on Klöckner & Co. SE (ETR:KCO)

Worthington Steel GmbH Announces Takeover Bid for Klöckner & Co SE

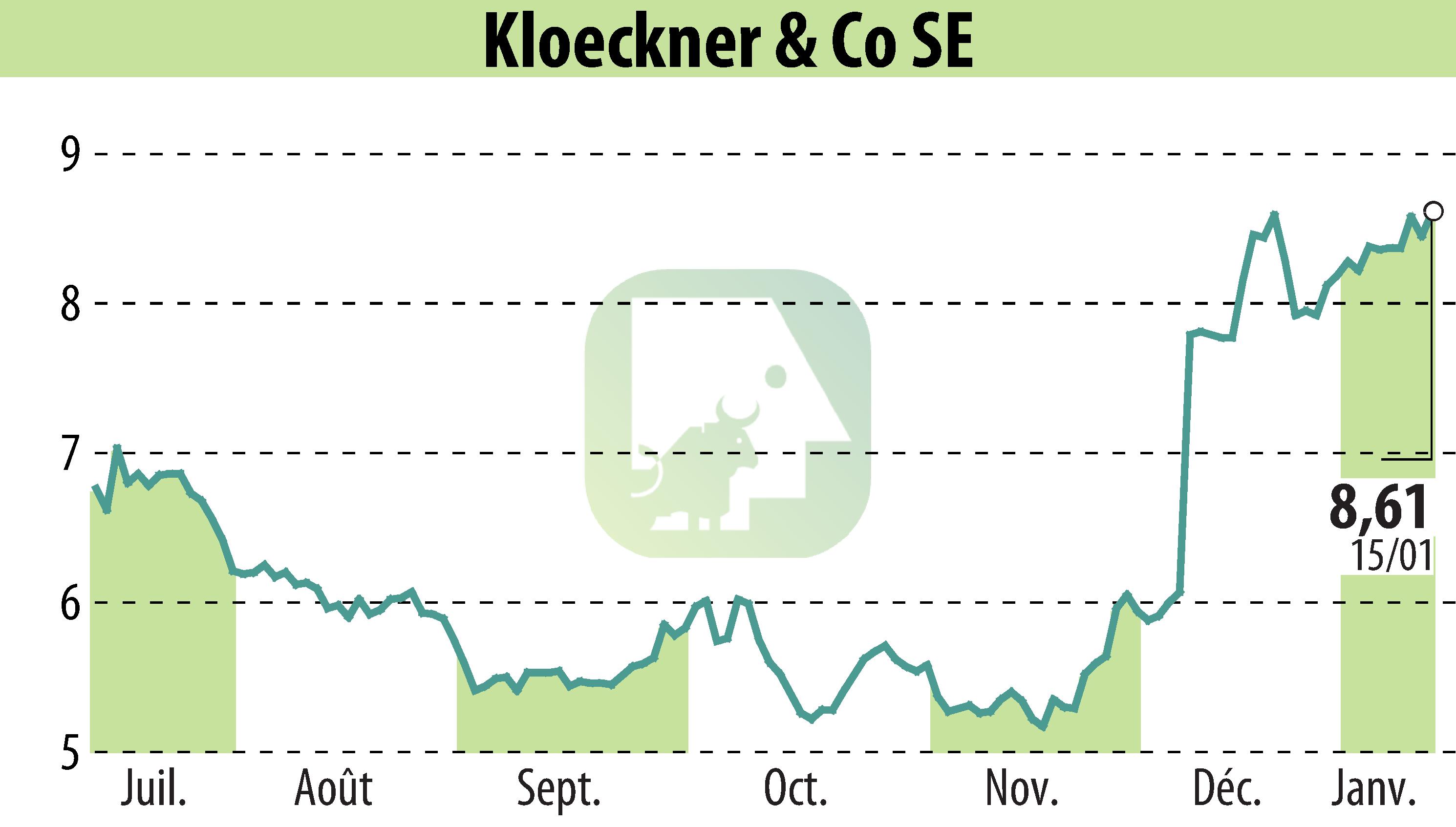

On January 15, 2026, Worthington Steel GmbH, a subsidiary of Worthington Steel, Inc., declared its intention to launch a voluntary public takeover offer for Klöckner & Co SE. The proposed cash consideration is EUR 11.00 per share, offering significant premiums compared to recent trading prices of Klöckner shares on the XETRA system.

A Business Combination Agreement was signed to enhance the companies' operational synergy, aiming to form North America's second-largest steel service center by revenue. SWOCTEM GmbH, Klöckner's major shareholder, has committed to selling its 41.53% stake.

The takeover's success is contingent upon regulatory approvals and achieving a minimum acceptance of 65% of Klöckner's shares. Both Klöckner's Management and Supervisory Boards expressed their support, pending a detailed review of the offer.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Klöckner & Co. SE news