on Henkel KGaA (ETR:HEN3)

Henkel Reports Strong 2024 Financial Results Amid Strategic Growth

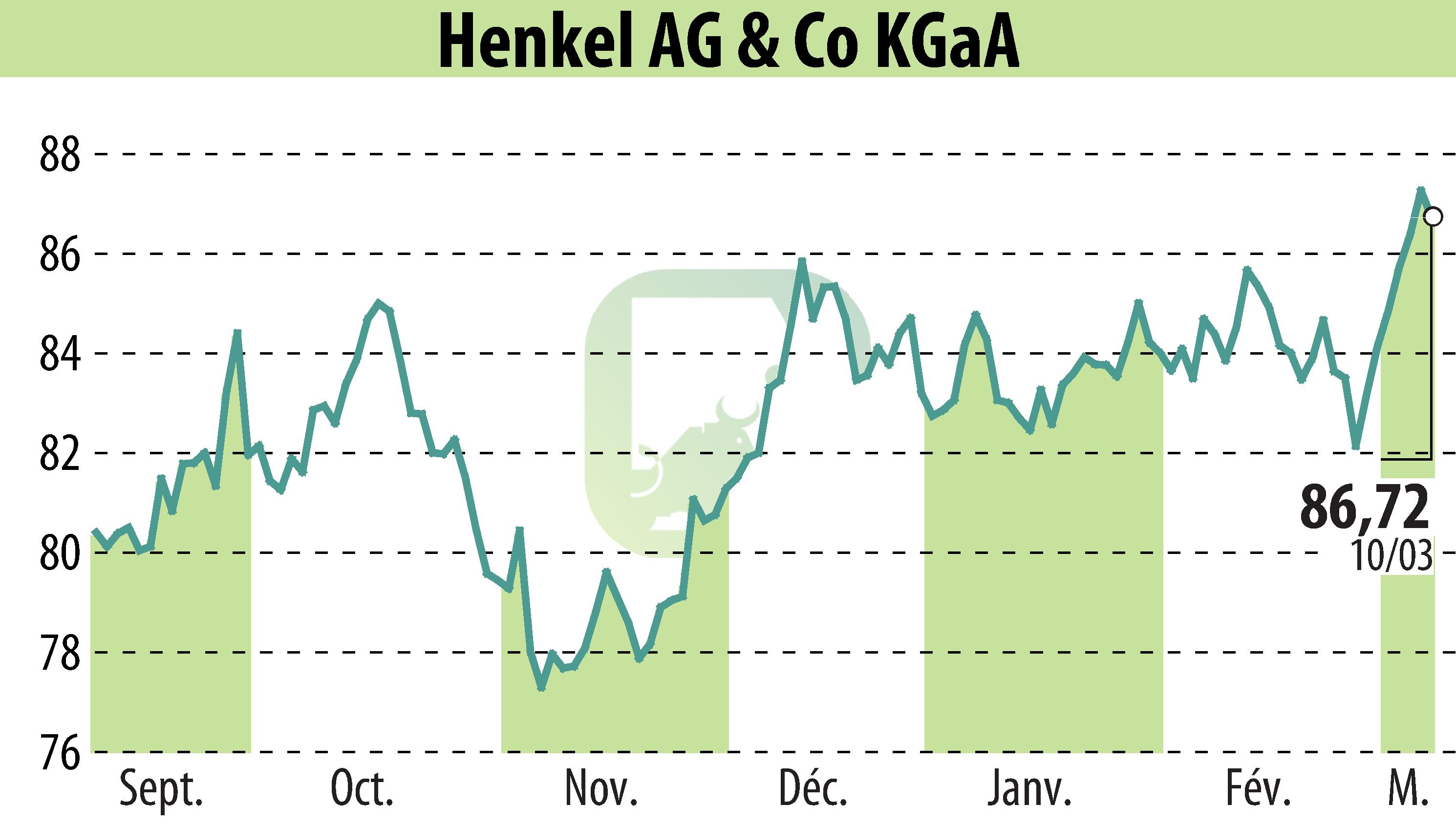

Henkel AG & Co KGaA announced its 2024 fiscal results, showcasing robust growth. Sales reached €21.6 billion, with an organic increase of 2.6%. Operating profit (EBIT) saw a significant rise of 20.9%, totaling €3.1 billion, and the EBIT margin improved by 240 basis points to 14.3%. The earnings per preferred share rose by 25.1% at constant exchange rates to €5.36.

Henkel's Purposeful Growth Agenda has been key, with consumer brand integration and adhesive technologies driving the success. A share buyback program worth up to €1 billion was also announced. For 2025, Henkel predicts organic sales growth between 1.5% and 3.5%, highlighting a slow start but acceleration later in the year.

Challenges persist in economic conditions, but Henkel aims for further profitability and margin improvements. CEO Carsten Knobel credits team commitment and strategic direction for these strong outcomes, solidifying confidence in future expansions and success.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Henkel KGaA news