on Hawesko Holding AG (isin : DE0006042708)

Hawesko Group Maintains Strong Performance Amid Market Challenges in 2023

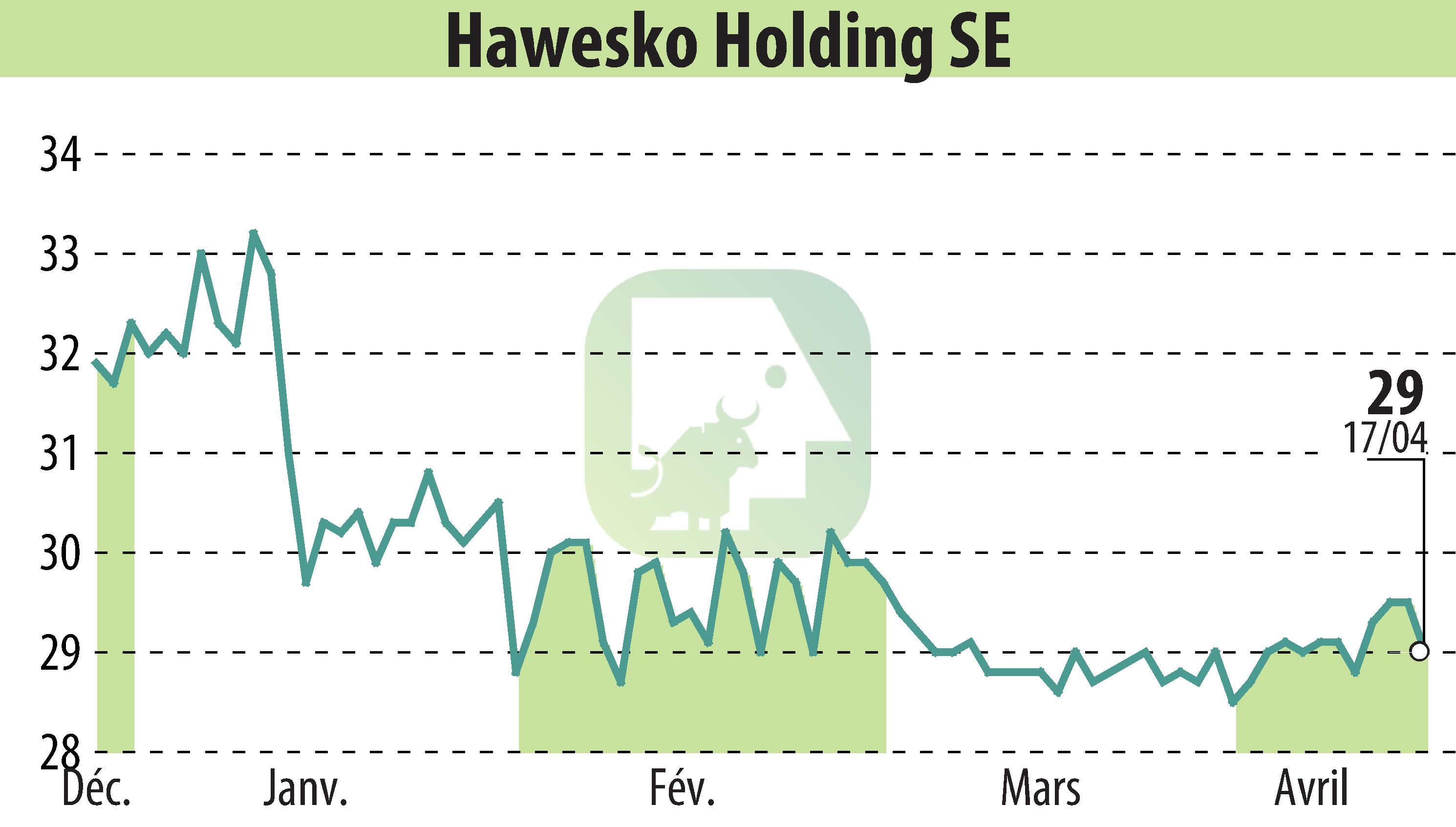

Hawesko Holding SE released its annual report for 2023, revealing that despite severe economic conditions and a general decline in the wine market, their sales remained robust, nearly matching the previous year's figures. The company managed to maintain its profitability with only a slight decrease, despite high production costs and an overall downturn in consumer spending and e-commerce in Germany.

CEO Thorsten Hermelink emphasized the company's strategy of cost discipline and price adjustments, which allowed them to perform better than the market average. The group reported €660 million in sales, a slight decline of 2% from the previous year but still significantly higher than pre-pandemic levels. The operating EBIT stood at €34 million with a stable margin of 5.1%.

Despite these challenges, in 2023, Hawesko entered a joint venture with the Dunker Group to expand its B2B segment in the Baltics, aiming to solidify its position in the European premium wine market. For 2024, they predict a stable performance with hopes for a boost in year-end sales influenced by better consumer sentiment, particularly in their retail and B2B sectors.

The company also highlighted its advancements in logistics with the expansion of a center in Tornesch and the incorporation of autonomous technologies, expecting these efforts to bolster growth and efficiency moving forward.

R. E.Copyright © 2024 FinanzWire, all reproduction and representation rights reserved. Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hawesko Holding AG news