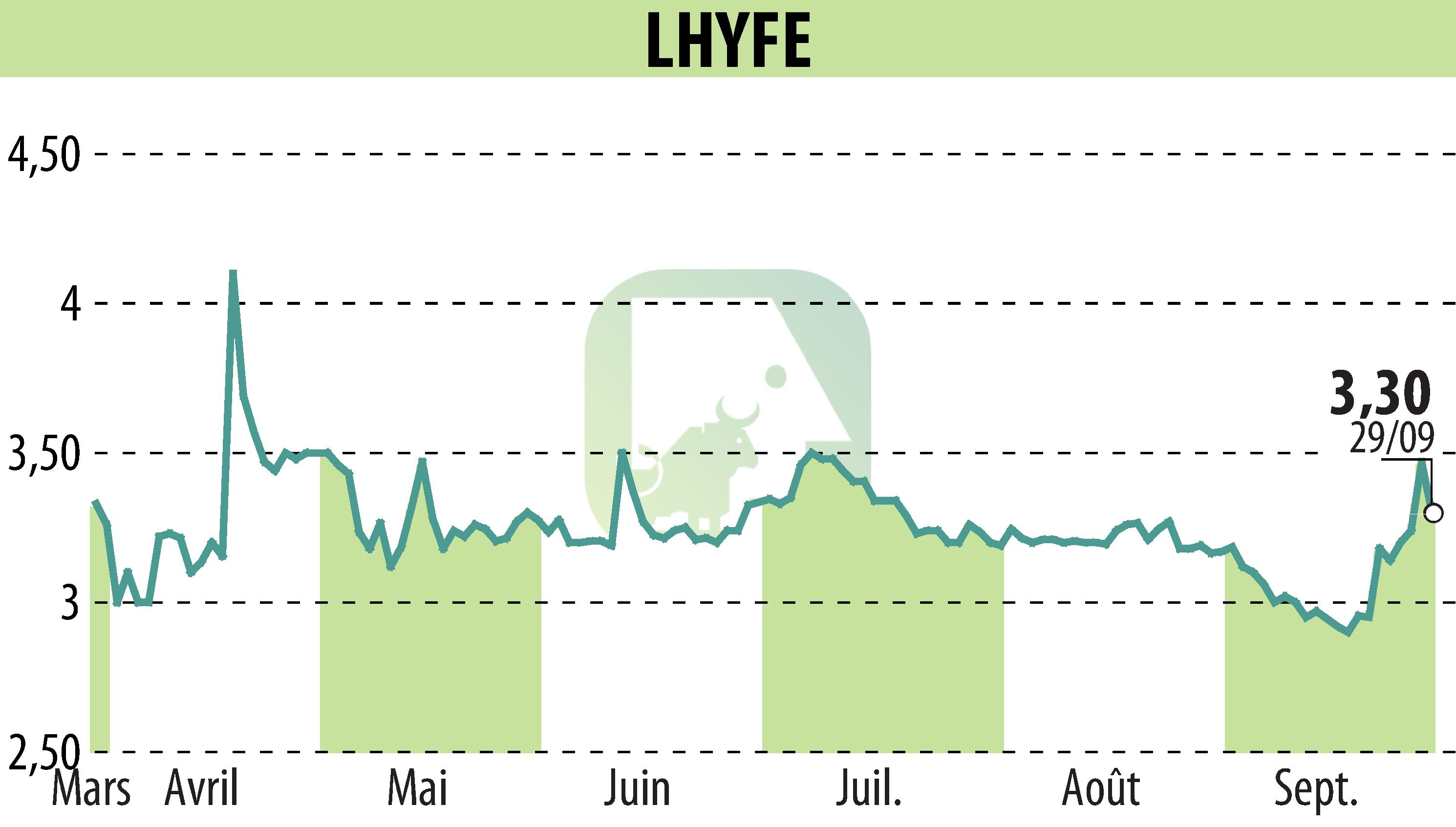

on LHYFE (EPA:LHYFE)

Lhyfe Reports Strong H1 2025 Revenue Growth Amid Industrial Expansion

Lhyfe, a leader in green hydrogen production, announced tripling its H1 2025 revenue to €4.6 million, driven by industrial and commercial growth. The increase surpasses the €1.7 million achieved in H1 2024. The company enhanced its European distribution with over 370 deliveries, doubling from the previous year. Expansion in Germany and increased deliveries in France and Sweden contributed significantly. Lhyfe is constructing new production sites, expecting a 65% capacity increase.

A €53 million financing package validates Lhyfe's financial strategy and supports future expansion. The firm has a solid cash position of €65 million. Despite this growth, the company reported a net loss of €21.7 million, reflecting increased operating and financing expenses. Nonetheless, Lhyfe remains optimistic, anticipating doubled annual sales in 2025 and leveraging co-development strategies to enhance production capabilities.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LHYFE news