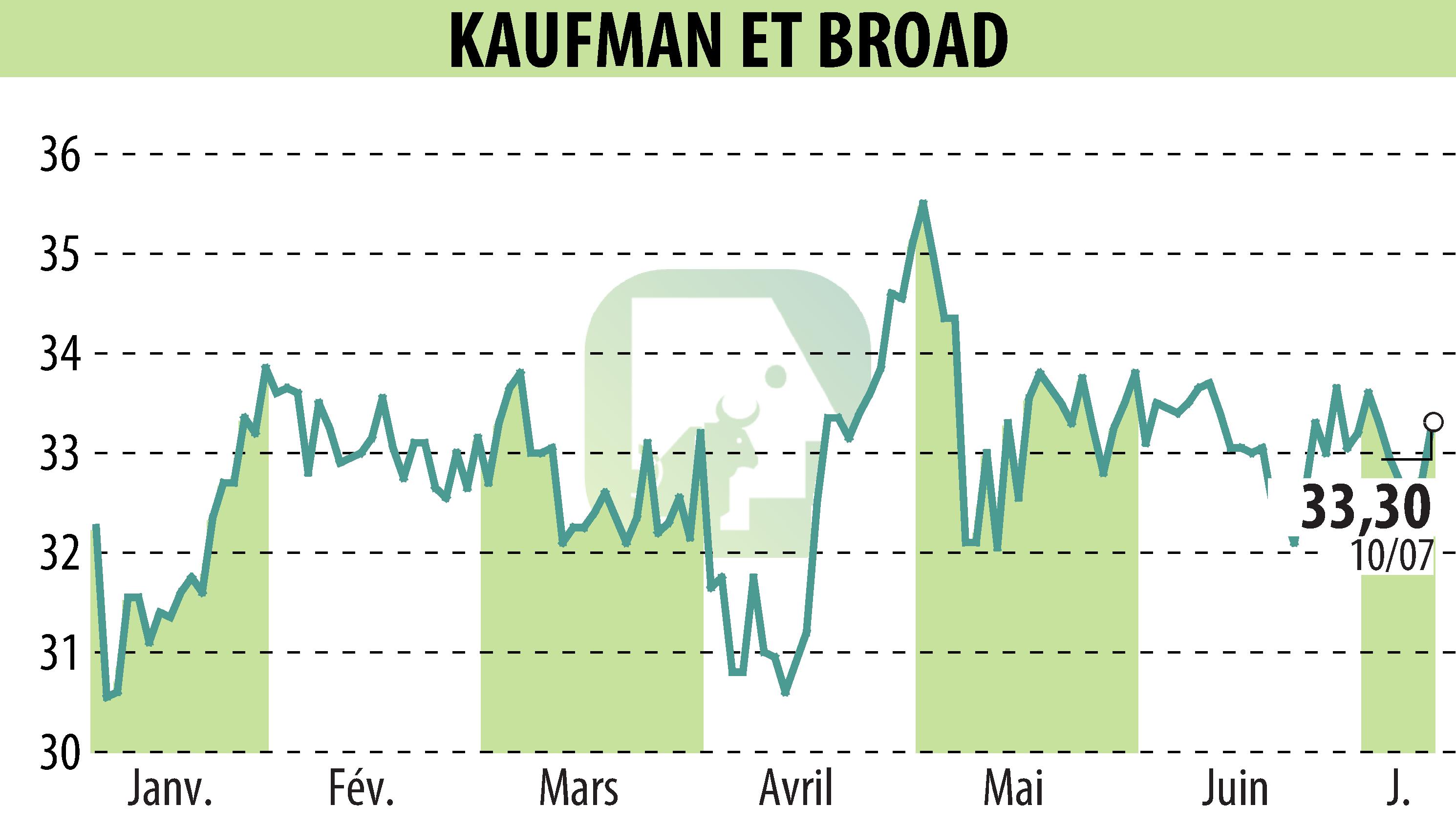

on KAUFMAN & BROAD (EPA:KOF)

Kaufman & Broad Releases 1st Half Year 2025 Results

Kaufman & Broad has announced the financial results for the first half of the fiscal year 2025. The company reported a stable business activity with total orders amounting to €61.3 million including VAT, driven by strong housing sales. Housing orders reached €561.8 million, with volume up by 8.7% despite a 2% decrease in the overall new home market.

The revenue for this period was recorded at €499.4 million, with housing accounting for €406.0 million of this. The gross margin was reported at €104.8 million, while net income attributable to the company was €23.2 million. Kaufman & Broad maintains a substantial backlog valued at €2,423.2 million excluding VAT, providing significant visibility on future revenue.

The company continues its strategy focused on tight geographical areas, with the housing portfolio composed mainly of these zones. Noteworthy developments include the progress in the Austerlitz commercial project and winning a new development concession in Lille. The full-year outlook remains positive, with anticipated sales growth of 5% for 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KAUFMAN & BROAD news