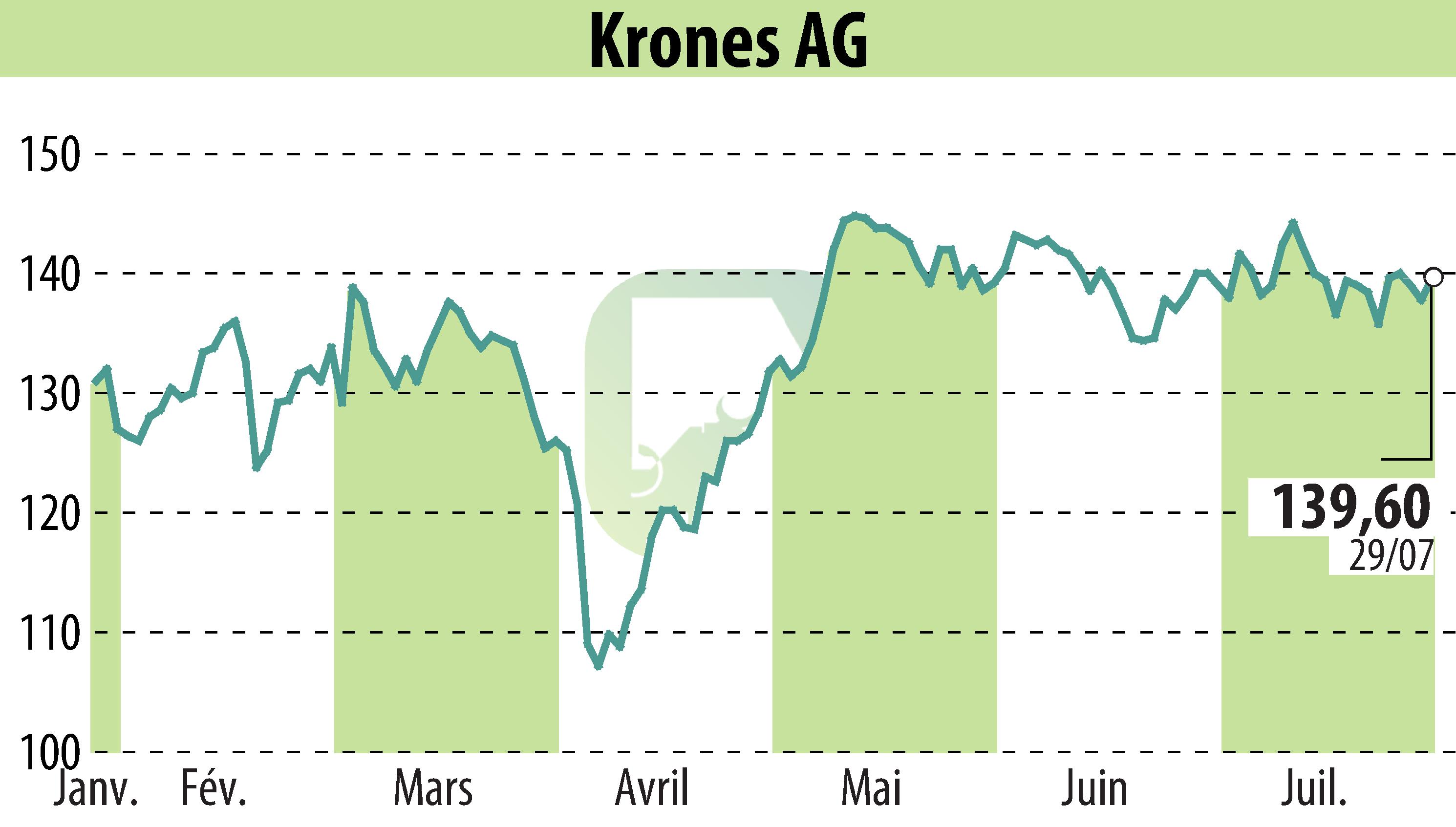

on Krones AG (ETR:KRN)

Krones Reports Strong Profitability Growth in H1 2025

Krones AG reported a notable increase in profitability during the first half of 2025, despite macroeconomic uncertainties. The company, operating in the food and beverage sector, saw only a marginal 2.2% decrease in order value compared to last year’s high figure, totaling €2,730.4 million.

Revenue rose by 6.7% to €2,726.5 million, though growth slowed in Q2 due to calendar effects. EBITDA jumped 12.6% to €288.5 million, improving the EBITDA margin from 10.0% to 10.6%. Krones also increased ROCE from 18.8% to 19.0%.

The company maintained a strong order backlog of €4,293.4 million and expects revenue growth of 7-9% for 2025. Despite global challenges, Krones confirmed its full-year targets, projecting an EBITDA margin of 10.2% to 10.8% and ROCE between 18% and 20%.

Krones' financial stability was further supported by net cash of €375.2 million by June 2025 and a free cash flow improvement to €46.7 million, excluding M&A impacts.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Krones AG news