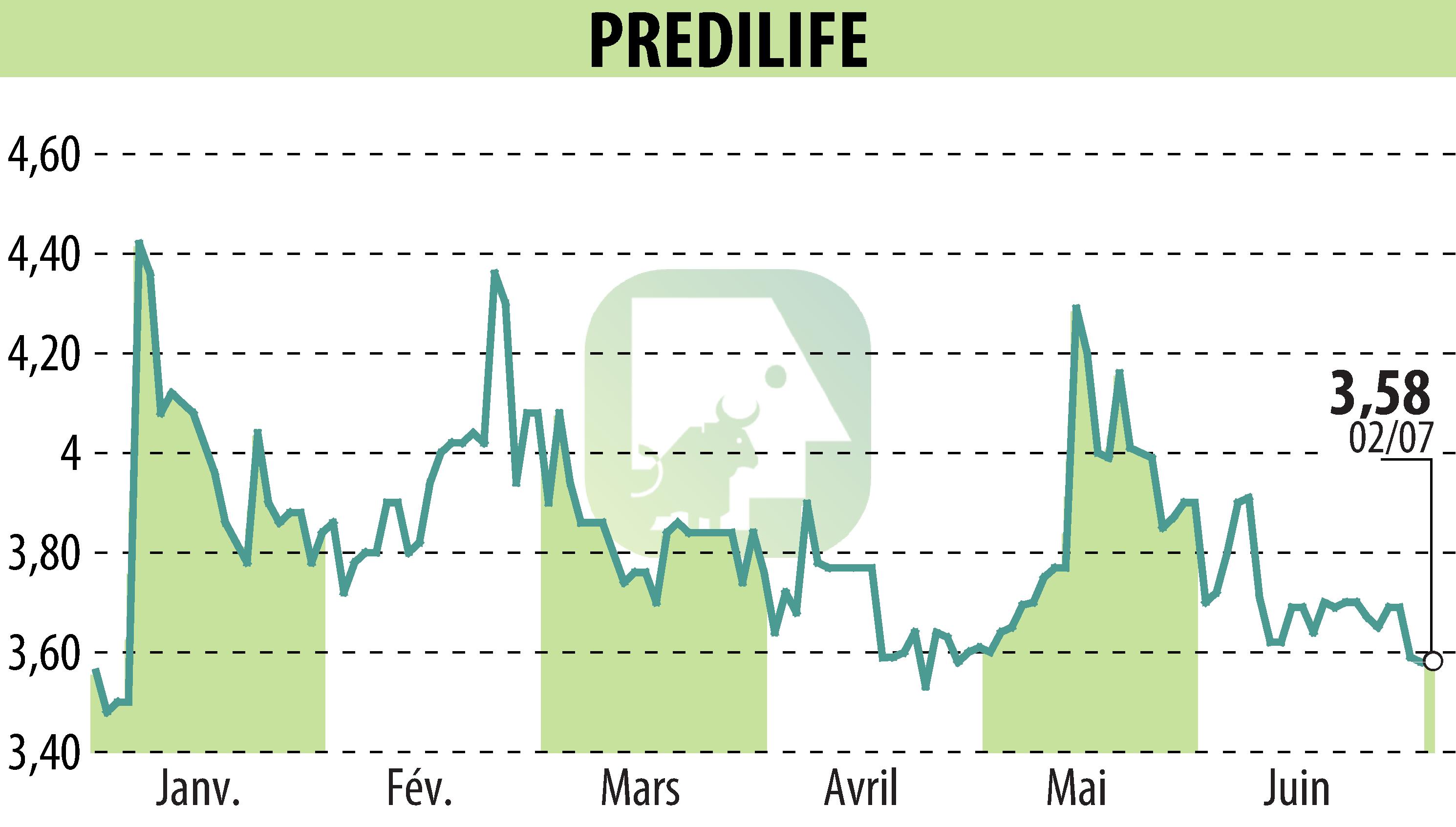

on PREDILIFE (EPA:ALPRE)

Predilife launches a private placement with a growth perspective

Predilife, a specialist in pathological risk prediction, announces a private placement of convertible bonds maturing in 2029. This initiative is accompanied by an expansion in sales, notably through the continued success of its predictive health assessments, reflecting a trend towards more preventative and personalized medicine. The first half of 2025 saw a tripling of sales.

This financing aims to ensure continued operations ahead of a major transaction involving its subsidiary MammoRisk. The goal is to extend the company's cash flow horizon through 2026 while leveraging industrial and financial partnerships.

The OCEANE bonds issued will have a nominal value of €1,000, with an annual interest rate of 8.5%. Investors will have the option to convert these bonds into shares according to a set schedule, providing flexibility in managing repayments.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PREDILIFE news