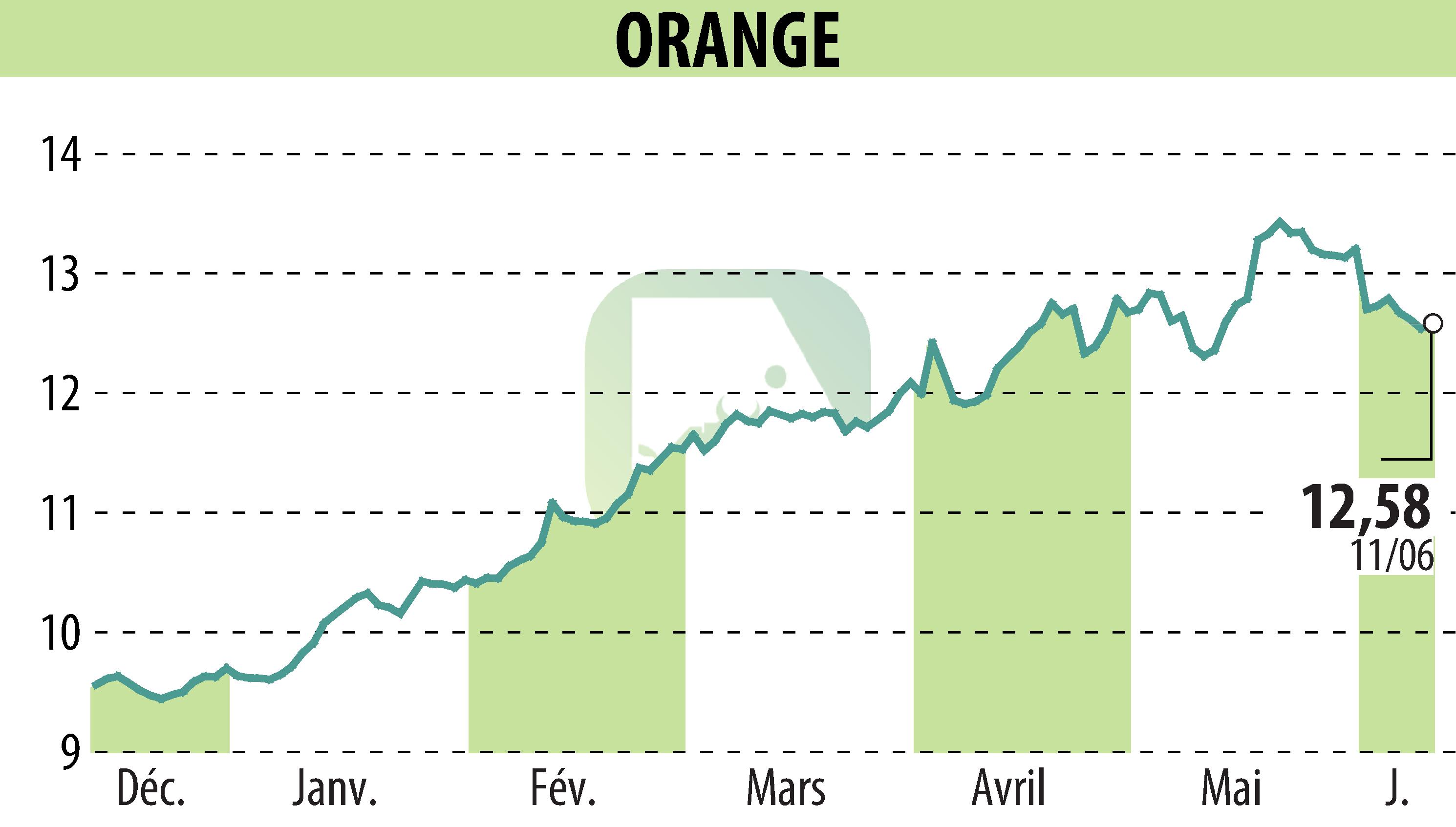

on ORANGE (EPA:ORA)

Orange considers new hybrid bonds and a buyback of existing bonds

Orange SA announces the upcoming issuance of new perpetual deeply subordinated bonds in euros. These bonds will include an early redemption option starting in June 2032 and will bear interest at a resettable fixed rate. A rating of BBB-/Baa3/BBB- is expected by the rating agencies, considering these securities to be 50% equity.

At the same time, Orange is launching a tender offer for some of its existing hybrid bonds, with a total value of €1.75 billion, aimed at managing its portfolio of hybrid instruments. The offer ends on June 19, 2025, with the results announced on June 20.

This mechanism allows qualified holders to sell their current securities before the next interest rate reset. Orange aims to optimize its financial structure through these operations.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ORANGE news