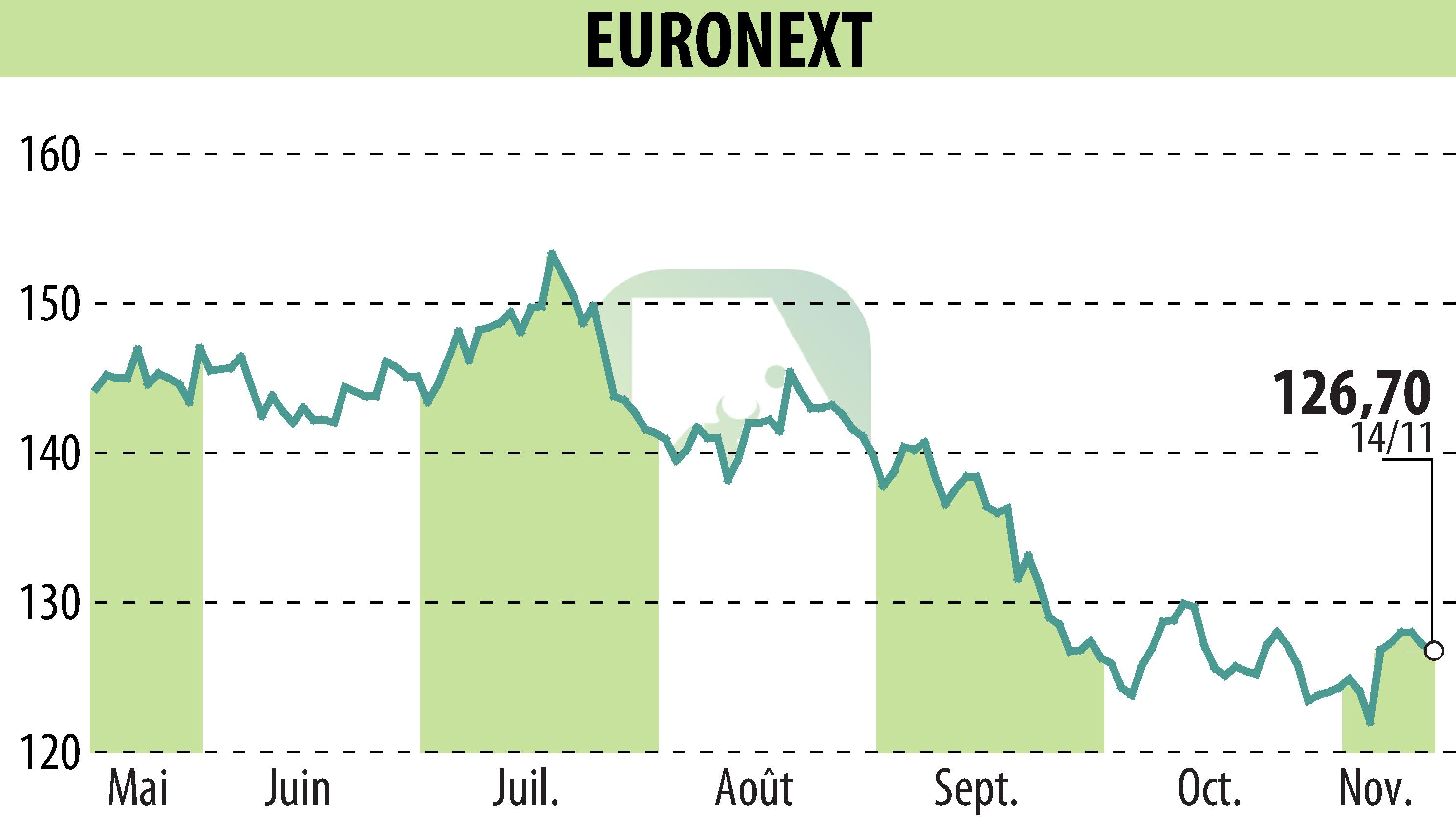

on EURONEXT NV (EPA:ENX)

Euronext Launches Tender Offer for 2026 Bonds and Plans New Issuance

On 17 November 2025, Euronext N.V. announced a tender offer for its outstanding €600 million 0.125% bonds maturing in 2026. The Amsterdam-based company aims to purchase these bonds for cash at a price of 99.05% of their principal amount. This tender offer aims to manage Euronext's debt maturity profile effectively.

In conjunction with the tender offer, Euronext plans to issue new euro-denominated fixed rate bonds, subject to market conditions. The purchase of existing bonds through the offer depends on the successful issuance of these new bonds. Bonds not bought back in the offer will be redeemed at their maturity.

Crédit Agricole, ING Bank, J.P. Morgan, and Société Générale have been engaged as dealer managers for the offer, with Kroll Issuer Services acting as the tender agent.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURONEXT NV news