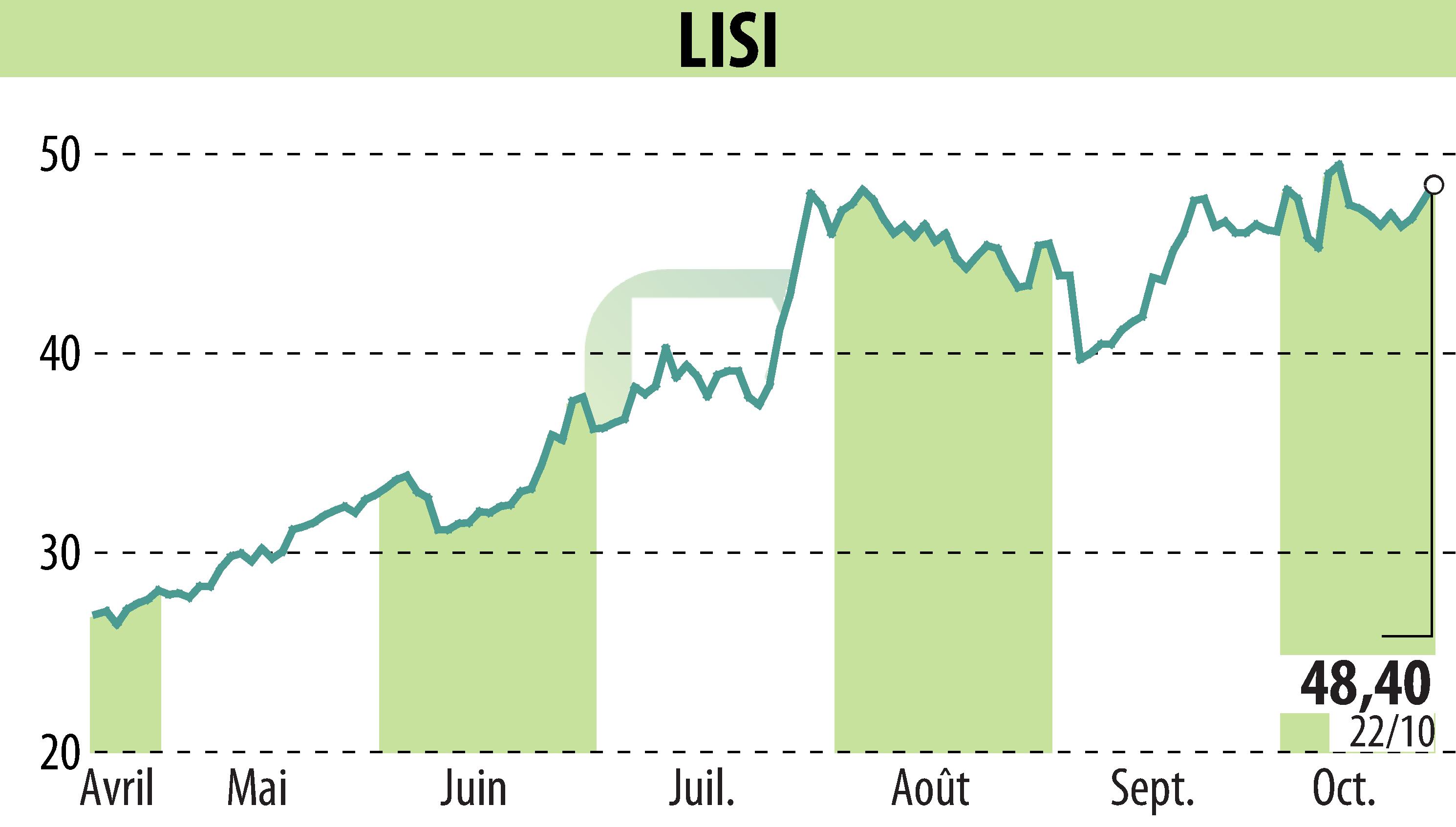

on LISI (EPA:FII)

LISI Group Financial Performance in Q3 2025

The LISI Group reported a cumulative revenue increase of 9.1% for the first nine months of 2025, reaching €1.44 billion. LISI AEROSPACE contributed significantly with a 20% revenue rise in Q3 compared to 2024. Conversely, LISI AUTOMOTIVE reported stable revenue, and LISI MEDICAL is gradually recovering in the US market.

For Q3, LISI's consolidated revenue rose 10.7% year-over-year, with exports making up 72% of revenue. Adjusted for currency impacts and LISI AUTOMOTIVE Nomel's divestment, growth was 11.3% year-to-date and 14.8% in Q3.

LISI AEROSPACE, representing 61% of total revenue, displayed robust growth across segments, benefiting from heightened aircraft production and component demand. LISI MEDICAL showed a slight decline, with a planned sale to SK Capital underway.

Despite global uncertainties, LISI Group remains committed to achieving its 2025 targets, emphasizing its aerospace division as a key growth driver.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all LISI news