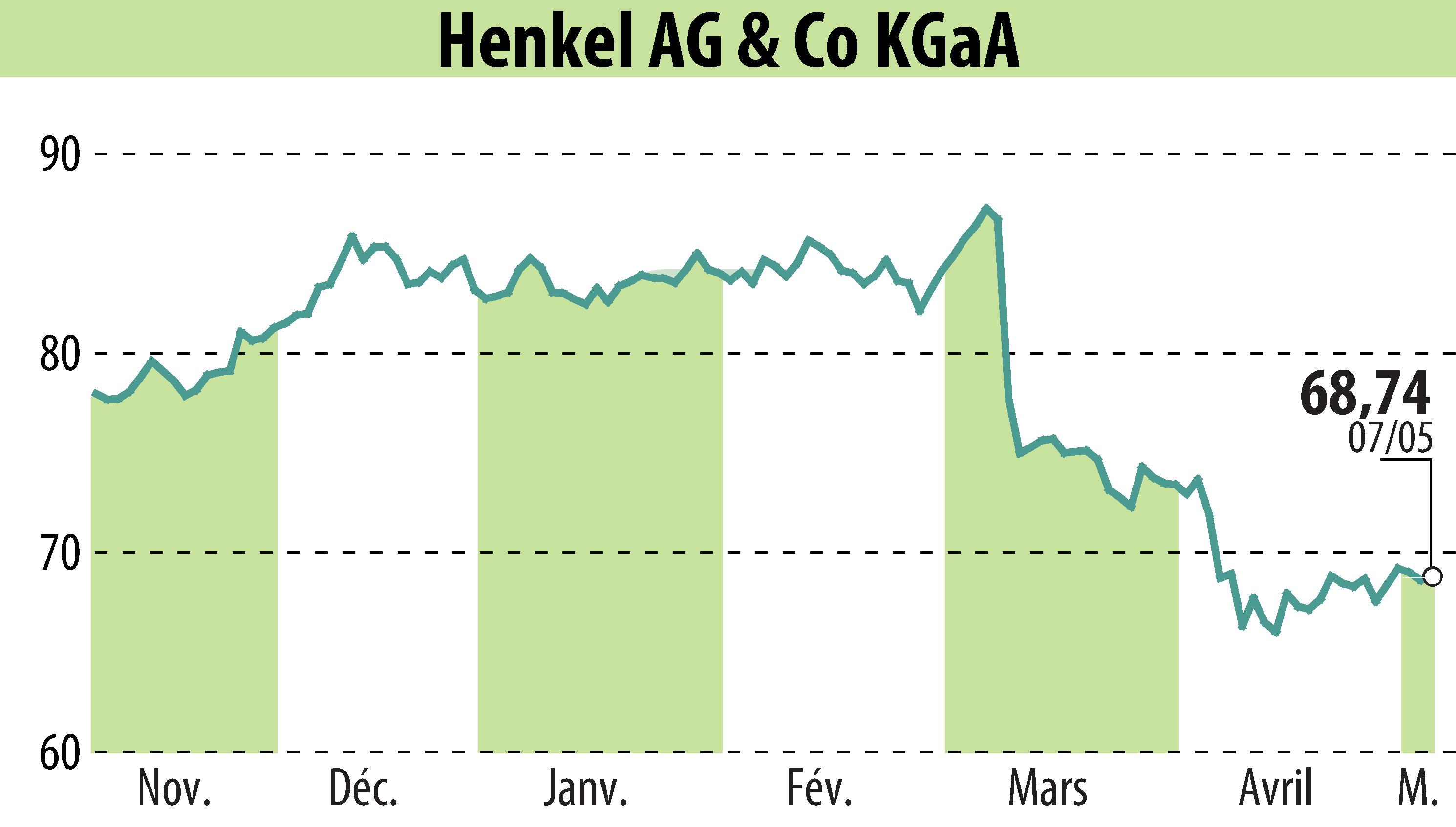

on Henkel KGaA (ETR:HEN3)

Henkel Maintains Strong Profitability Amid Volatile Market Conditions

Henkel AG & Co. KGaA reported stable financial metrics for Q1 2025, with group sales around 5.2 billion euros, a slight decline from the previous year. Despite a 1.0% decrease in organic sales due to challenging geopolitical and macroeconomic conditions, Henkel's profitability remains robust. Adhesive Technologies showed positive growth, marking a 1.1% increase, driven by strong demand in Mobility & Electronics. Contrastingly, Consumer Brands faced a 3.5% decline, affected by subdued consumer sentiment and supply chain issues.

Henkel's strategic initiatives progressed with the completion of the Retailer Brands divestment in North America, refocusing efforts on branded consumer goods. The company anticipates organic sales growth between 1.5% and 3.5% for 2025. Despite increased market volatility, Henkel expects a stronger second half, driven by innovation and sustained brand investment.

Regionally, organic sales rose in IMEA and Asia-Pacific, while North America and Europe faced declines. Henkel's strategic focus on growth areas and efficient management underpins its optimistic outlook for the year, maintaining an adjusted EBIT margin target of 14.0% to 15.5%.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Henkel KGaA news