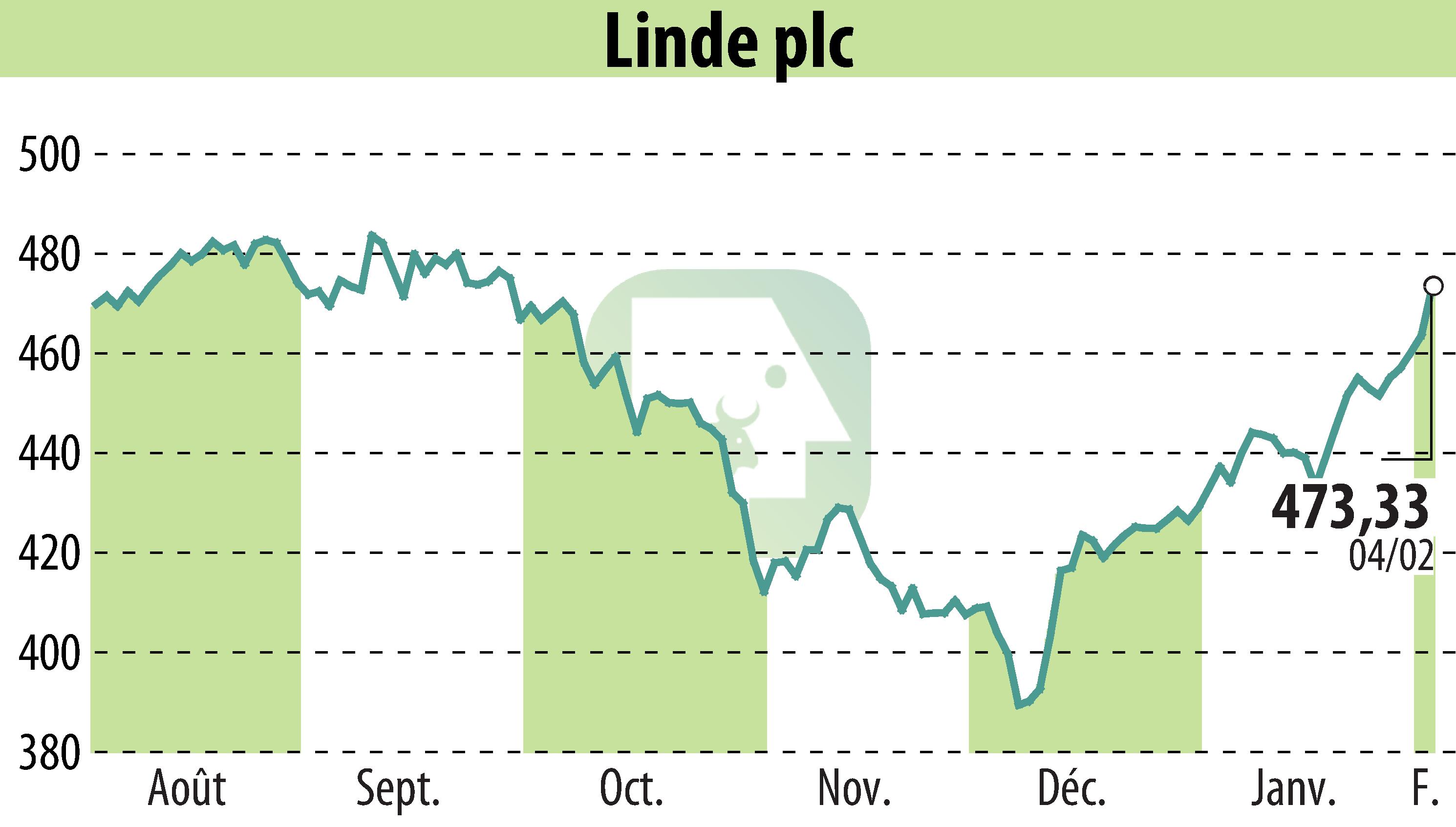

on Linde Plc (NASDAQ:LIN)

Linde Posts Strong 2025 Financial Results and Positive Outlook for 2026

In its latest financial report, Linde plc reported notable growth for the fiscal year 2025. Sales climbed to $34.0 billion, a 3% rise compared to the previous year, with underlying sales up 2%. Operating profit grew by 4% to $8.9 billion, with an adjusted operating profit of $10.1 billion. Notably, the operating profit margin stood at 26.3%, while the adjusted margin reached 29.8%. Linde's diluted earnings per share (EPS) rose 6% to $16.46, and operating cash flow surged by 10% to $10.4 billion.

The fourth-quarter results reflected similar growth dynamics. Sales increased by 6% to $8.8 billion. The operating profit for the quarter was $2.0 billion, with an adjusted figure of $2.6 billion, marking a 4% rise. Linde also signaled strong shareholder returns, dispensing $7.4 billion through dividends and share buybacks in 2025.

Looking ahead, Linde provided an adjusted EPS forecast for 2026 of $17.40 to $17.90, projecting 6-9% growth. This outlook highlights Linde's confidence in maintaining performance despite potential economic headwinds.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Linde Plc news