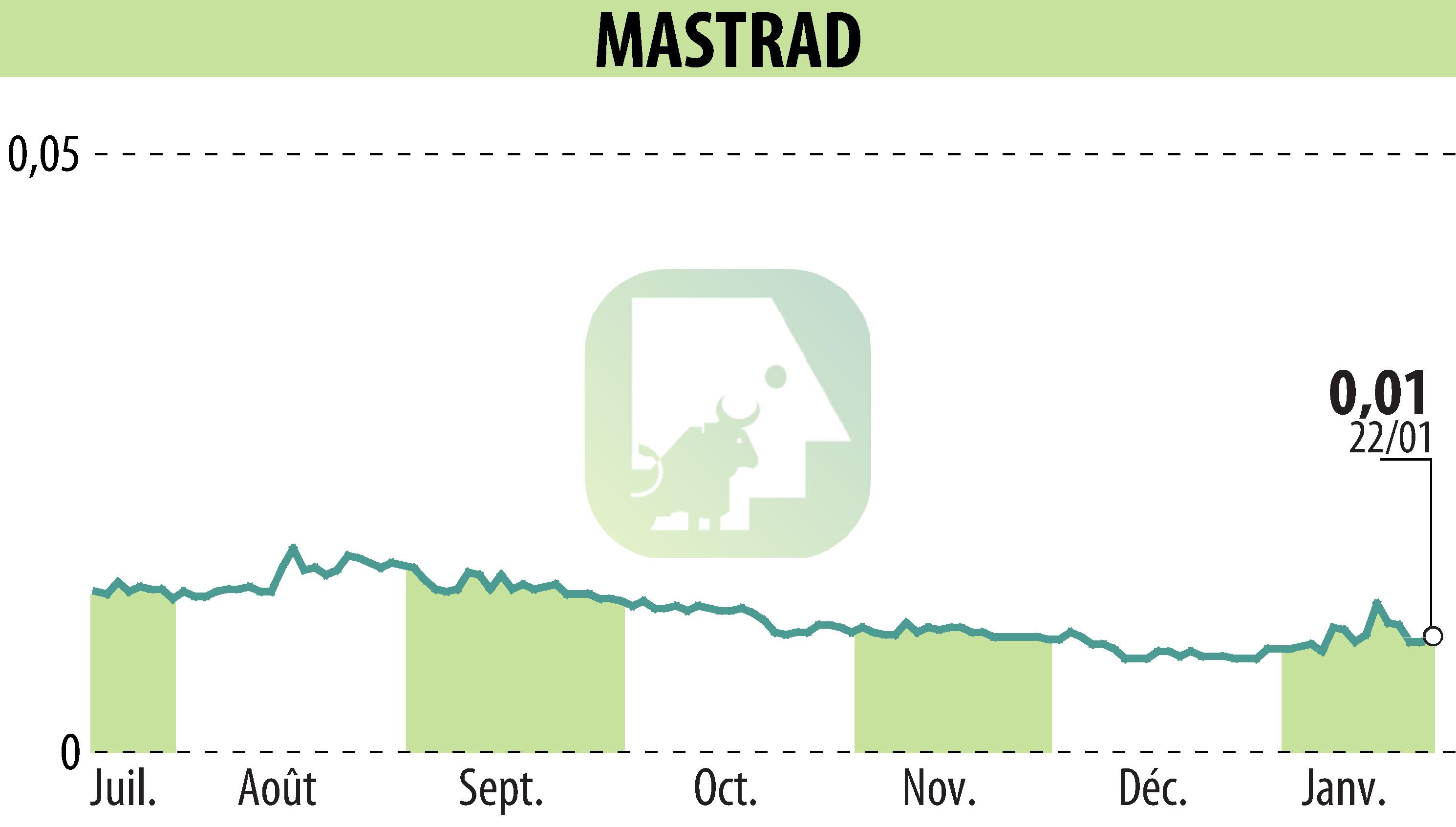

on MASTRAD (EPA:ALMAS)

MASTRAD Strengthens its Financing and Carryes Out a Capital Increase

On January 22, 2026, MASTRAD announced the release of the third tranche of its bond financing. This tranche includes 240 bonds of €1,000 each, totaling €240,000, shared between Hexagon Capital Fund and Beluga SCI. Simultaneously, a capital increase took place following a default on the second bond tranche. This resulted in the issuance of 48,840,203 new ordinary shares, diluting 38% of the existing shares.

Looking ahead, the objective is to stabilize the financial situation and strengthen business activity, notably by investing in FoodCycler, an eco-friendly solution for managing food waste. However, the risks of dilution and share price volatility remain, affecting the nominal value of MASTRAD shares.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MASTRAD news