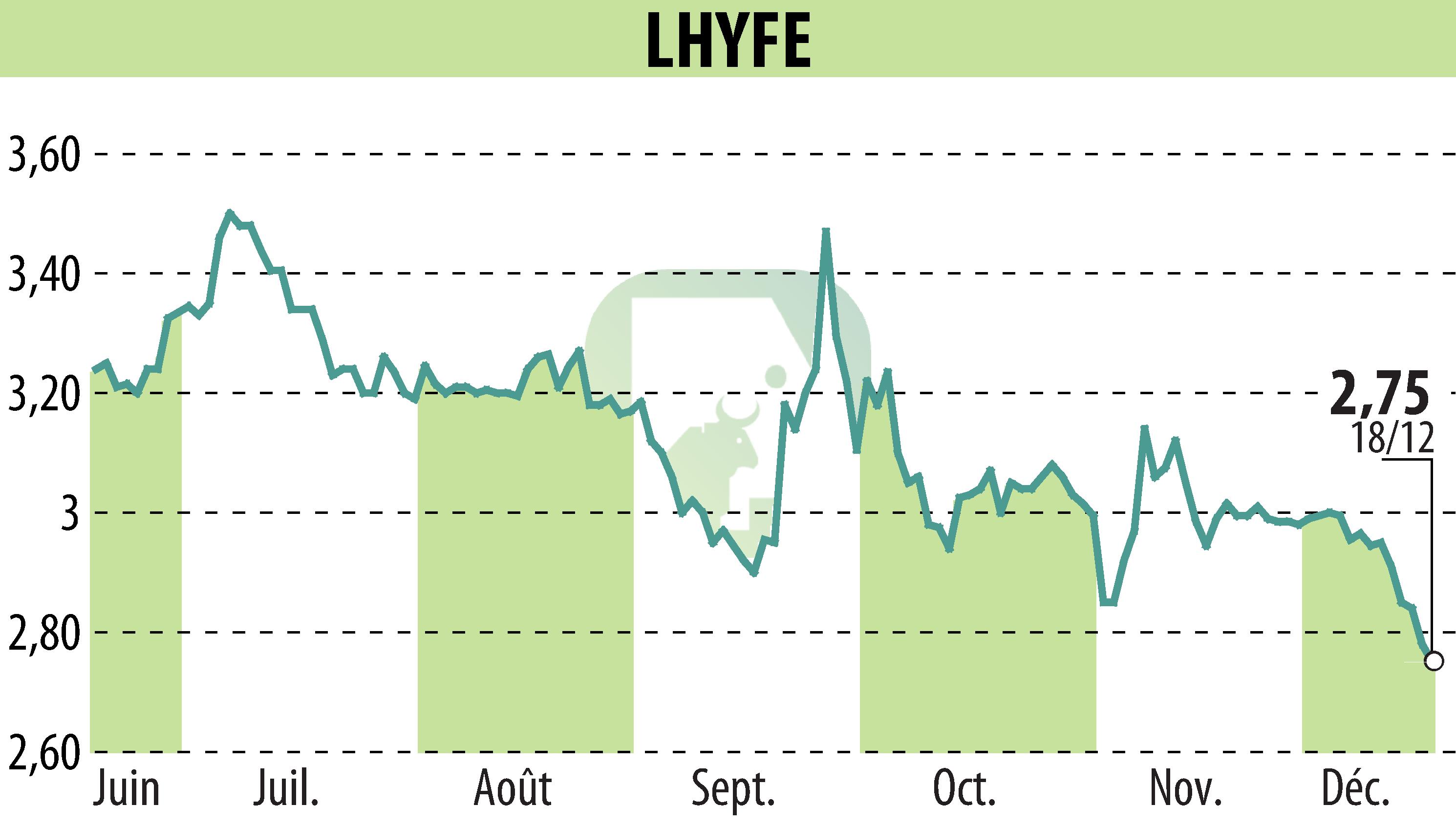

on LHYFE (EPA:LHYFE)

Lhyfe Confirms Revenue Growth and Strategic Focus for 2026

Lhyfe, a leader in green hydrogen production, reported a doubling of its 2025 revenues to approximately €10 million. The company is targeting growth in new markets while refining its strategy. For 2026, Lhyfe plans to reinforce its commercial and operational activities across Europe, leveraging its production and logistics capacities which include 22 MW of production capacity and multiple sites in France and Germany.

The company plans to focus on mature European markets, such as mobility in the UK and industry in Europe. This involves refocusing engineering on core expertise and outsourcing EPC activities. By 2026, Lhyfe aims to reduce costs by 30%, showing a strategic shift toward increased profitability and efficient project development.

Lhyfe continues to bolster its position in renewable energy by adapting to market demands while ensuring robust growth underpinned by a mature value chain and solid industrial base.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LHYFE news