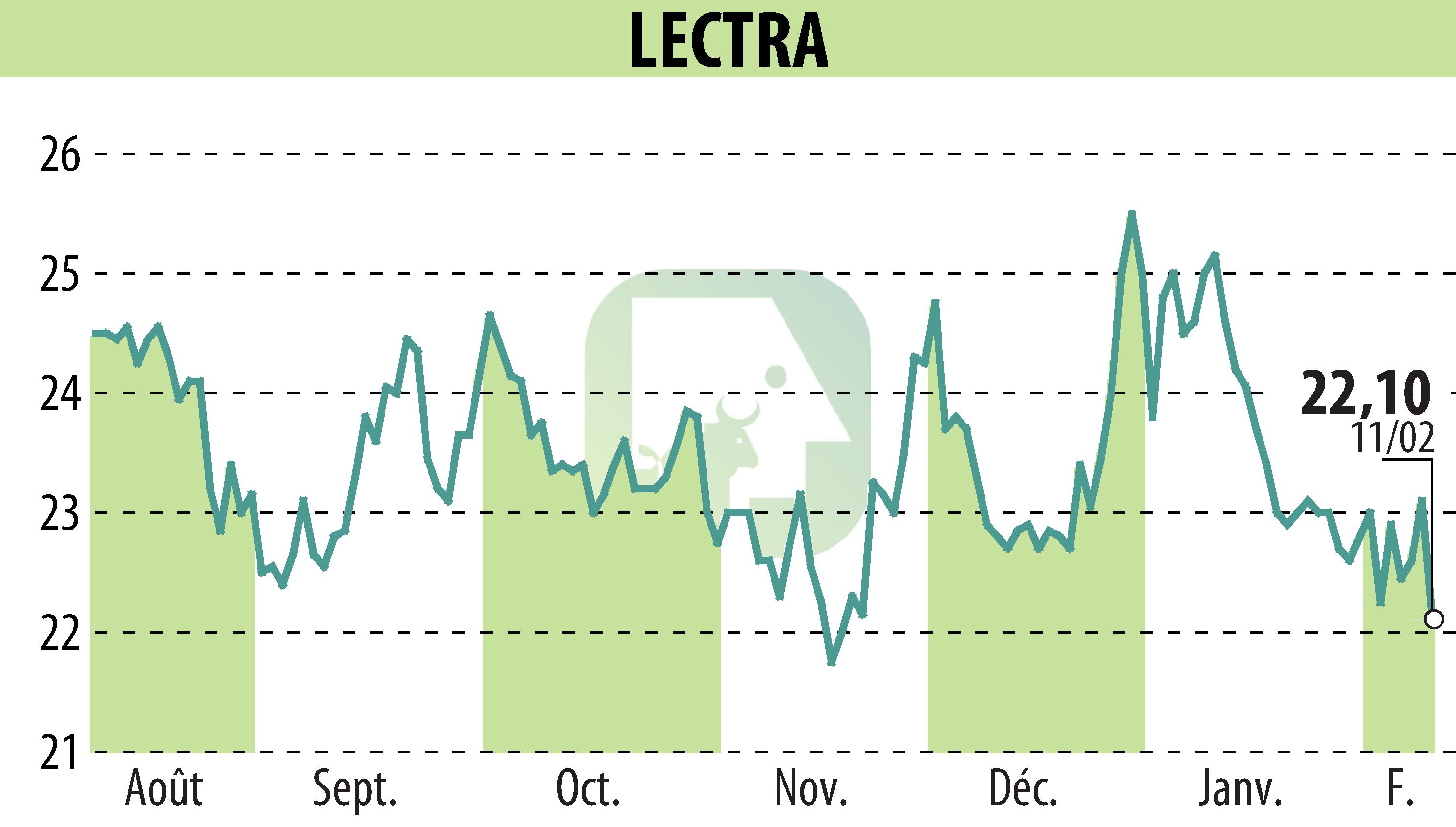

on LECTRA (EPA:LSS)

Lectra: 2025 Assessment: Between SaaS Growth and Resilience

Lectra reports 2025 revenue of €506.7 million, down 2% on a like-for-like basis. Recurring revenue, representing 75% of this figure, grew by 2%, primarily driven by SaaS subscriptions, which increased by 14%. This strong SaaS performance boosted Annual Recurring Revenue, reaching €97.2 million (+14%).

Despite trade tensions that hampered investment, Lectra leveraged its SaaS strategy to mitigate the impact. This adaptation resulted in an EBITDA margin of 15.7%, even though current EBITDA decreased by 8%. Free cash flow reached €57 million, demonstrating the group's financial strength.

For 2026-2028, Lectra plans to intensify digital synergies, with annual SaaS ARR growth targets of 15% and an improved EBITDA margin. The group is pursuing a strategy of targeted acquisitions and an attractive dividend distribution policy.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LECTRA news