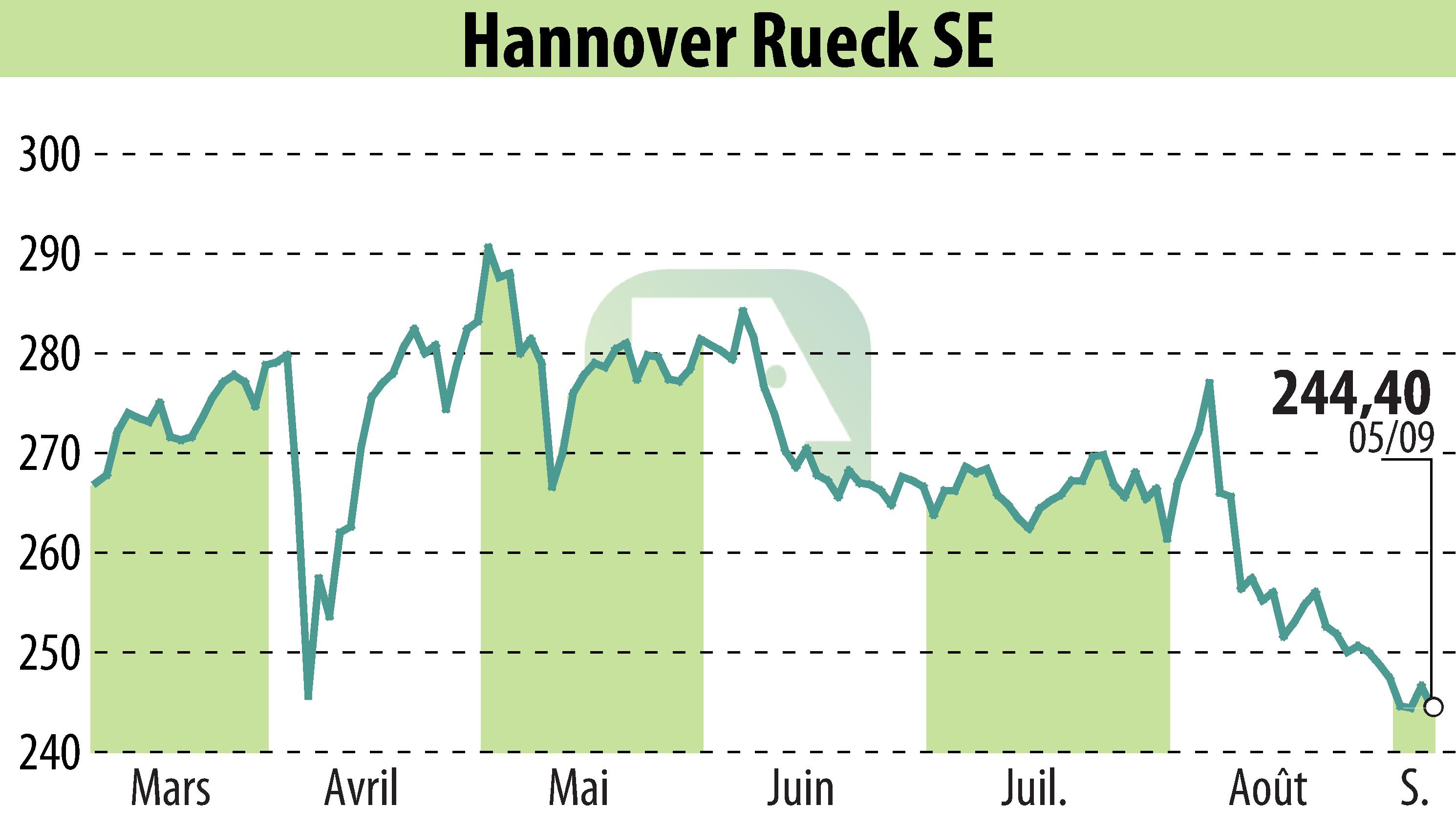

on Hannover Rück SE (ETR:HNR1)

Hannover Re Expects Stable Market in 2026 Renewals

Hannover Re, a leading global reinsurer, anticipates a stable to slightly lower pricing environment for the property and casualty reinsurance treaty renewals on January 1, 2026. The company expects terms and conditions to remain favorable, amidst increasing competition.

Demand for quality reinsurance continues to grow, while supply rises due to sound reinsurer capitalization. Prices have generally remained stable or decreased, particularly in loss-free natural catastrophe covers. Hannover Re sees opportunities for selective growth in areas like catastrophe covers and structured reinsurance.

The reinsurer intends to offer more capacity in 2026, provided pricing aligns with risk. Price adjustments are anticipated for loss-impacted programs, while loss-free contracts could see moderate decreases.

Sustained demand, regulatory changes, and technological advances drive growth in dynamic segments such as cyber and catastrophe covers, positioning Hannover Re for continued profitable expansion.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hannover Rück SE news