on Hypoport AG (ETR:HYQ)

Significant Growth in Hypoport SE's Real Estate Financing in H1 2025

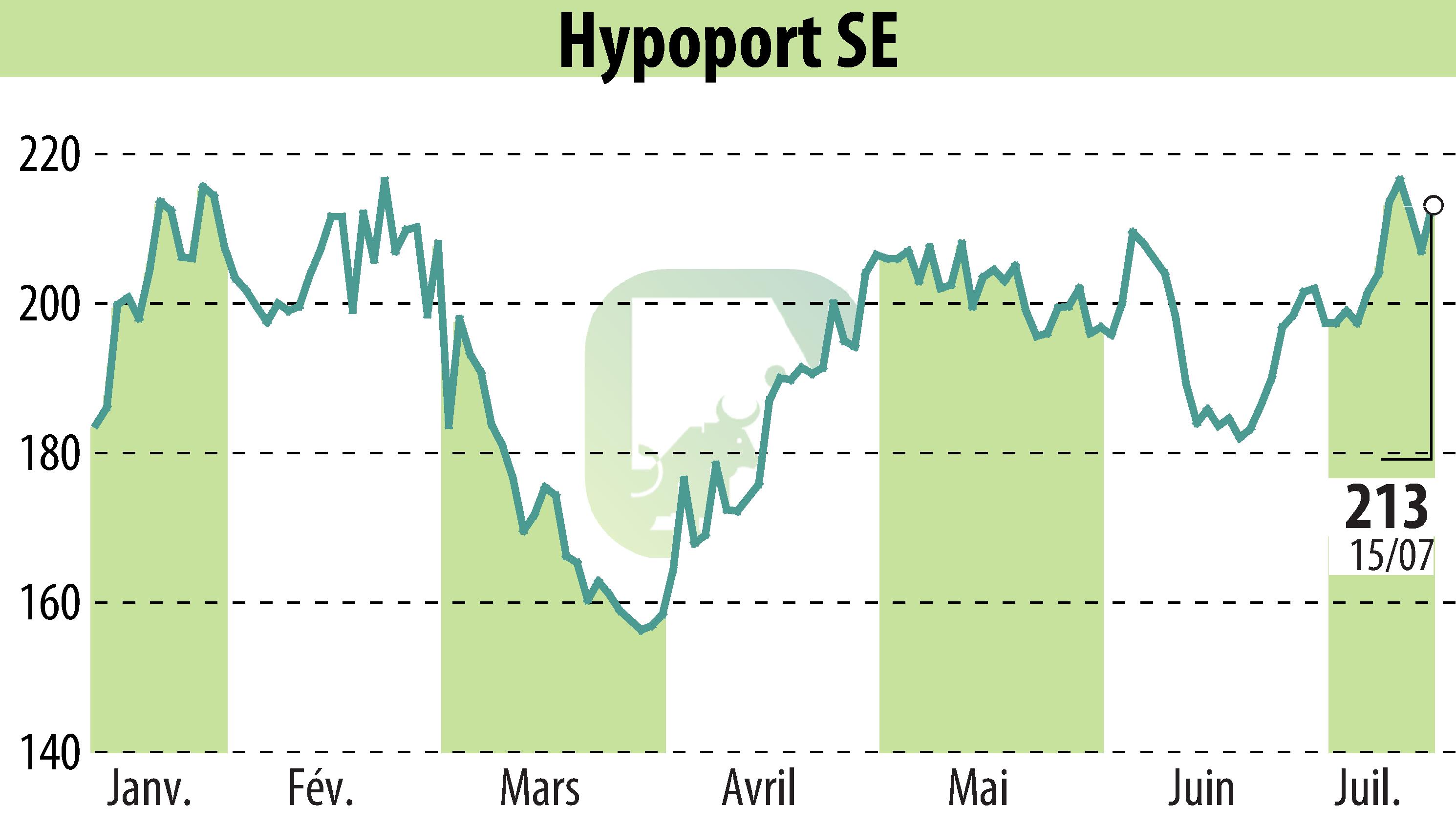

Hypoport SE reported a notable increase in business volume within its private real estate financing sector for the first half of 2025. The Europace platform saw a 23% rise in transaction volumes compared to the previous year. Cooperative and savings banks also showed strong performance, with increases of 31% and 23%, respectively. Moreover, Dr. Klein's sales volumes for private customers matched this growth, rising 23% year-on-year.

The positive trend was driven by a more favorable market environment and a shift towards purchasing existing properties due to a challenging rental market. Despite high construction costs, there was a modest increase in loan volumes for new builds. However, loans for energy-efficient renovations remained low.

The announcement of increased government debt in March led to an interest rate spike, slightly affecting transaction volumes in Q2 compared to Q1. Regardless, Hypoport's platforms maintained robust operations, and customer acquisitions in residential property management were strong.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Hypoport AG news