on Klöckner & Co. SE (ETR:KCO)

Klöckner & Co Reports Strong Operating Income for 2024

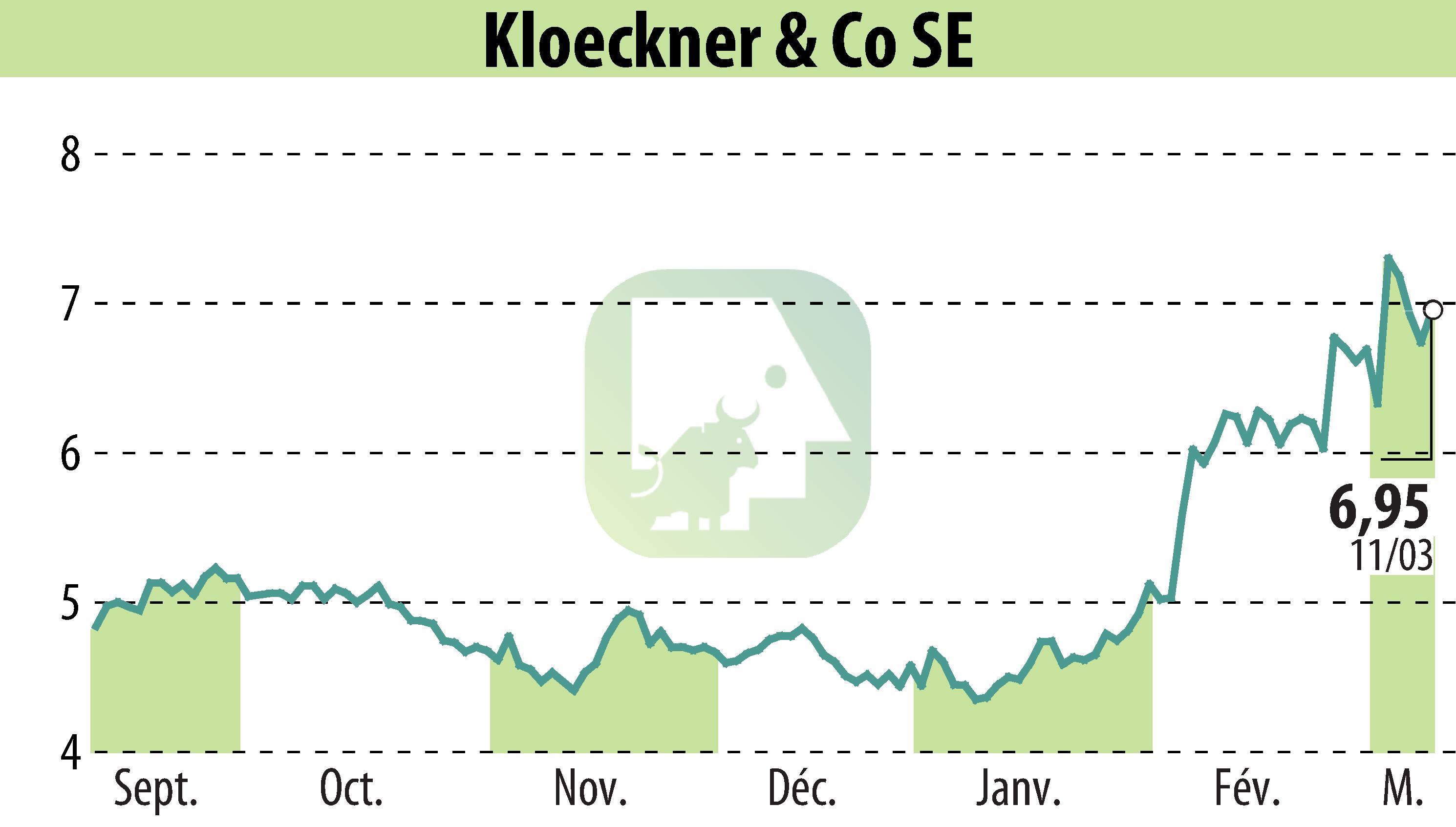

Klöckner & Co SE announced a robust operating income of €136 million for fiscal year 2024, down from €190 million in 2023. The company saw a slight rise in shipments to 4.5 million tons and a decrease in sales to €6.6 billion, primarily due to lower steel prices. Despite these challenges, they achieved a positive operating cash flow of €160 million. Klöckner is transitioning from steel distribution to metal processing, aiming to reduce dependence on metal price volatility.

The group strategy focuses on higher value-added business, with significant investments in processing facilities. Over 80% of sales now come from steel service centers and high value-added services. Klöckner plans to propose a €0.20 per share dividend for the fourth consecutive year. A new aluminum processing plant in the U.S. marks a key growth strategy for 2026.

Digitalization efforts continue, enhancing efficiency through tools like the Kloeckner Assistant. Sustainability remains central, with advanced emissions tracking through the Nexigen® PCF Algorithm. The company has raised its carbon reduction target to 62.5% by 2030. The outlook for 2025 is positive, with forecasts for increased sales and EBITDA.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Klöckner & Co. SE news