on Nabaltec AG (ETR:NTG)

Nabaltec AG Faces Sales Decline Yet Remains Promising

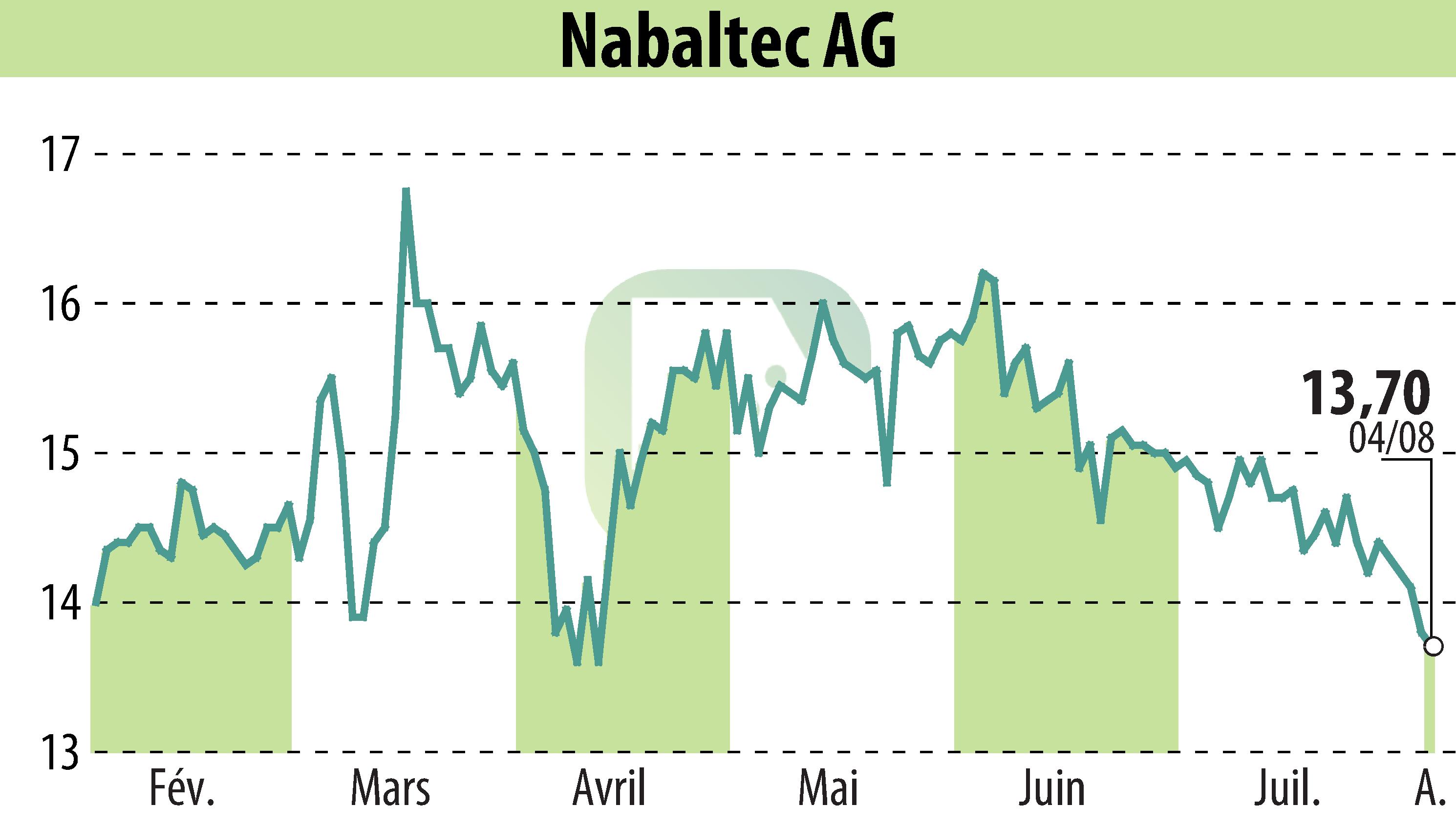

NuWays AG has revised its research on Nabaltec AG, maintaining a "BUY" recommendation despite adjusted forecasts. Nabaltec has lowered its FY25 sales guidance due to an unfavorable foreign exchange effect and reduced demand from the industrial and automotive sectors, particularly affecting boehmite used in EV batteries. Sales are expected to decline by 1-2% year over year.

Preliminary Q2 figures show a 4.6% drop in group sales to €51.8 million. Specialty Alumina and Functional Fillers both experienced declines. However, demand for aluminum hydroxide remains robust, with projection for continued growth.

Nabaltec maintains a stable EBIT margin of 7-9%, with energy prices favorably affecting material costs. Despite current challenges, the company sees long-term growth potential driven by increasing demand for its core products and expects an improvement from 2026.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Nabaltec AG news