on Nanohale AG (ETR:FYB)

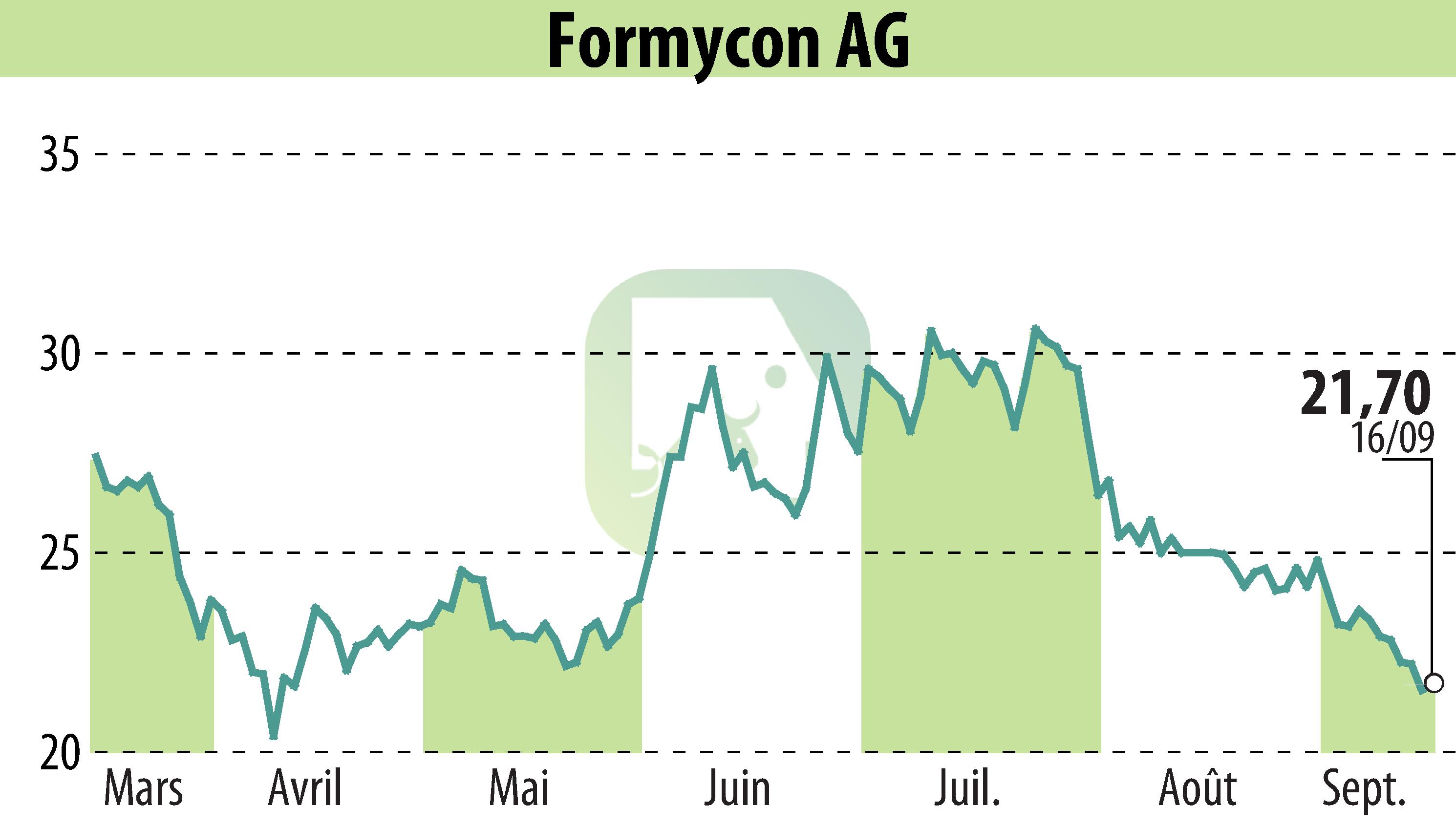

Formycon AG: Updated Research and Performance Forecast

First Berlin Equity Research has released an update on Formycon AG, maintaining a "Buy" recommendation but adjusting the target price from €49 to €48. The research notes that the company's H1 2025 revenue of €9.0 million fell short of the annual forecast of €55-€65 million. However, a stronger performance is anticipated in H2, driven by sales of the FYB202 (Stelara biosimilar) in the U.S. and Europe, and the commercialisation of FYB206 (Keytruda biosimilar).

Formycon is notably the first non-Chinese entity to complete recruitment for a pivotal Keytruda biosimilar trial. Results are expected in Q1 next year, potentially positioning the company for early negotiations with Merck, the reference product manufacturer. Discussions aim to secure a timely market launch for FYB206, which would aid in achieving the company’s medium-term goal of positive EBITDA by 2026 or 2027.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Nanohale AG news