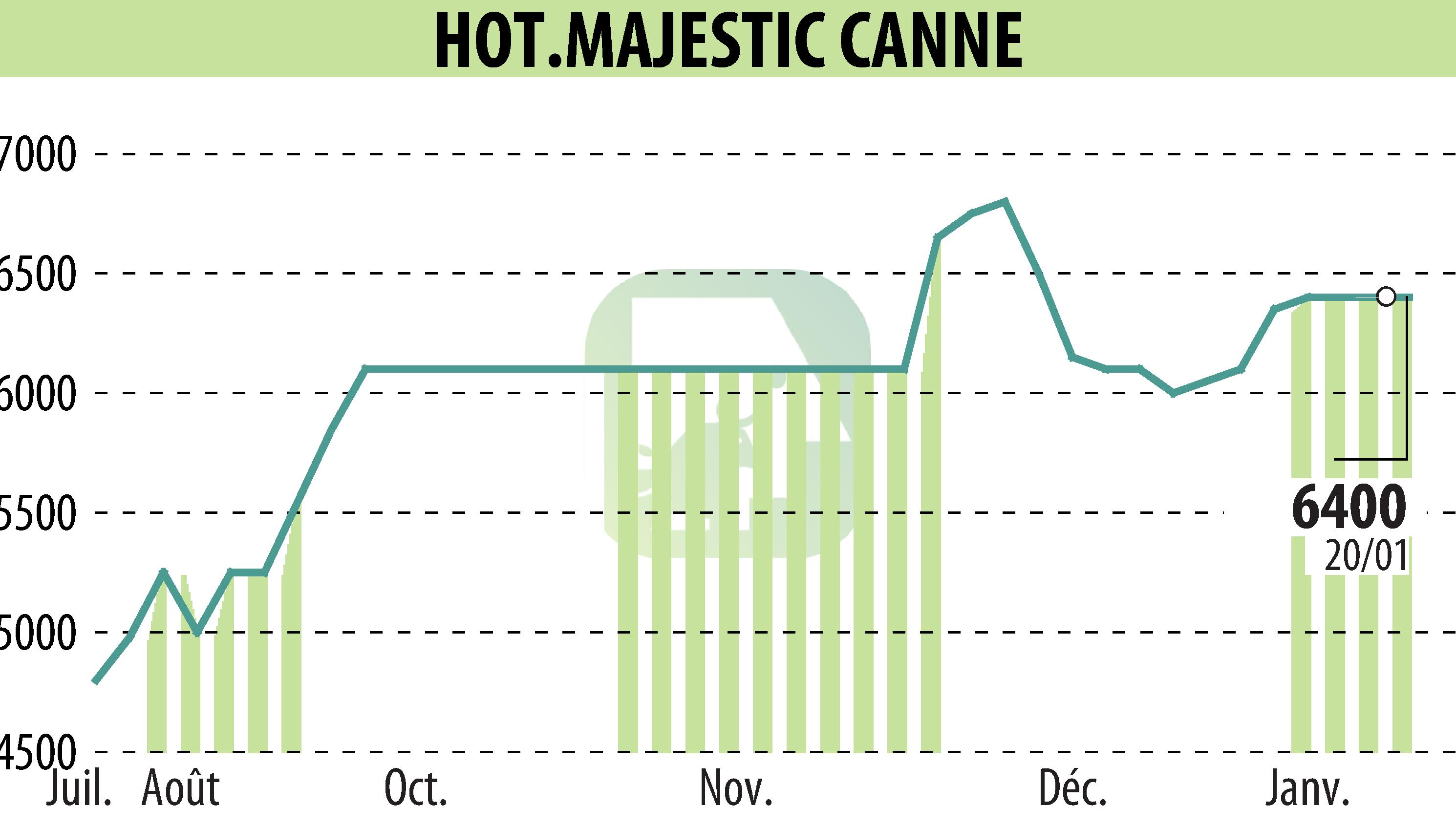

on HOTEL MAJESTIC CANNES (EPA:MLHMC)

Stable financial performance for the Hotel Majestic Cannes as of October 31, 2025

The Board of Directors of the Hotel Majestic Cannes has closed the accounts as of October 31, 2025. Revenue benefited from strategic investments and the attractiveness of Cannes, despite a decrease in the occupancy rate to 56.9% compared to 60.1% in 2024. The Average Revenue per Room nevertheless increased by 5.9%, reaching €956.

Total revenue for accommodation reached €61.4 million, an increase of 3.9%. Food and beverage and other revenue also saw growth. Operating income was positive at €34.3 million, stable compared to the previous year, influenced by an increase in operating expenses. Net income remained unchanged at €26.1 million. No dividend distribution is planned for 2025.

Net cash stands at €137.4 million, marking a significant improvement compared to 2024. Looking ahead, the economic environment calls for caution. Business activity since November 2024 has followed a steady trajectory.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all HOTEL MAJESTIC CANNES news