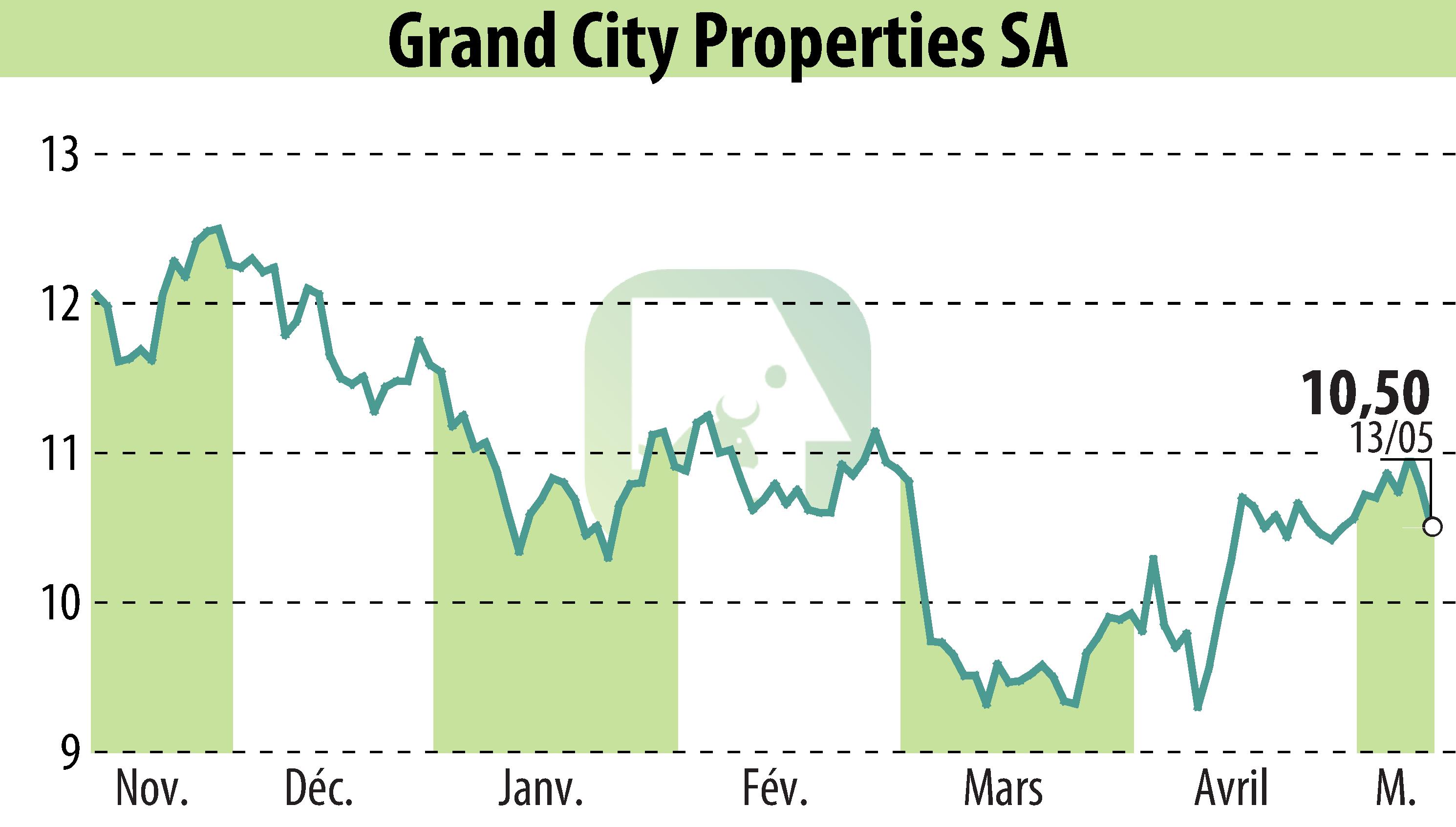

on Grand City Properties S.A., (ETR:GYC)

Grand City Properties S.A. Records Modest Q1 2025 Growth

Grand City Properties S.A. reported a 1% rise in net rental income for Q1 2025, reaching €106 million. The growth was buoyed by a 3.8% like-for-like rental increase, despite asset disposals during the period. Adjusted EBITDA also rose by 3% to €85 million, reflecting enhanced operational efficiency.

The company achieved net profit doubling to €88 million, while earnings per share increased to €0.35 from €0.17. A 0.6% property revaluation on a like-for-like basis contributed positively.

GCP's liquidity remains strong with €1.7 billion in cash and assets and maintains a conservative financial stance with 32% LTV and €6.3 billion unencumbered assets. However, the credit rating was reduced to BBB by S&P in April 2025.

For 2024, no dividends will be recommended as the company focuses on financial stability and leverage reduction.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Grand City Properties S.A., news