on Grand City Properties S.A., (ETR:GYC)

Grand City Properties' Credit Rating Downgrade and Market Outlook

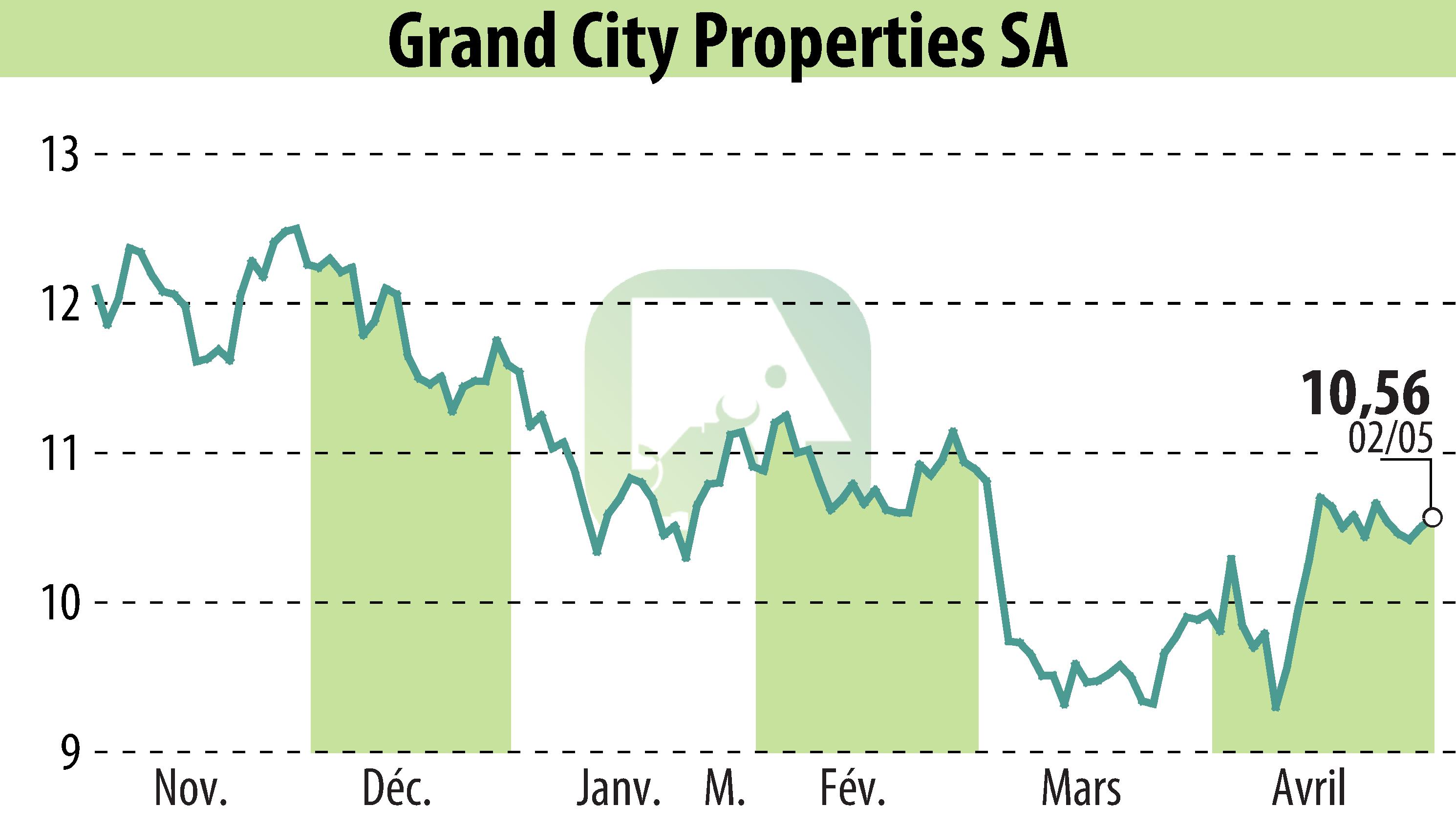

First Berlin Equity Research has reiterated its "Buy" recommendation for Grand City Properties S.A., with a target price of €14.20. This comes after Standard & Poor’s downgraded Grand City's credit rating from BBB+ to BBB, but with a stable outlook. The downgrade aligns with the similar downgrade of Aroundtown, in which Grand City holds a 62% stake. The decision by S&P reflects concerns about the German economy's impact on Aroundtown’s 2025 disposal activities and its leverage compliance.

Despite the downgrade, Grand City’s standalone credit profile remains at BBB+, backed by strong operational performance and positive fundamentals in the residential markets of Germany and London. Notably, Grand City’s bonds showed little reaction, indicating that the market had already anticipated this re-rating. The analyst maintains a positive outlook, pointing to a potential 35% upside in stock value.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news