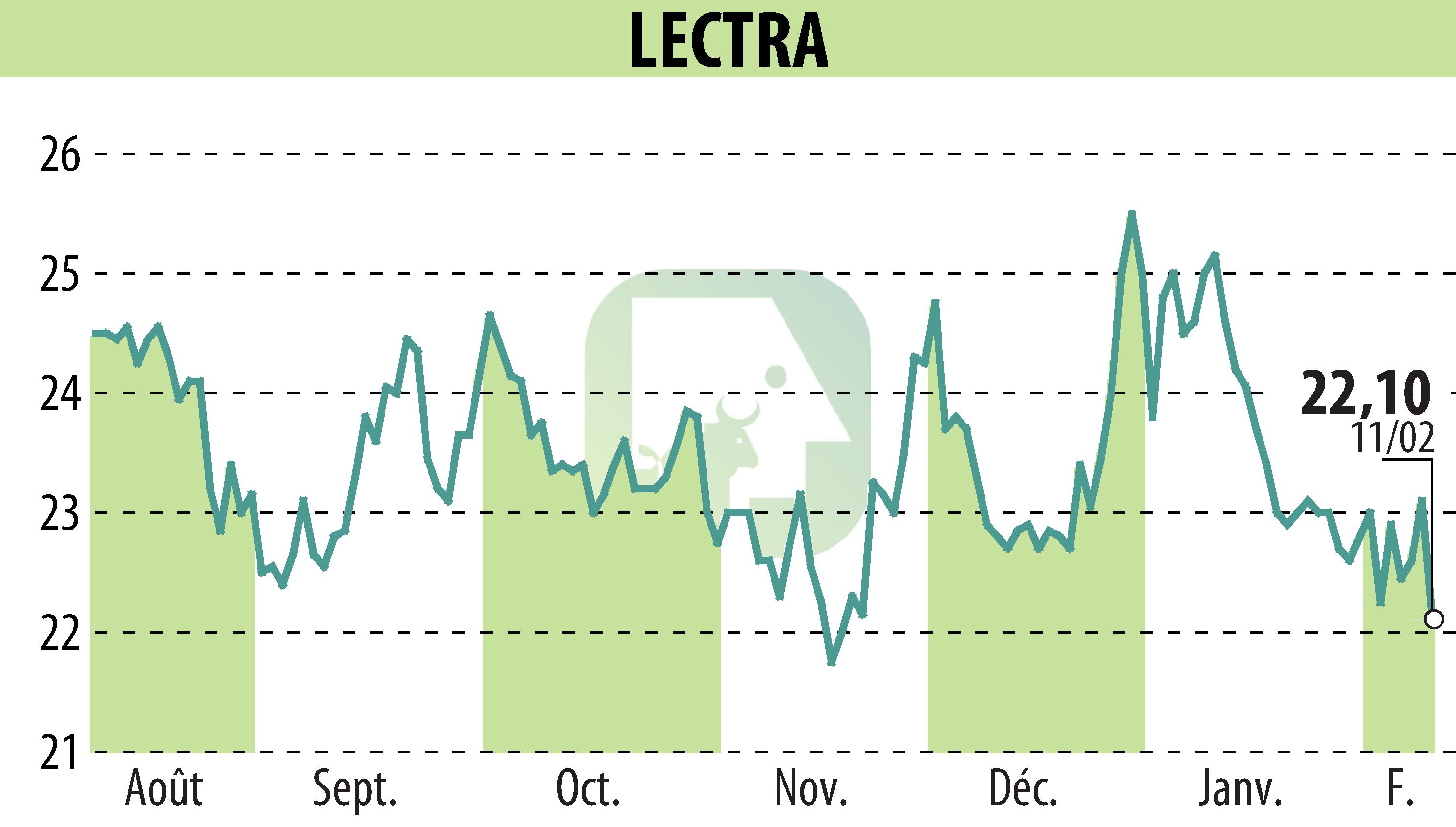

on LECTRA (EPA:LSS)

Lectra's 2025 Financial Results: Stability in Uncertain Times

Lectra's 2025 financial results reflect a downward trend in overall revenues but highlight growth in recurring revenues and a robust operational foundation. The company reported revenues of €506.7 million, a 2% like-for-like decline, with recurring revenues, comprising 75% of the total, increasing by 2%, bolstered by a 14% growth in SaaS subscriptions.

The annual recurring revenue (ARR) reached €97.2 million, marking a 14% upsurge. However, EBITDA before non-recurring items dropped by 8% to €79.7 million, with margins decreasing to 15.7%. The security ratio of 96% underscores Lectra's resilience.

Lectra's strategic focus on transitioning to SaaS, maintaining R&D investments, and promoting operational efficiency has helped mitigate market uncertainties stemming from political tensions and credit restrictions. With an ambitious 2026-2028 roadmap, Lectra aims for competitive positioning, leveraging AI and big data.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LECTRA news