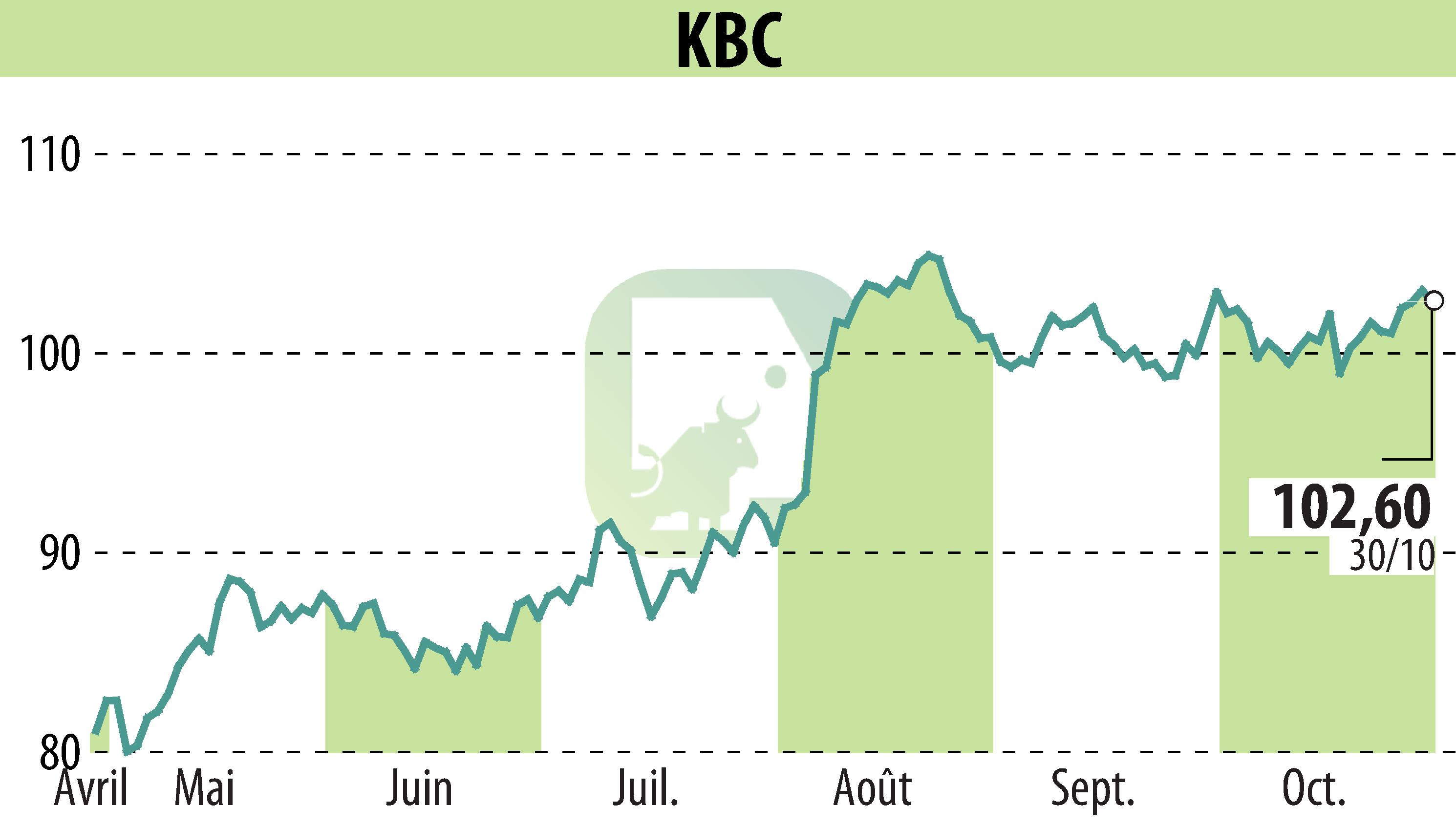

on KBC (EBR:KBC)

KBC's capital exceeds the ECB's minimum requirements

The European Central Bank (ECB) recently informed KBC of its new minimum capital requirements, granted under the Prudential Review Exemption Program (SREP) for 2025. The Common Equity Tier 1 (CET1) capital requirement for KBC has been slightly lowered to 10.85% for the third quarter of 2025. This requirement includes various buffers, such as the capital conservation buffer and the sector buffer.

KBC revealed that its CET1 capital ratio for the second quarter of 2025 was 14.6%, well above the new requirements. This level demonstrates KBC's financial strength. The risk-weighted asset allocation for the second pillar has been reduced to 1.00%.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all KBC news