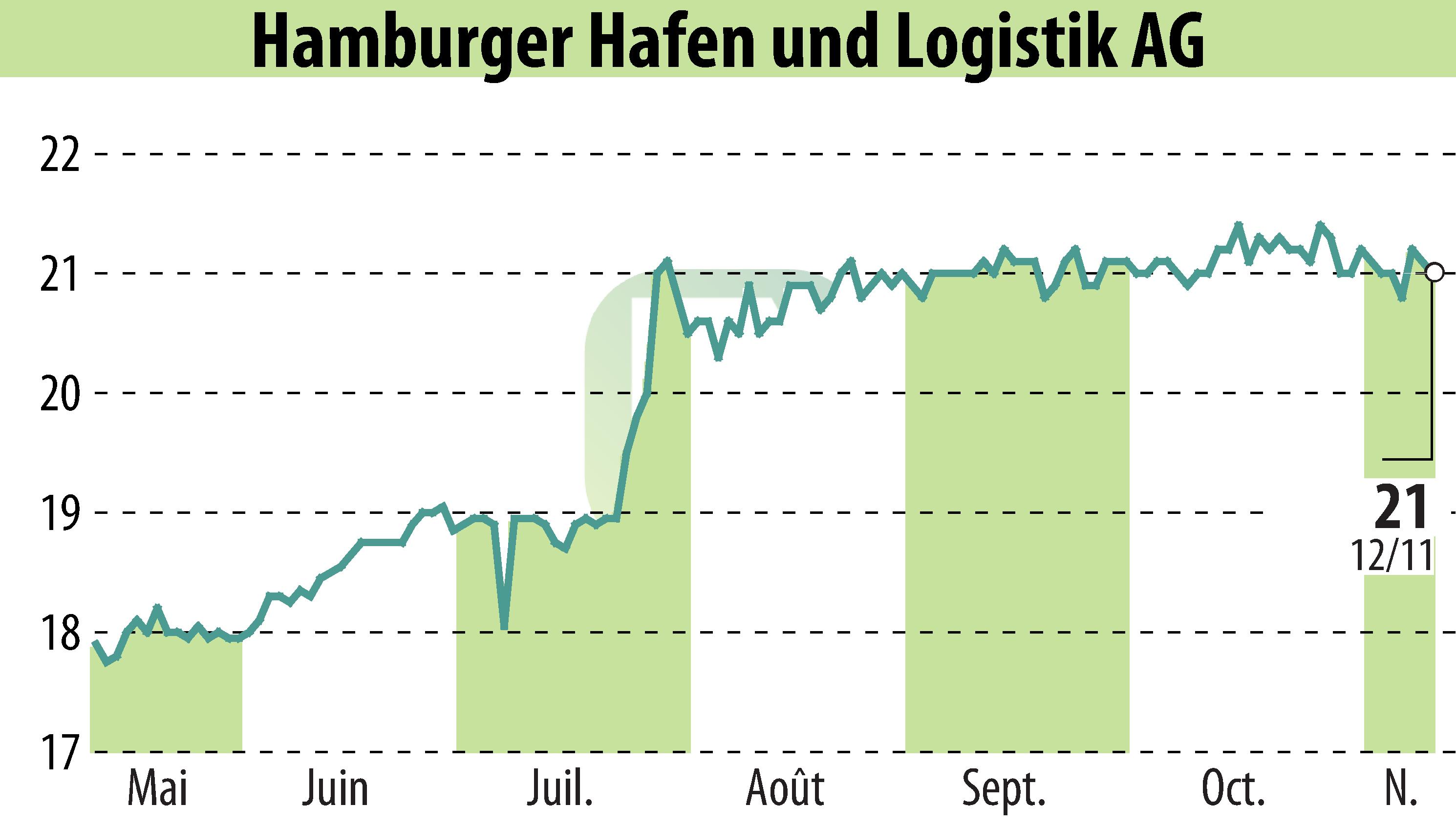

on Hamburger Hafen Und Logistik AG (ETR:HHFA)

HHLA Reports Strong Revenue Growth Amid Challenges

Hamburger Hafen und Logistik AG (HHLA) displays robust financial growth despite a turbulent economic climate. In the first nine months of 2025, HHLA's revenue rose by 12.5% to €1.33 billion, with an operating result (EBIT) increasing by 25.7% to €117.1 million. This came amid ongoing geopolitical tensions and trade uncertainties. The Port Logistics subgroup saw a notable 12.8% rise in revenue to €1.3 billion, underpinned by a 31.7% EBIT increase.

Container throughput displayed a 6.7% rise to 4,798 thousand TEU, while container transport surged by 13.6% to 1,501 thousand TEU. Noteworthy contributors to growth included resumed operations at the Container Terminal Odessa and increased volumes at HHLA PLT Italy. The Intermodal segment showed significant enhancement, with rail and road transport figures climbing by 13.7% and 13.2% respectively.

The Real Estate subgroup reported slight revenue growth at 1.5%, but faced a notable decrease in EBIT by 16.9% due to non-operating expenses. As HHLA continues to navigate a challenging landscape, its forecast has been adjusted, projecting a full-year EBIT between €160 and €175 million.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hamburger Hafen Und Logistik AG news