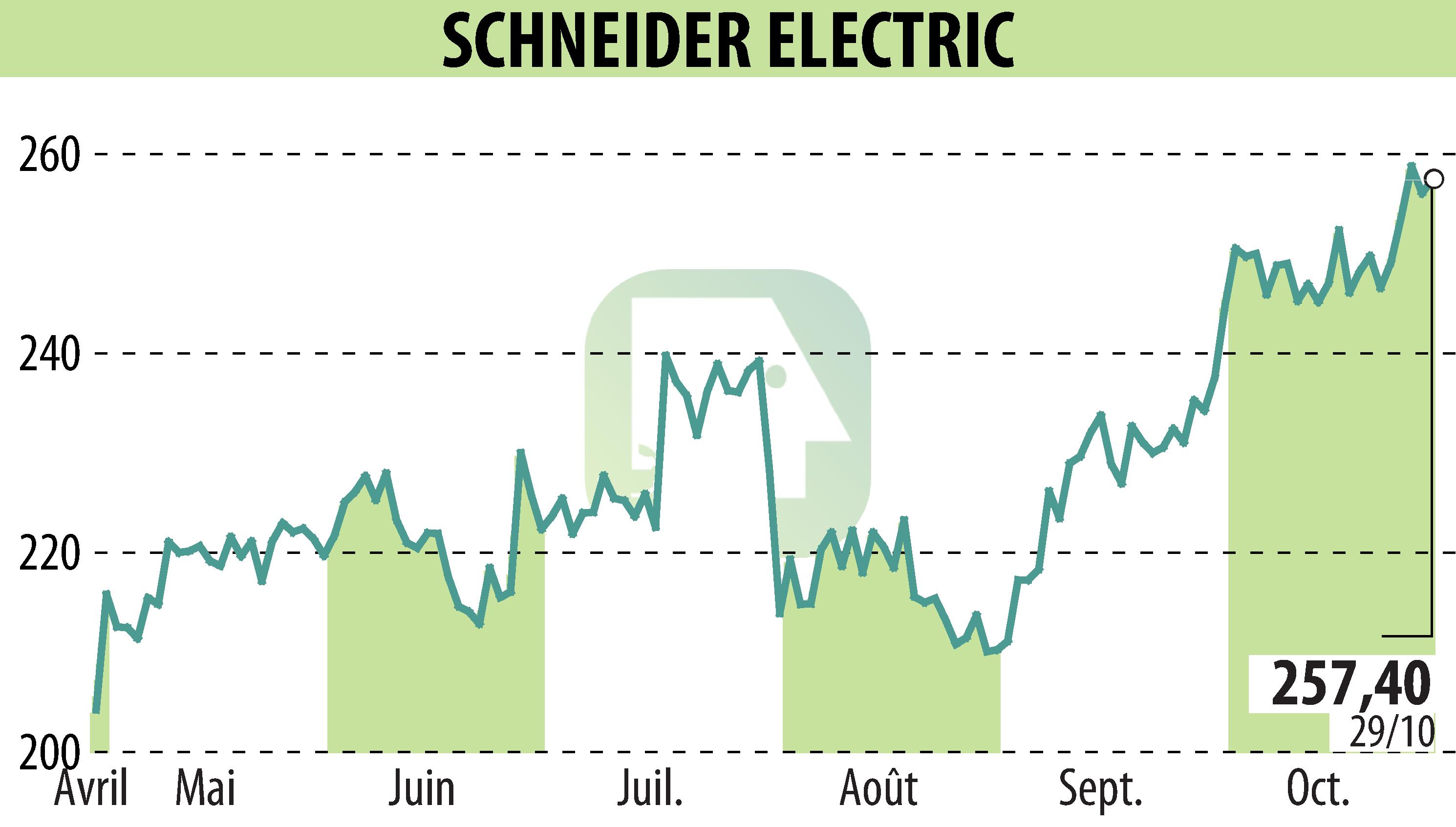

on SCHNEIDER ELECTRIC (EPA:SU)

Schneider Electric Reports 9% Organic Growth in Q3 2025 Revenues

Schneider Electric announced strong financial results for the third quarter of 2025, reporting a 9% increase in organic revenues to €10 billion. This growth was spearheaded by a 10% rise in Energy Management, primarily driven by Data Center demand, and a 6% lift in Industrial Automation, supported by a recovery in Discrete automation.

All regions contributed to this growth, with North America leading the way at a 15% increase, spurred by the U.S. systems business. Western Europe, Asia Pacific, and the Middle East also showed significant strides. Schneider has launched its Energy Tech vision and SE Advisory Services, reaffirming its full-year financial targets for 2025.

The company's Sustainability Impact program shows promising progress, nearing successful completion by year-end 2025. Schneider continues to innovate and strengthen its consulting capabilities to address challenges in energy efficiency and sustainability.

R. H.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all SCHNEIDER ELECTRIC news