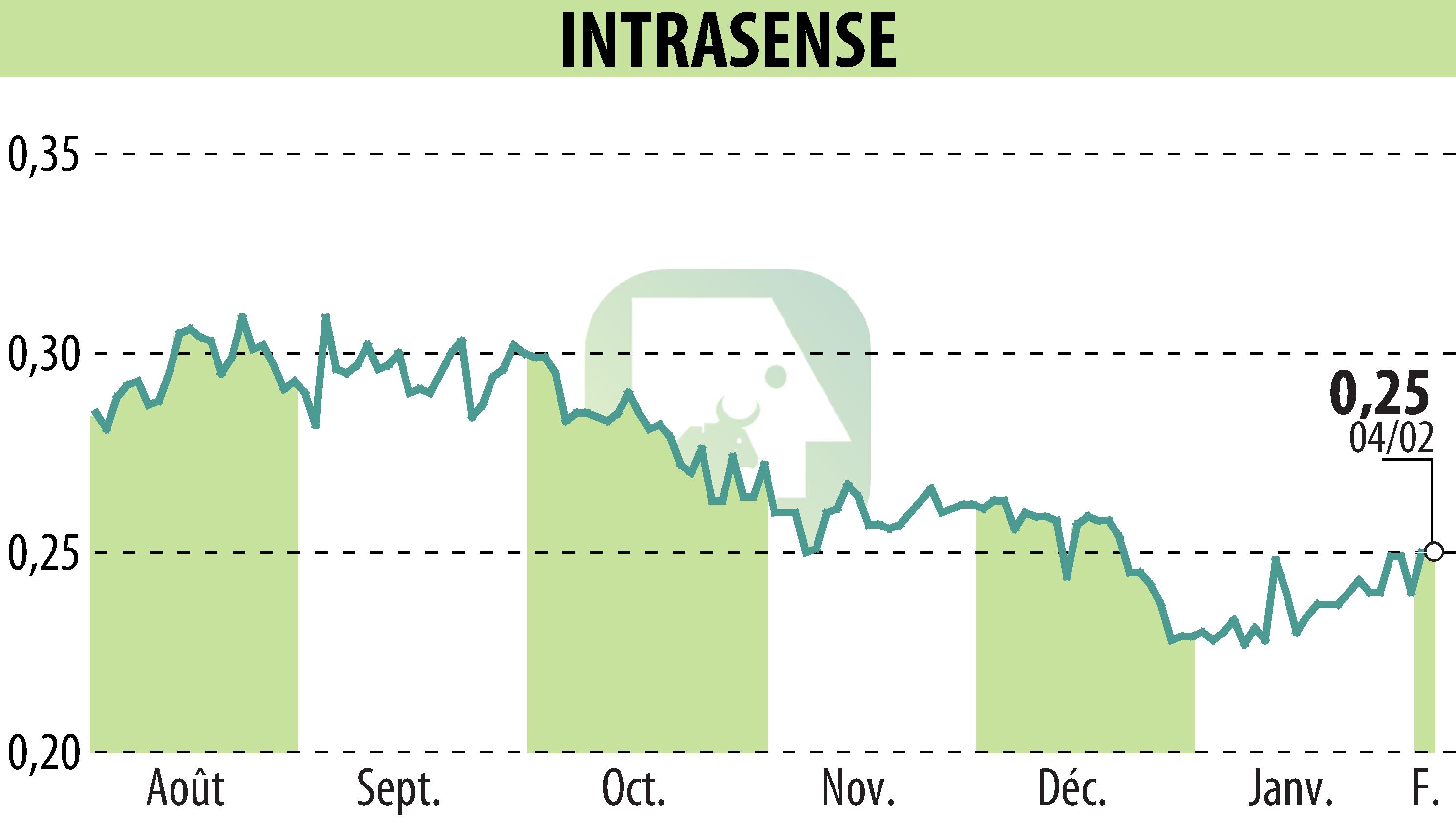

on INTRASENSE (EPA:ALINS)

Intrasense Revenue Rises 43% in 2025

In 2025, Intrasense reported a 43% increase in annual revenue, reaching €3.2 million, aligning with their annual targets. This growth was largely driven by the strong performance of the Myrian® product line internationally.

The company achieved significant order intake, totaling over €6.1 million, securing a backlog of more than €3.0 million for 2026-2029. Intrasense's geographical revenue breakdown shows growth in Europe by 316% and in France by 13%. However, revenue in China decreased by 39% amidst ongoing divestment activities.

Intrasense's strategic roadmap included obtaining CE markings for Myrian® 2.14.x and the DUOnco™ range, contributing to product portfolio value. The company plans to continue its participation in major radiology events in 2026 to further promote its innovations and engage with industry partners.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all INTRASENSE news