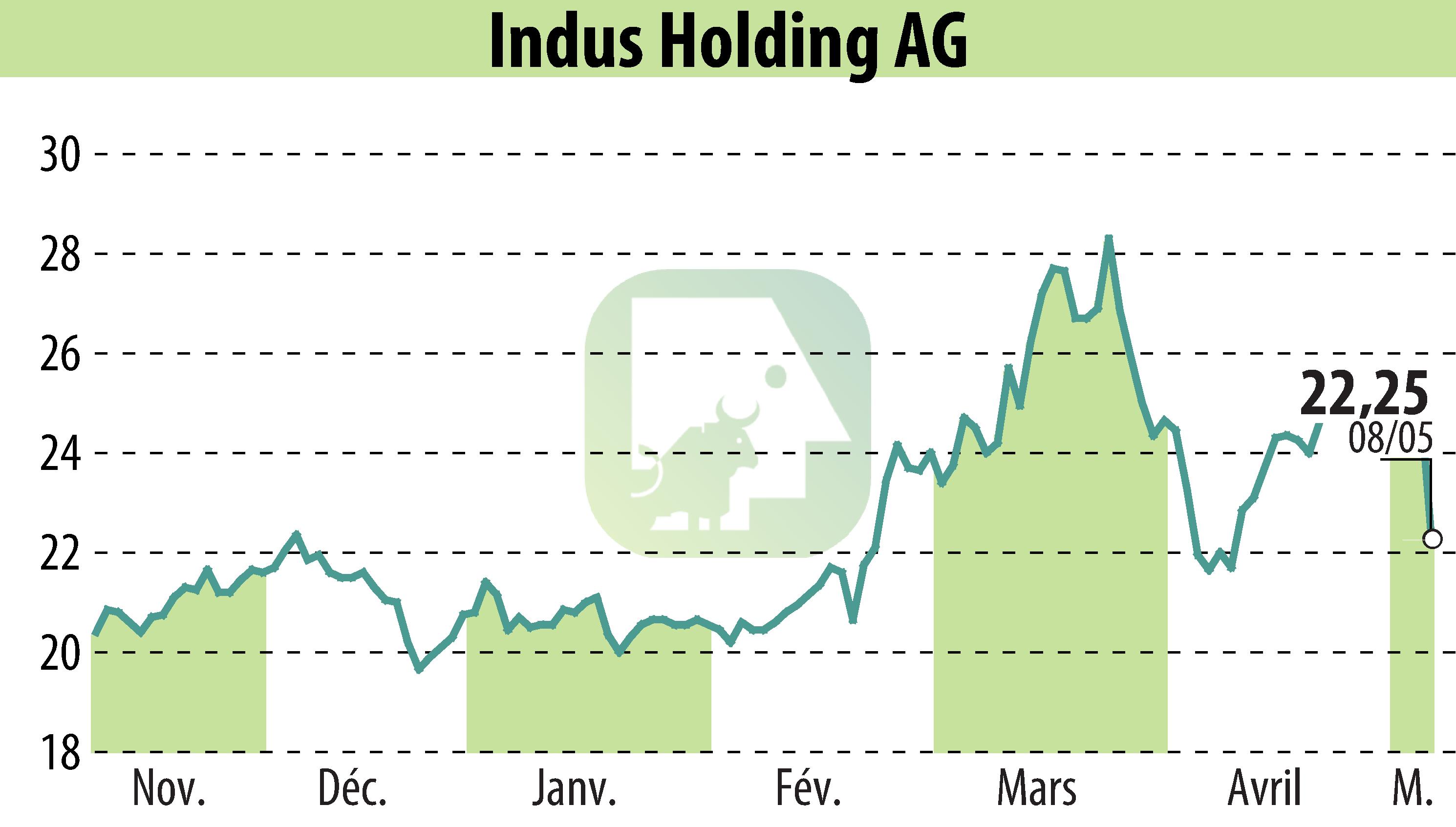

on INDUS Holding AG (ETR:INH)

INDUS Holding AG Faces Supply Chain Challenges but Remains a Buy

NuWays AG has released an updated recommendation of "Buy" for INDUS Holding AG, maintaining a target price of EUR 34.00 for the next 12 months. The research highlights significant challenges faced by INDUS, particularly in its Materials Solutions segment. These challenges arise from a 10% tariff on US exports and extended export controls on tungsten compounds from China, heavily impacting its subsidiary BETEK.

BETEK, reliant on tungsten from China, which accounted for 82% of global production in 2024, may face up to € 40 million in potential revenue losses if supply chains remain disrupted. Despite lowering its sales forecast, INDUS anticipates long-term resilience due to BETEK's technological edge. NuWays AG remains optimistic, reiterating the "Buy" rating, though with conservative estimates given the current tungsten supply issues.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INDUS Holding AG news