on MTU Aero Engines Holding AG (ETR:MTX)

MTU Aero Engines AG Completes EUR 600 Million Convertible Bond Placement

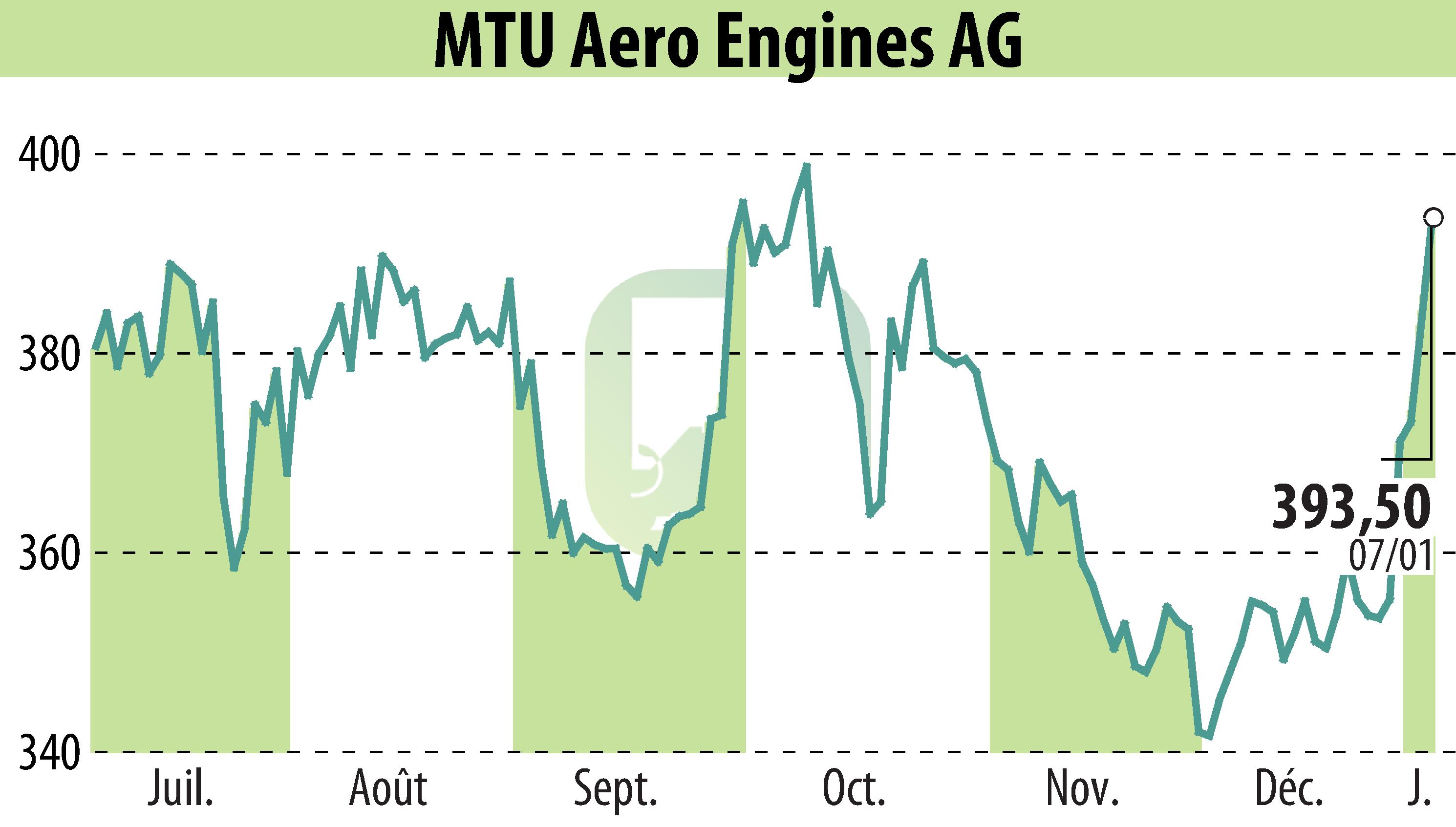

On January 8, 2026, MTU Aero Engines AG announced the successful placement of convertible bonds, raising EUR 600 million. These unsecured bonds, maturing in July 2033, come with no interest (0.000% coupon) and a redemption price of 105% of their principal, implying a yield to maturity of 0.651%. A conversion premium of 47.5% is set above the reference share price.

Proceeds will be used to repurchase convertible bonds due in 2027 and for general purposes. The transaction was coordinated by BNP PARIBAS, Deutsche Bank, and HSBC. MTU has conformed to private placement regulations, excluding United States investors.

Settlement is anticipated around January 15, 2026, with the Frankfurt Stock Exchange expected to list the bonds soon thereafter. This strategic financial move underscores MTU's fiscal planning and commitment to its long-term objectives.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all MTU Aero Engines Holding AG news