on GEA Group Aktiengesellschaft (ETR:G1A)

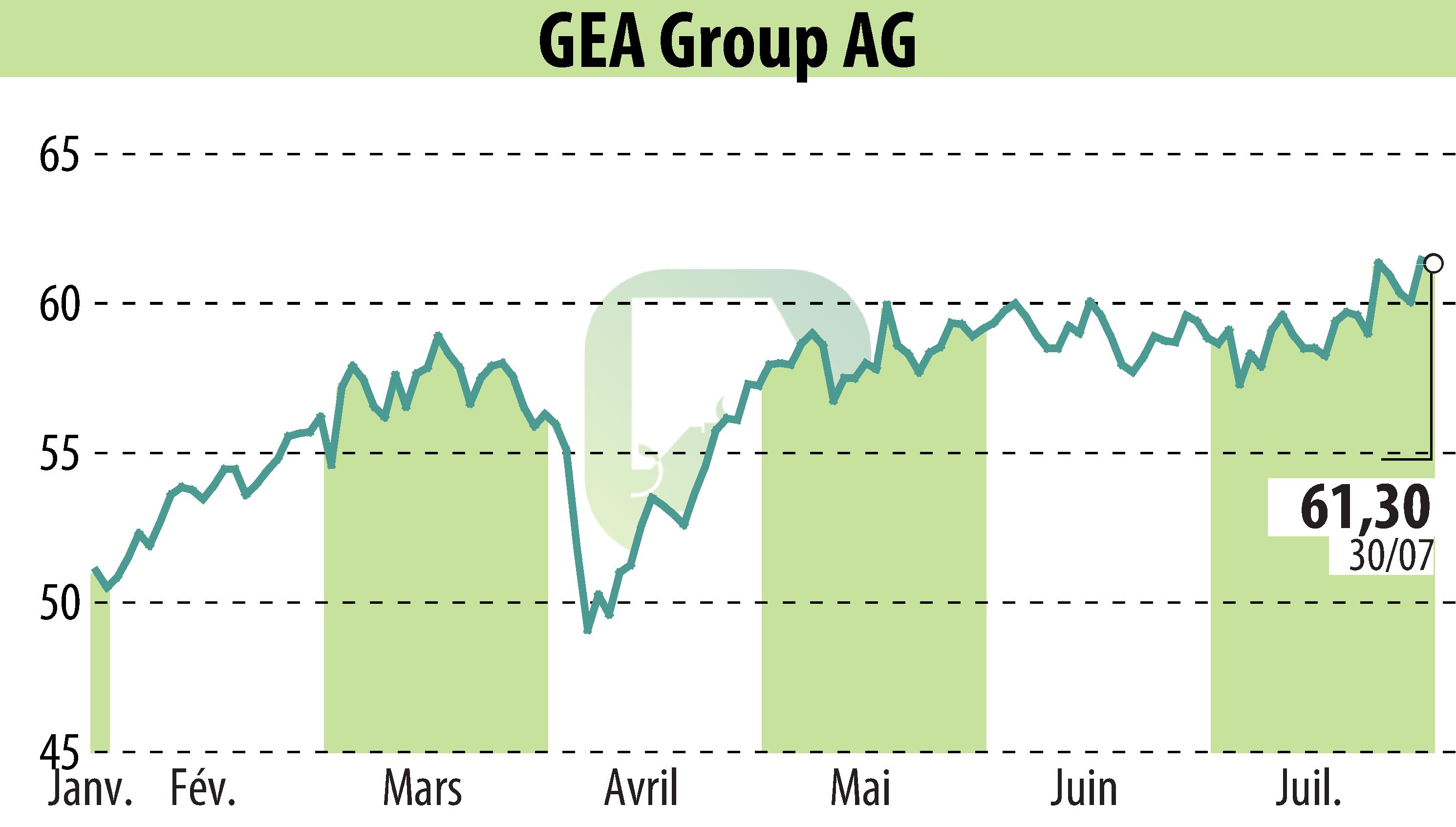

GEA Group Elevates 2025 Forecast Following Strong First Semester

GEA Group Aktiengesellschaft has revised its fiscal year 2025 forecast upward, following a robust operating performance in the first half of the year. The company now anticipates organic sales growth between 2% and 4%, an EBITDA margin before restructuring expenses of 16.2% to 16.4%, and a return on capital employed (ROCE) between 34% and 38%. Previously, these indicators stood lower, showcasing a positive development.

The enhancements in key financial metrics are attributed to increased order intake, strong base business, and efficiency improvements. Notably, a significant order ranging from EUR 140 million to EUR 170 million is set to be accounted for in the latter half of 2025. GEA CEO Stefan Klebert expressed optimism, highlighting the company's favorable order situation and continued profitability improvement.

Though facing a challenging environment, GEA anticipates further interesting projects in 2025 and projects to accelerate revenue growth in 2026, reaffirming its Mission 30 goals.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all GEA Group Aktiengesellschaft news