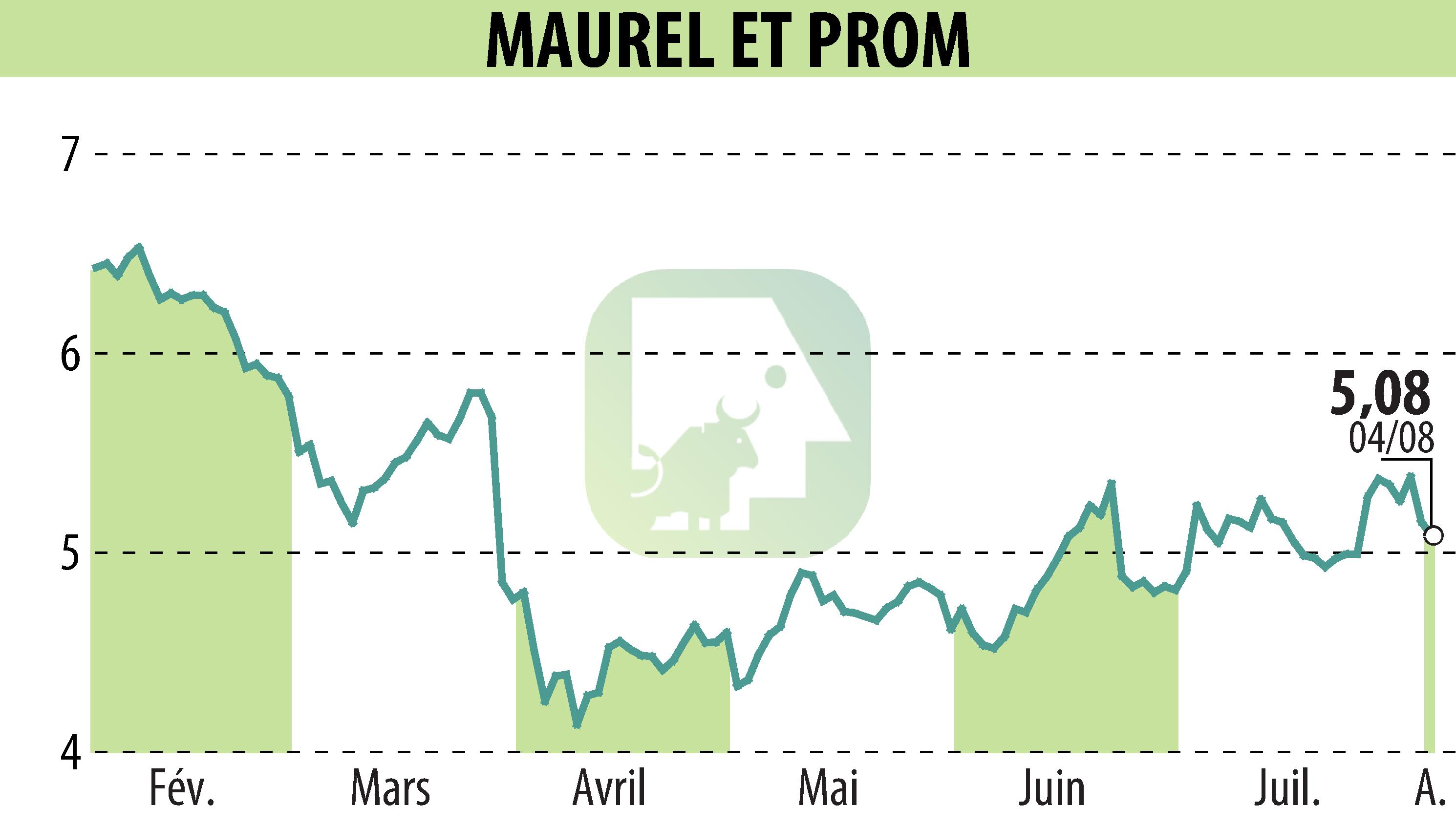

on MAUREL & PROM (EPA:MAU)

Maurel & Prom's Resilient Financial Performance Amid Lower Oil Prices

Maurel & Prom (M&P) showed financial resilience in the first half of 2025 despite falling crude oil prices. The company reported a total working interest production of 37,637 boepd, a 1% increase from the first half of 2024. However, the average sale price of oil decreased by 16% to $70.9/bbl.

M&P's robust first-half results included sales of $289 million and an EBITDA of $140 million. The group net income registered at $107 million. Operating cash flow stood strong at $108 million, with a free cash flow of $64 million. The net cash position was $91 million by mid-2025, bolstered by $225 million in cash and $134 million in debt.

Efforts to diversify and grow included M&P's operations in Venezuela, showing an 18% increase in oil production. The anticipated acquisition of a 61% stake in the Sinu-9 gas permit in Colombia is set for completion by September 2025, enhancing future production capacity significantly.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MAUREL & PROM news