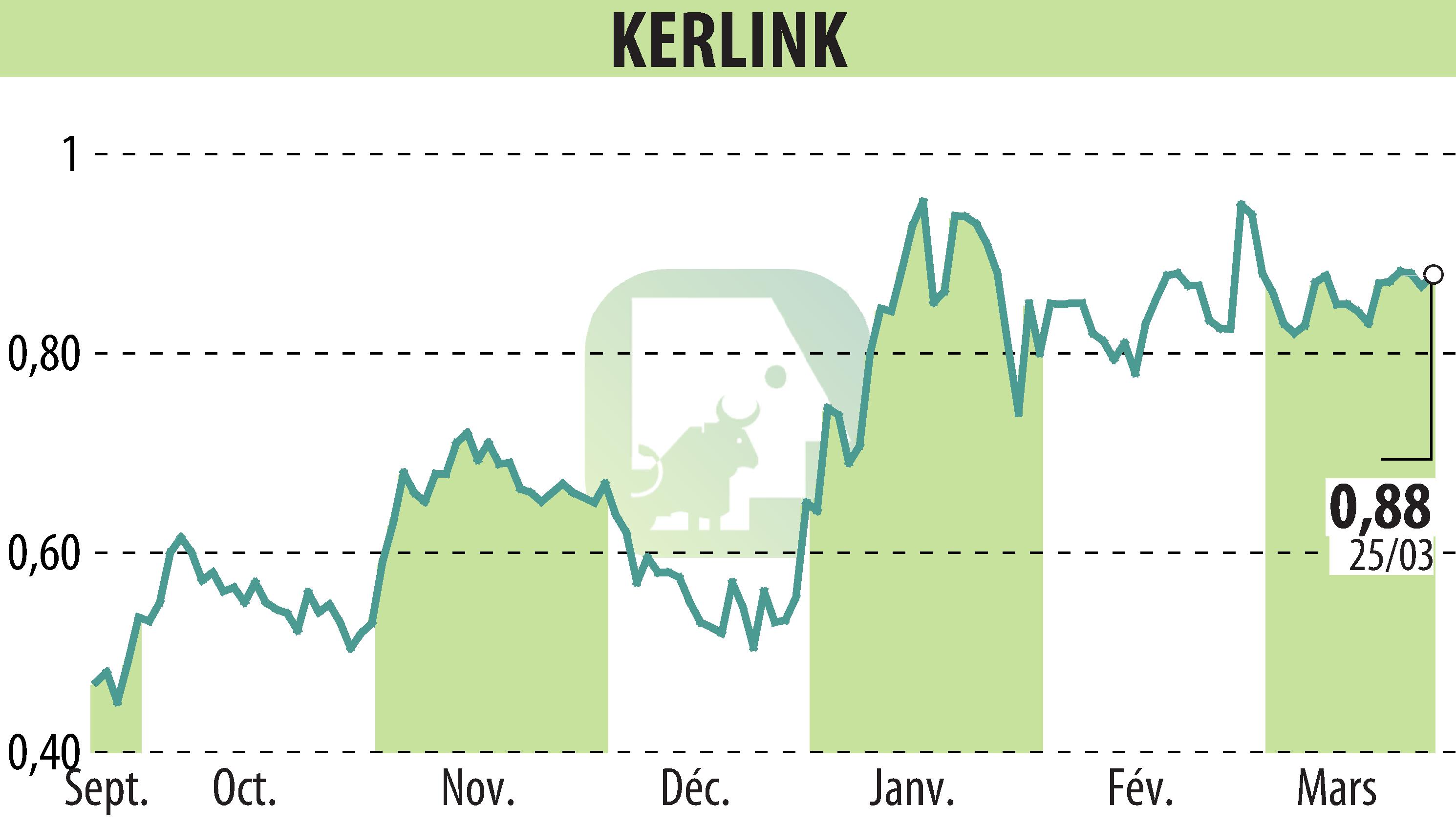

on KERLINK (EPA:ALKLK)

Kerlink targets 20% growth in turnover and positive EBITDA in 2024

Growth targets and positive EBITDA for Kerlink in 2024

By Roger HERRMANN - Kerlink, a specialist in networks and solutions dedicated to the Internet of Things (IoT), announced in a press release its outlook for the 2024 financial year. The company expects growth of around 20% in its turnover. business and aims for positive EBITDA.

This confidence in the business outlook is based on the conquest strategy initiated in the second half of 2023, which is based on proposals for new offers based on differentiating, efficient and secure solutions, as well as efficient and beneficial collaboration with its ecosystem. Kerlink thus confirms its status as a leader in technological innovation.

Kerlink gateways differentiate themselves from their competitors by natively embedding SecureBoot and SecureStorage elements, the most advanced security bricks on the market. Kerlink also has 100% control over the management of security certificates for marketed gateways (PKI). These solutions have already been qualified and adopted by numerous groups for which security is a major issue (mobile operators for example).

Kerlink gateways have always been designed according to the Group's ISO processes, in an industrial “carrier grade” manner. They are industrialized in France, certified in more than 75 countries and guaranteed for life. Their failure rate is less than 0.1%.

After the “Covid” years and widespread shortages of electronic components in 2022, the Group has strengthened its Supply Chain and secured its supplies, thus strengthening its ability to supply its customers under the best conditions.